Cut the rates!

Yesterday’s strong labour force report should be no deterrent to monetary easing for four reasons.

Wages are down down. The SEEK quarterly average annualised is a lousy 2.8%!

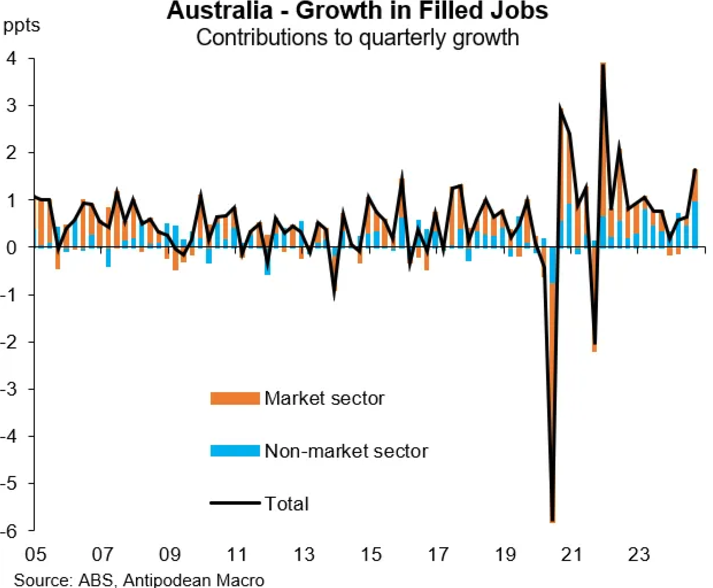

All the jobs are lowly paid public sector positions.

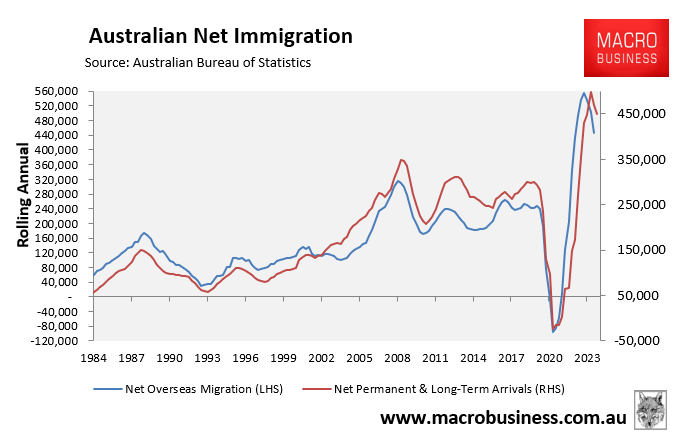

Immigration remains strong and we need around 35,000 jobs per month just to soak it up.

Worse, it is now strongly Indian, whose folks work more for less, so the supply shock is more negative for wages than in the previous cycle.

All of this adds up to an immigration-led economy in which the non-accelerating inflation rate of unemployment (NAIRU) is much lower than anybody realises.

NAIRU should be rebadged NAIRI (the non-accelerating inflation rate of immigration).

It probably has a two-handle.

Cut the rates and go for generational low unemployment (with falling living standards).