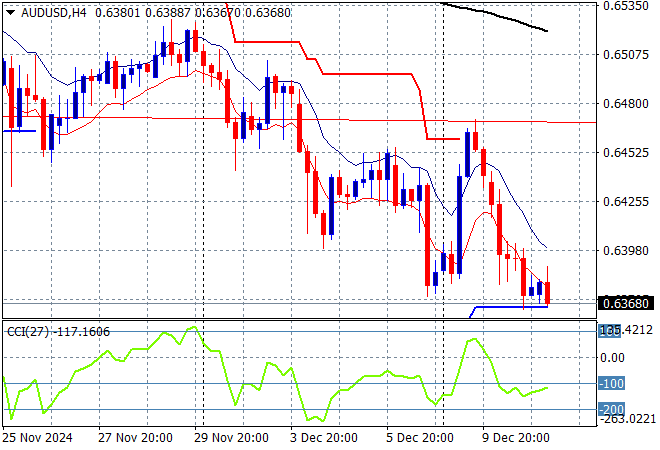

Asian stock markets are generally lower across the board, following the risk off mood that is building on Wall Street. The USD was pushed around by Yen in afternoon trade due to wholesale inflation data and possible tax rises while the Australian dollar remains under pressure well below the 64 handle following yesterday’s hold from the RBA.

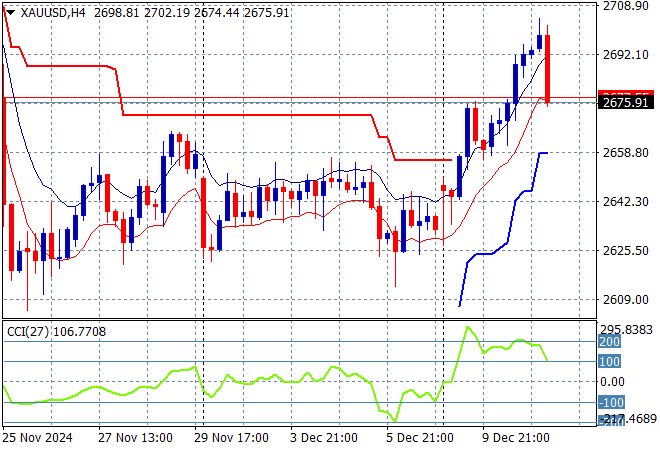

Oil futures are pushing up slightly after pulling back to their recent weekly lows with Brent crude lifting slightly above the $72USD per barrel level while gold is failing to hold on to overnight gains, currently back down to the $2670USD per ounce level:

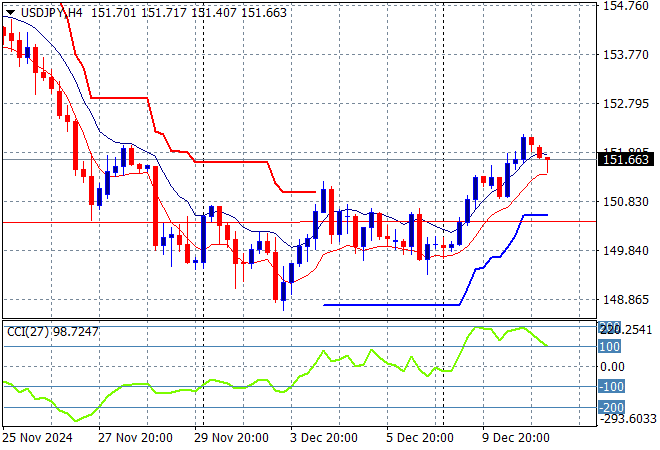

Mainland Chinese share markets are having a mild session with the Shanghai Composite up just 0.2% to extend above the 3400 point level while the Hang Seng Index is taking back its previous gains, off by over 0.8% to 20259 points. Japanese stock markets are somewhat mixed on internal inflation machinations with the Nikkei 225 down around 0.3% at 39270 points while the USDPY pair has been able to hold on to its overnight highs after bouncing off monthly lows as it breaks above the 151 handle:

Australian stocks are also in sell mode with the ASX200 closing 0.5% lower at 8353 points while the Australian dollar has remained well below the 64 cent level:

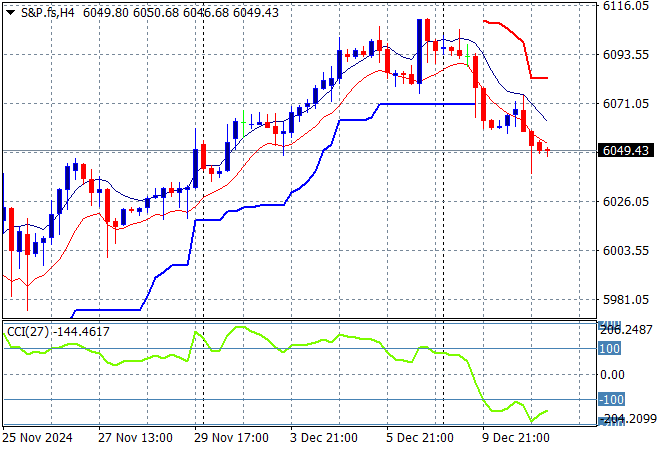

S&P and Eurostoxx futures are barely holding on to their overnight lows as we head into the London session with the S&P500 four hourly chart showing momentum now switching to negative settings after being overbought as price action rolls over towards the 6000 point area:

The economic calendar will be dominated tonight by the latest US CPI print.