Bloomberg has had a crack at what’s gone wrong for the energy superidiot.

As they age [coal], they’re failing more and more often: Three key stations were all in unplanned outages Wednesday, pulling about 7% of coal generation off the grid with minimal notice.

It wouldn’t be a problem if there was enough wind and solar power to make up the shortfall, but we’re very far from that. To hit the government’s target of a 82% renewable grid by 2030, the country needs to be installing about six gigawatts of utility-scale renewables each year. The real number is about half that level at best. The storage and transmission needed as a back up is doing even worse — just 1.3 GW has been installed so far this decade, of the 49 GW needed by 2030. Right now, things are going in the wrong direction: BloombergNEF estimates that installations of small-scale solar systems peaked in 2021 while utility-scale farms topped out in 2023.

…Australia has now hit the point where its failure to get clean power infrastructure built is putting a thumb on the scales in favor of fossil power — precisely the opposite of what should be happening.

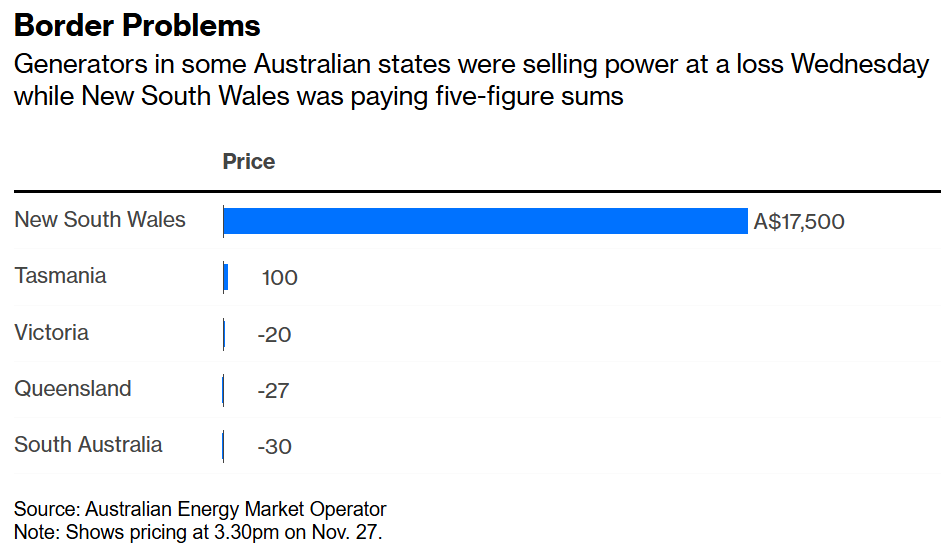

When power prices in New South Wales hit their regulatory limit of A$17,500 per megawatt-hour amid the threat of blackouts on Wednesday, demand was so lacking in neighboring states that most generators were selling at a loss. If there were sufficient wires to get electricity where it was needed, prices would have been more bearable across the entire network.

`

Yawn. A lack of renewable investment and insufficient grid interconnection is not the underlying problem.

These are symptoms of a more simple issue that has wrecked the transition plan from the ground up.

The plan was to use Australia’s abundant and cheap gas reserves to replace coal as backup firming power for intermittent renewables.

However, a vicious gas export cartel rose to dominate East Coast gas reserves and imposed an artificial gas shortage.

The resulting extortionate prices and insecurity of supply rendered investment in gas power plants untenable.

Now, we have a full-throated push towards intermittent renewables combined with stranded coal power stations and declining surge capacity without gas peakers.

Moreover, nobody has faith in the grid’s stability or the rules that operate it, so they won’t invest.

We are already desperately subsidising uneconomic coal power in NSW and VIC, subsidising new renewable capacity to offset it, and subsidising all consumers of energy because exorbitant gas sets the marginal price for everybody.

Each subsidy only begets more gouging by all the energy interests and prices keep rising anyway.

