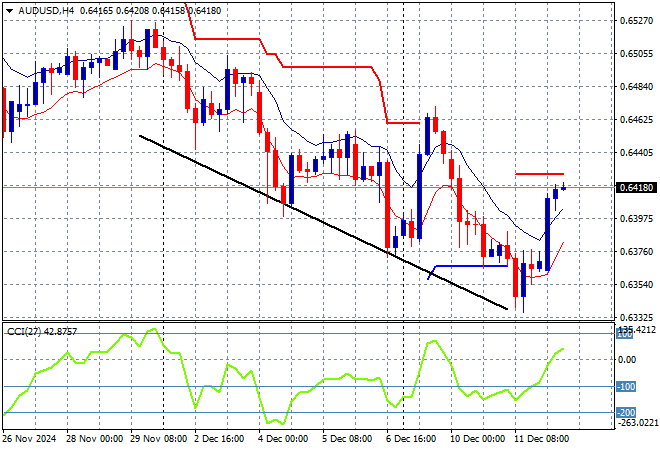

Asian stock markets are generally higher across the board, following the overnight as expected CPI print from the US that seems certain the Fed will cut rates next week, with anticipation building that the Swiss and European Central banks will do the same tonight. The USD has pushed all the undollars back into the place with Yen down in afternoon trade with the Australian dollar surprising to the upside due to a better than expected local unemployment print, but the move has been weak at best with just a small blip above the 64 handle.

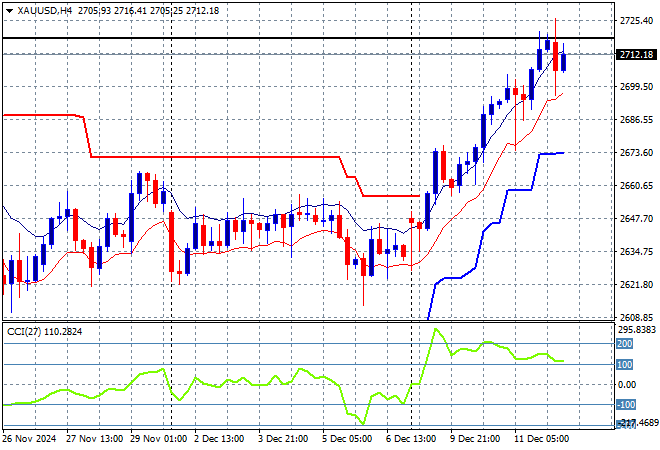

Oil futures are pushing up slightly after pulling back to their recent weekly lows with Brent crude lifting slightly above the $73USD per barrel level while gold is just holding on to its overnight gains, sitting just above the $2700USD per ounce level:

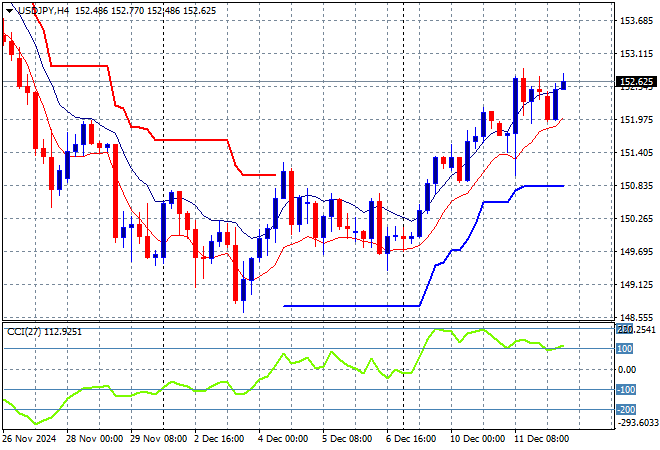

Mainland Chinese share markets are having a solid session with the Shanghai Composite up more than 0.7% to extend above the 3400 point level while the Hang Seng Index is taking back its previous losses, up by more than 1.5% in afternoon trade at 20482 points. Japanese stock markets are no longer mixed and seeing strong bids with the Nikkei 225 up more than 1.5% to just below the 40000 point level while the USDPY pair has been able to hold on to its overnight highs after bouncing off monthly lows as it holds well above the 152 handle:

Australian stocks continue to be the odd ones out and remain in sell mode with the ASX200 closing 0.3% lower at 8330 points while the Australian dollar has jumped higher on the unemployment print to just break above the 64 cent level:

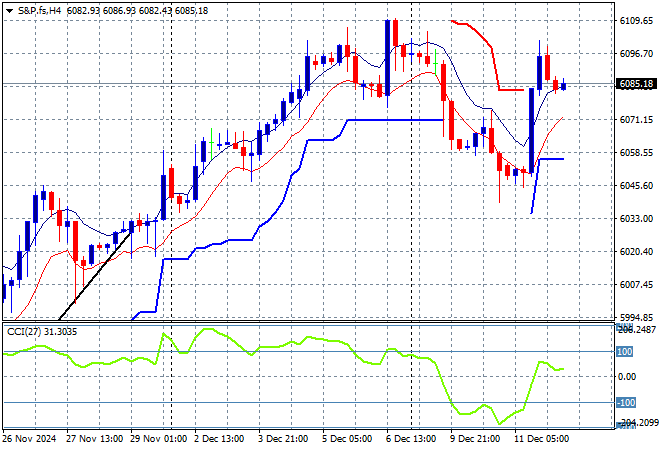

S&P and Eurostoxx futures are holding on to their overnight gains as we head into the London session with the S&P500 four hourly chart showing momentum still positive but only just as price action remains below last Friday’s NFP print:

The economic calendar will be dominated tonight by the dual European bank meetings, namely the SNB and ECB where cuts are expected.