The energy crisis continues to build.

Gas supplies across the east coast must be “carefully managed” if the fuel source is needed to support higher electricity demands over a hotter-than-average summer, the energy market operator has warned, conceding it may have to cancel maintenance work on transmission lines to make the grid more reliable.

…Energy Edge managing director Josh Stabler said a drawdown on gas over summer would hurt the readiness of the country in winter when states such as Victoria really needed the fuel source.

…Squadron, owned by billionaire Andrew Forrest, is close to completing work on its NSW LNG import facility.

“Squadron Energy’s Port Kembla Energy Terminal will open Australia up to new sources of gas supply as we transition to renewable energy,” Mr Wheals said.

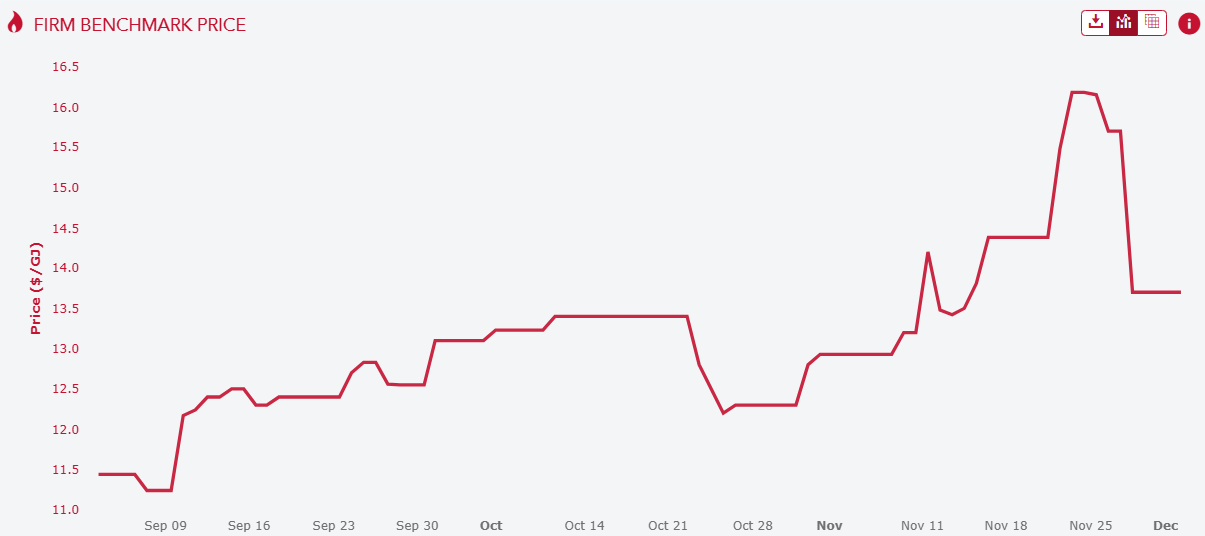

The spot market gas price is $13.70 today.

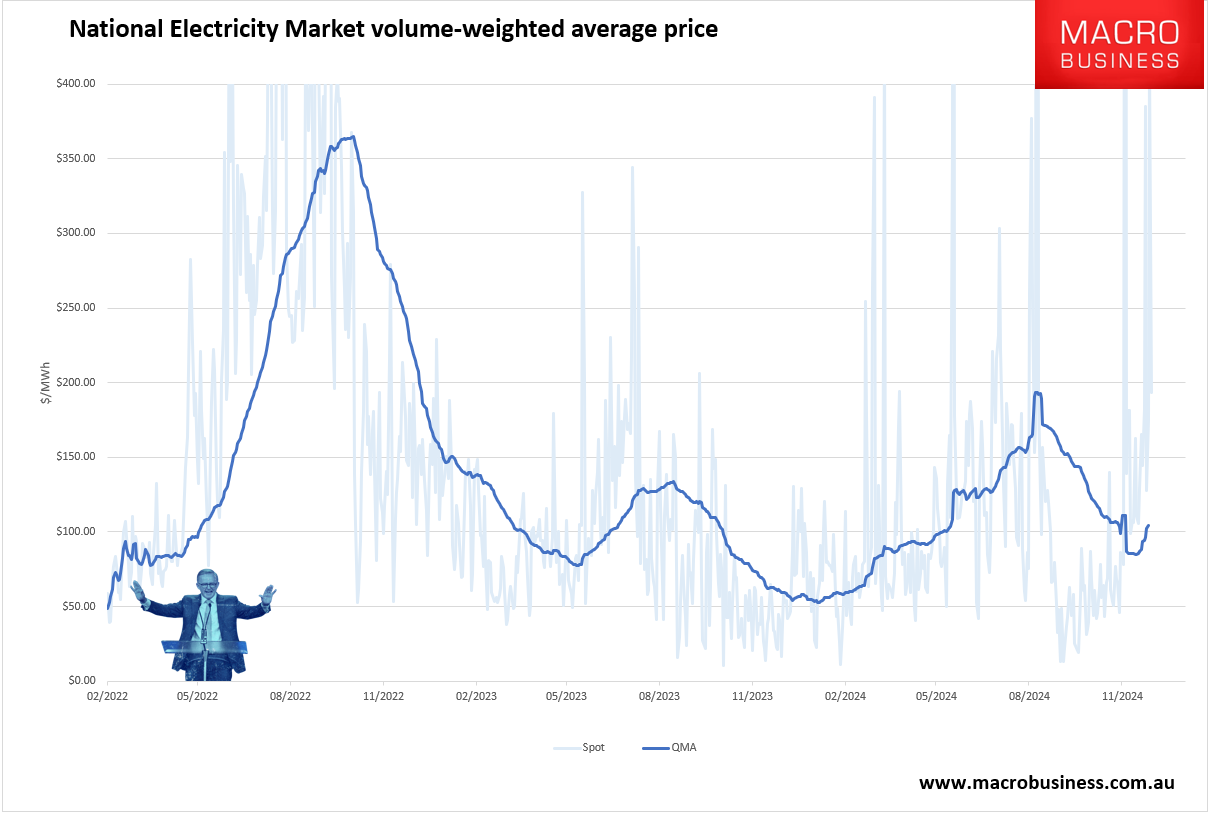

As a direct result, the electricity price has already bottomed at nearly double year on year.

