Asian stock markets are generally lower over continued macro concerns and the lead up to tonight’s US jobs print with the only bright spark coming from China over stimulus bets. The USD is relatively steady and strong against the other undollars while the Australian dollar remains under pressure just above the 64 handle.

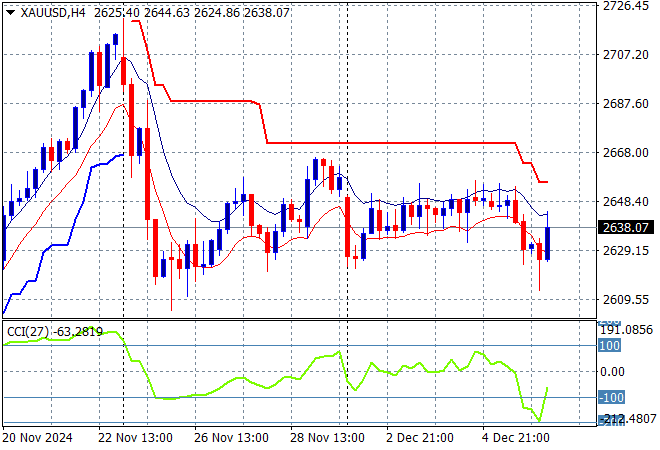

Oil futures are sliding back to their recent weekly lows as traders await the next OPEC meeting with Brent crude staying well below the $72USD per barrel level while gold is trying to clawback the overnight losses, currently up slightly at just below the $2640USD per ounce level:

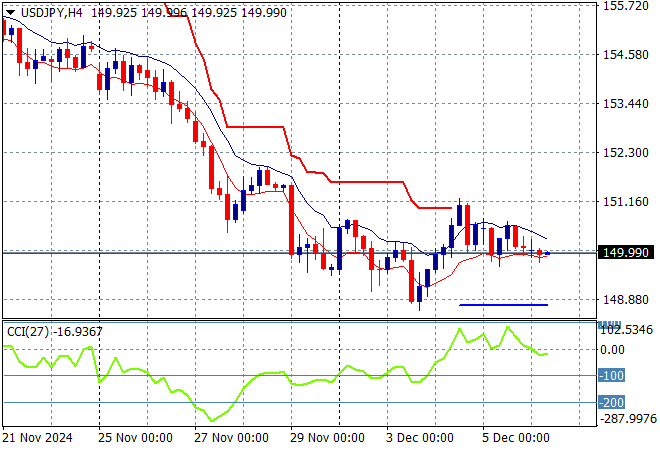

Mainland Chinese share markets are having a better finish with the Shanghai Composite up more than 1% at the 3404 point level while the Hang Seng Index is up nearly 1.6%, currently at 19860 points. Japanese stock markets however are in retreat mode with the Nikkei 225 more than 0.8% lower at 39063 points while the USDPY pair has failed to bounced back after recently hitting a new monthly low as it drifts below the 150 handle:

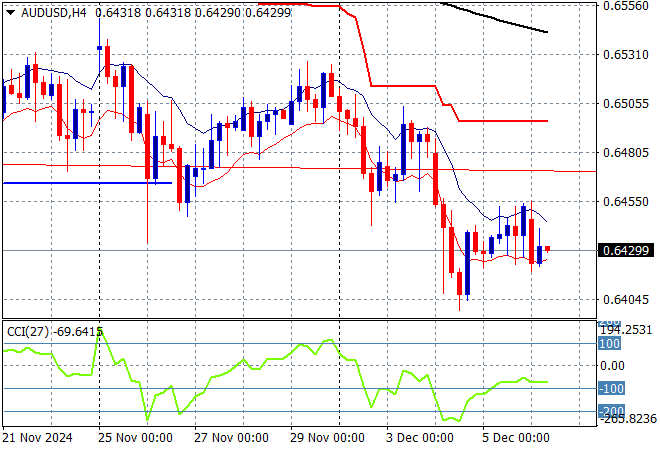

Australian stocks are also feeling the heat of lower iron ore prices with the ASX200 closing 0.6% lower at 8420 points while the Australian dollar has been able to recover from its steep drop in the previous session due to the weak national accounts data as it barely remains above the 64 cent level:

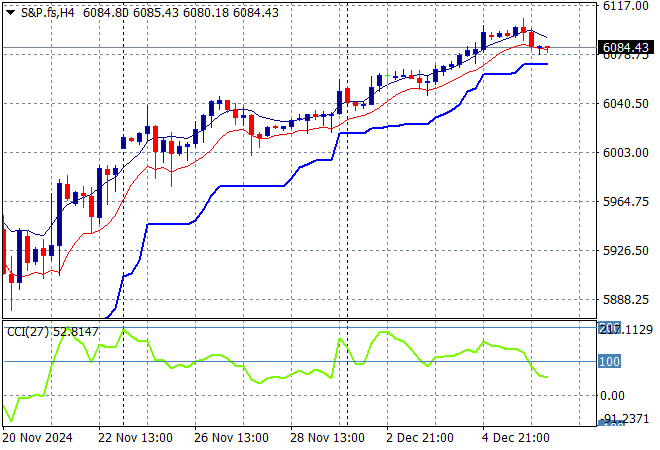

S&P and Eurostoxx futures are holding on to their overnight gains as we head into the London session with the S&P500 four hourly chart showing momentum still positive and quite overbought as price action remains on point to extend above the 6000 point area:

The economic calendar will focus squarely on the latest US NFP print tonight.