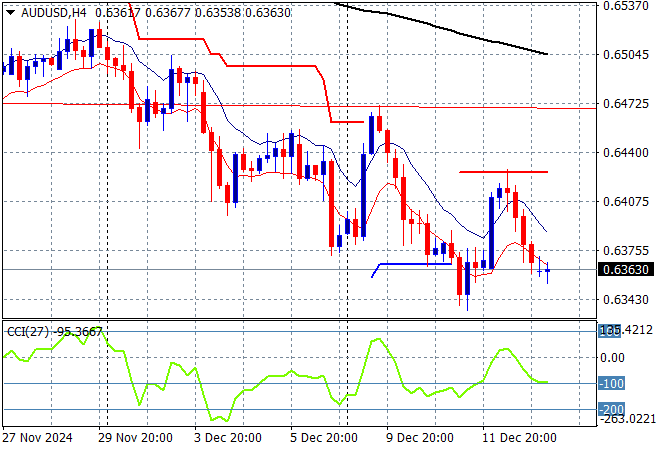

Asian stock markets are generally lower across the board, as the risk off mood from Wall Street spreads across the complex following the Swiss and European Central banks cuts from tonight. The USD has pushed all the undollars back into the place with Yen down in afternoon trade with the Australian dollar again unable to get back above the 64 handle.

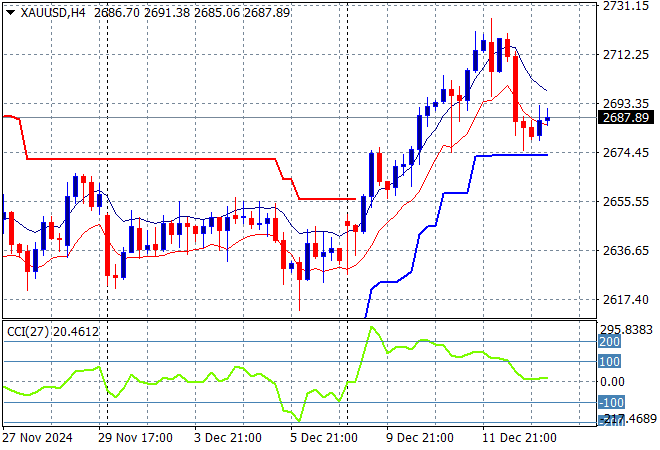

Oil futures are pushing up slightly after pulling back to their recent weekly lows with Brent crude staying above the $73USD per barrel level while gold is also trying to lick its wounds from overnight, sitting just below the $2690USD per ounce level:

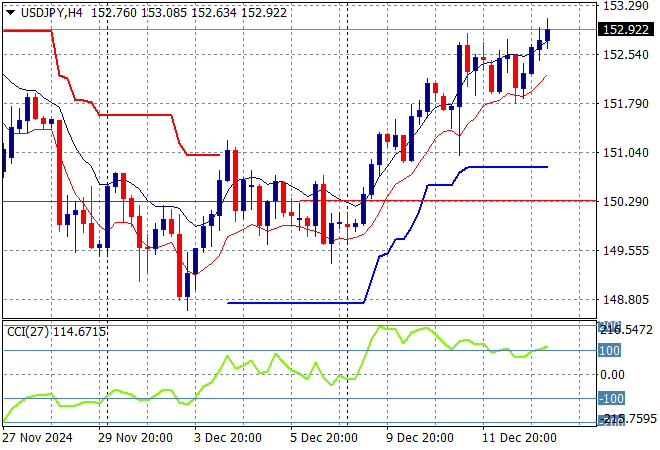

Mainland Chinese share markets are having a bad session to end the trading week with the Shanghai Composite down more than 1.5% to almost crack below the 3400 point level while the Hang Seng Index is also taking back its previous gains by losing more than 1.6% in afternoon trade at 20057 points. Japanese stock markets are also down with the Nikkei 225 off my more than 1% to be at the 39450 point level while the USDPY pair has been able to advance from its overnight highs to almost break the 153 handle:

Australian stocks remaining in sell mode with the ASX200 closing 0.4% lower at 8299 points while the Australian dollar has drifted slightly lower to remain well below the 64 cent level:

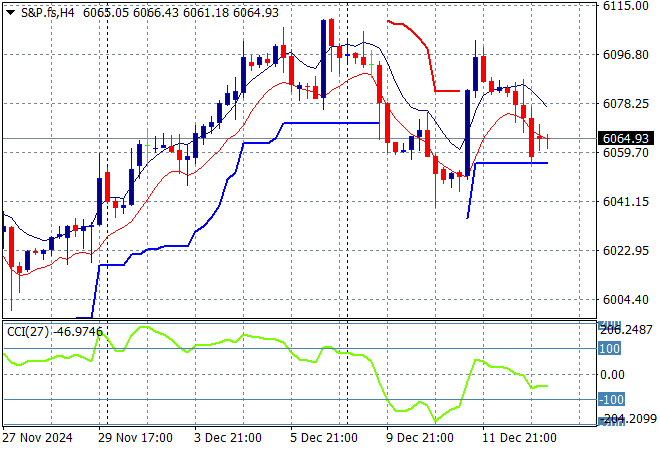

S&P and Eurostoxx futures are dropping back again as we head into the London session with the S&P500 four hourly chart showing momentum dipping into negative short term territory as price action remains below last Friday’s NFP print:

The economic calendar includes the UK GDP print, German trade figures and some US trade data as well.