Asian stock markets are generally positive for the first session of the trading week after a strong Friday night lead and some somewhat positive macro news over the weekend, although currencies have gapped lower against a resurgent USD. Euro is dicing with the 1.05 handle again while the Australian dollar also suffered a drop, now back below the 65 cent level despite strong retail sales and profit figures.

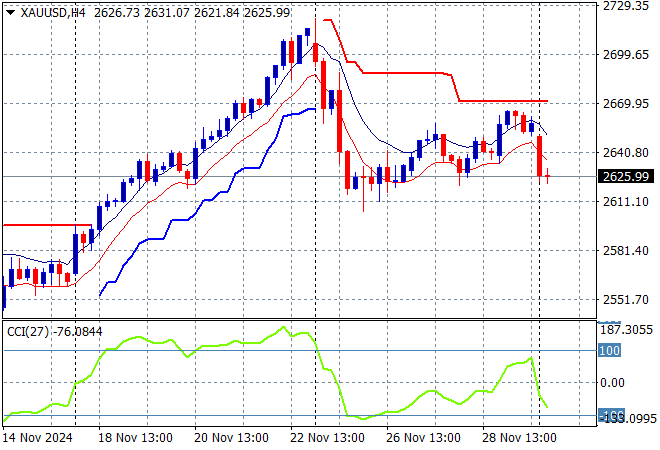

Oil futures are dipping lower with Brent crude almost below the $72USD per barrel level while gold failed to hold on to its Friday session gains as the weekend gap sees it drop back to the previous weekly low at the $2630USD per ounce level:

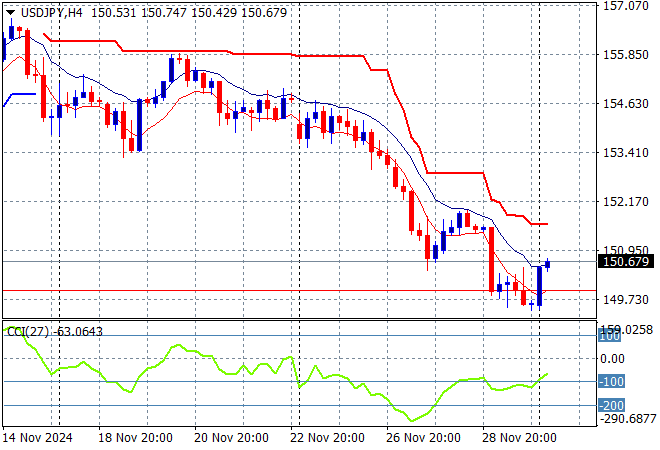

Mainland Chinese share markets are pushing higher with the Shanghai Composite up more than 1% going into the close at 3361 points while the Hang Seng Index is up just 0.2%, currently at 19452 points. Japanese stock markets are also doing relatively well with the Nikkei 225 more than 0.6% higher at 38452 points while the USDPY pair has bounced back slightly after recently hitting a new monthly low as it gets back above the 150 handle:

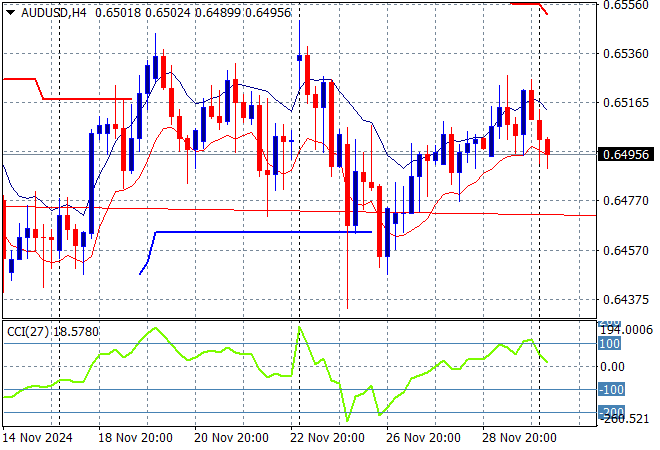

Australian stocks had another mixed session amid a series of positive economic prints with the ASX200 closing just 0.1% higher at 8444 points while the Australian dollar suffered a weekend gap blip lower to dive back below the 65 handle as it tries to get off its recent weekly low:

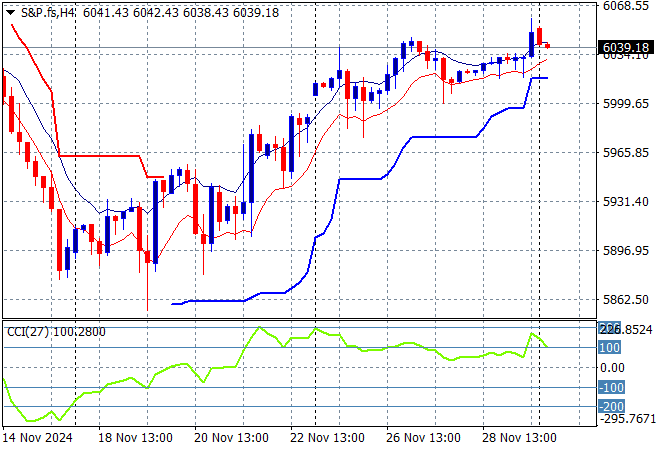

S&P and Eurostoxx futures are holding on to their Friday night gains as we head into the London session with the S&P500 four hourly chart showing momentum still positive and quite overbought as price action remains on point to extend above the 6000 point area:

The economic calendar includes the latest Euro wide unemployment figures followed by a speech by ECB President Lagarde then followed by the closely watched US ISM PMI print.