While Bitcoin makes headlines, Asian stock markets are generally lower over continued macro concerns and the lead up to tomorrow night’s US jobs print. The USD is relatively steady and strong against the other undollars while the Australian dollar remains under pressure just above the 64 handle.

Oil futures are failing to hold on to their recent gains as traders await the next OPEC meeting with Brent crude staying well below the $73USD per barrel level while gold unlike Bitcoin is going nowhere, holding steady at the $2640USD per ounce level:

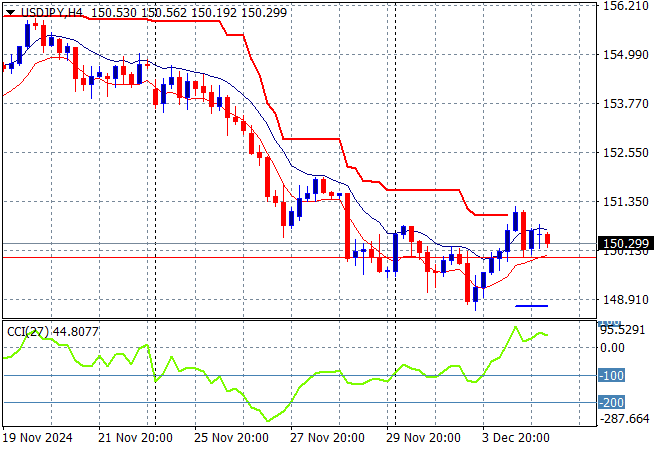

Mainland Chinese share markets are trying to make ground with the Shanghai Composite still unchanged at the 3360 point level while the Hang Seng Index is down nearly 1%, currently at 19547 points. Japanese stock markets are doing slightly better but its all relative, with the Nikkei 225 just 0.3% higher at 39412 points while the USDPY pair has bounced back slightly after recently hitting a new monthly low as it stays above the 150 handle:

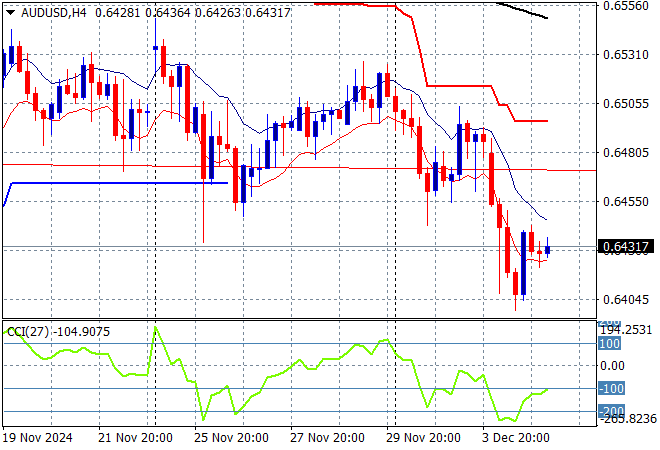

Australian stocks are also still indecisive ASX200 closing just 0.1% higher at 8471 points while the Australian dollar has been able to recover from its steep drop in the previous session due to the weak national accounts data as it barely remains above the 64 cent level:

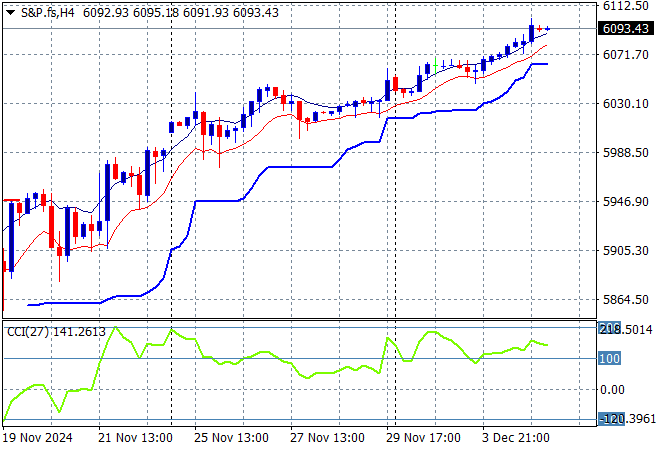

S&P and Eurostoxx futures are holding on to their overnight gains as we head into the London session with the S&P500 four hourly chart showing momentum still positive and quite overbought as price action remains on point to extend above the 6000 point area:

The economic calendar includes a few more Fed speeches, German factory orders for November, then US initial jobless claims as a prelude to Friday night’s NFP print.