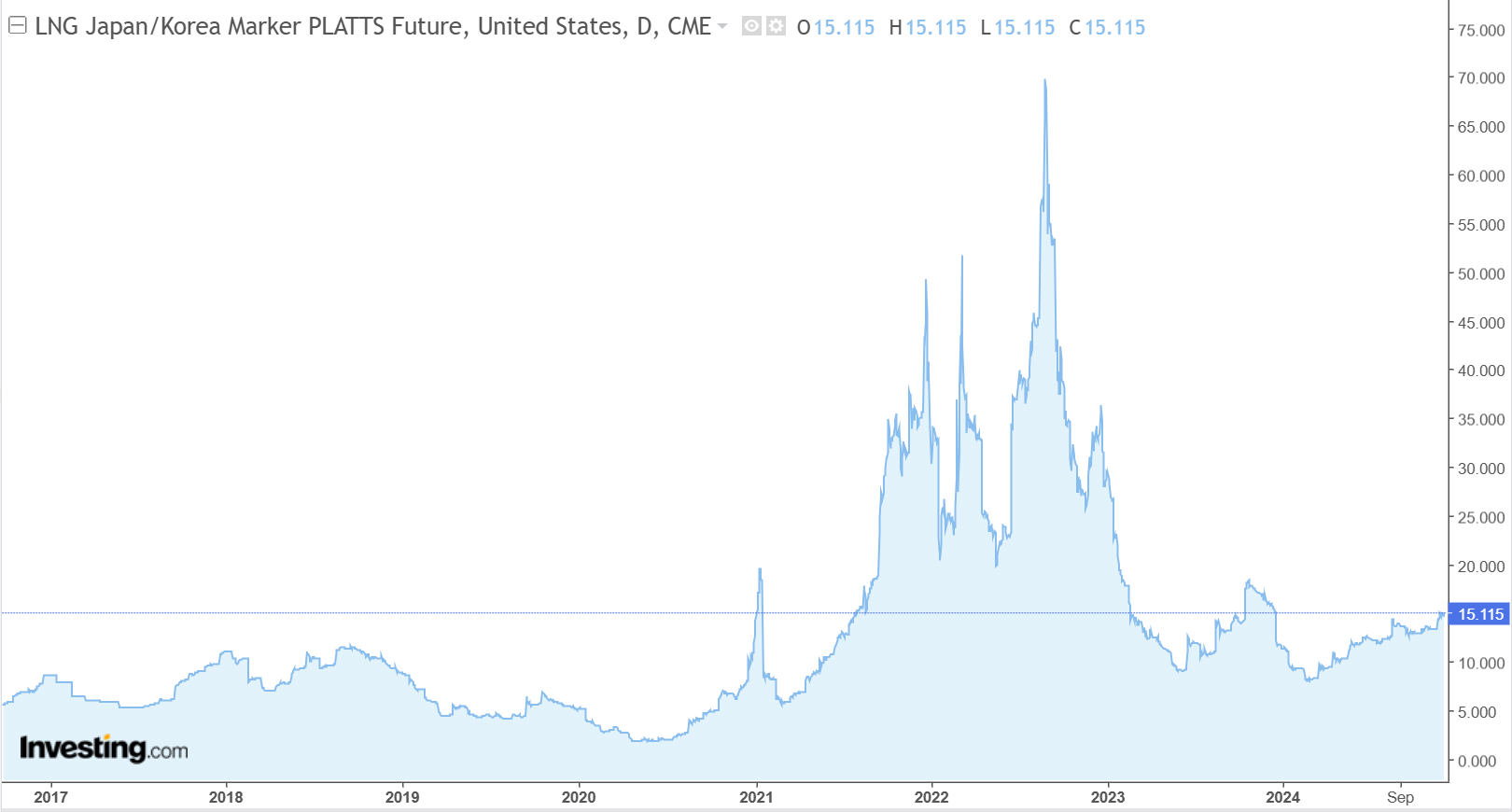

If LNG imports were in operation today, the gas would cost Squadron (jointly owned by Andrew and Nicola Forrest) about $25Gj ($23Gj + an import margin).

And don’t kid yourself. Once gas imports begin, the gas export cartel will further limit local supply to ensure import parity becomes the marginal price setter of gas, guaranteeing all local gas is sold at that price, smashing Albo’s $12Gj price cap joke.

In short, if LNG imports were in place today, the entire East Coast economy would be in the middle of another massive energy and inflation shock, nearly doubling gas bills and driving power bills higher by one third.

This is equivalent to 2% added to CPI before spillovers.

The RBA would be hiking interest rates to “make room” for Twiggy LNG imports, and the economy would crater into recession as house prices led the way down.

LNG imports are not an answer to the self-imposed energy crisis; they are the end of the nation as you know it.

Gas domestic reservation and/or export levies now.