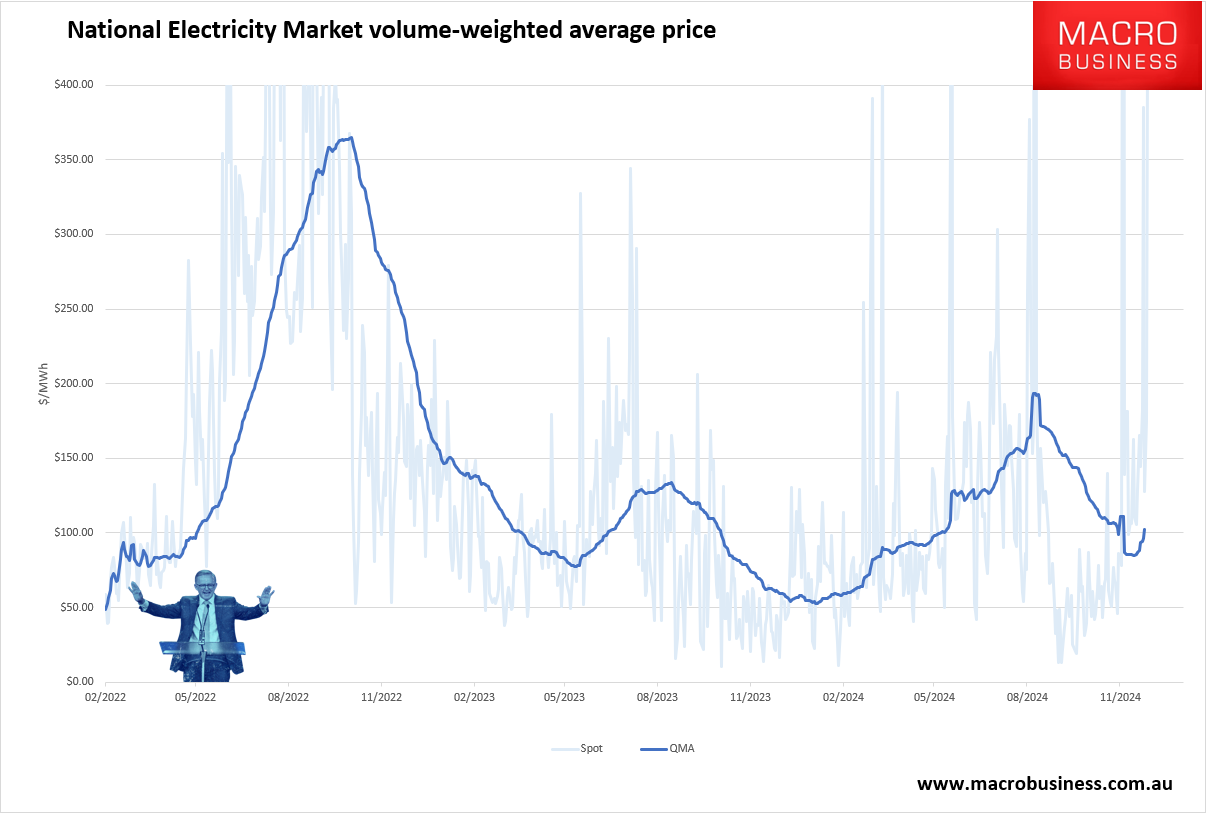

Today, we are supposed to be in the energy off-season and the price shock has roared to higher to 80% year on year.

It’s a doom loop that gets further away from a real solution with each passing crisis measure. Check out today’s media atrocity.

In 2022, the Albanese government capped gas prices and made producers guarantee domestic supplies. This year, big gas users such as manufacturers and smelters will be paid to reduce consumption in a bid to lower the risk of households running out.

Rick Wilkinson from energy advisory firm EnergyQuest says such interventions will not cut it for long and that import terminals are the only viable solution.

“We should bring on whatever gas projects we can when it’s available and if it’s lower cost than importing,” Wilkinson says. “But our analysis is clear that even if you did all of that, it won’t happen in big enough volumes quickly enough.”

Wilkinson says imports make the most financial sense, arguing they are cheaper than building pipelines from where excess gas was available around the country – namely Western Australia and Queensland.

“Our analysis shows that it is 10 times the capital investment required to build a pipeline from Western Australia to Moomba [in South Australia, to join the east coast gas network] than it is to build a gas import terminal,” Wilkinson says.

EnergyQuest is an industry-biased newsletter. Is the capital cost of solutions the right metric? Of course not.

The right metric is the public interest and therein the macroeconomic impact of gas imports versus alternatives like increased pipeline capacity and storage supported by gas domestic reservation.

LNG imports will deliver a permanent energy price shock as the local price is reset above import parity prices, which are 50% higher today.

This will smash the East Coast economy every time a butterfly flaps its wings anywhere in the world. It breaks monetary and fiscal policy to boot.

LNG imports are so negative for every dimension of the economy that whatever it costs to secure and use our own gas will make us far better off.

The answer is as straightforward as it is distant from consciousness in public discussion: domestically reserve gas and/or apply export levies to crash the local price.

Imports are not an answer. They are not even “stupid”.

LNG imports are catastrophic for the levered Australian economy, most especially for Nine profits, where this appalling analysis was published.