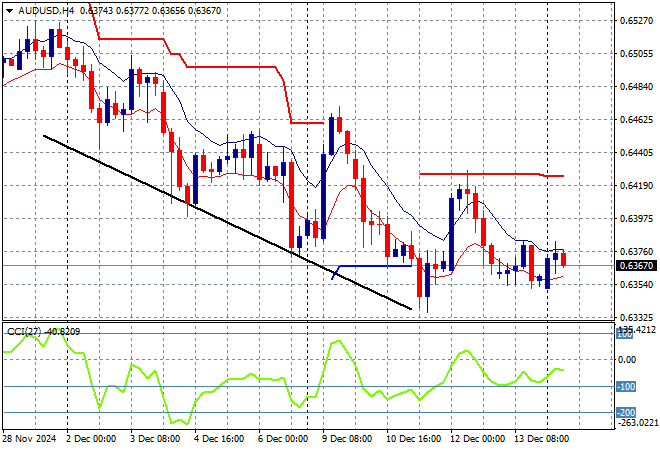

While Bitcoin hits a new high, Asian stock markets are generally lower across the board, as the risk off mood from Wall Street on Friday night remains as traders await this week’s central bank meetings include the Fed. The USD has pushed all the undollars back after the weekend gap with the Australian dollar again unable to get back above the 64 handle.

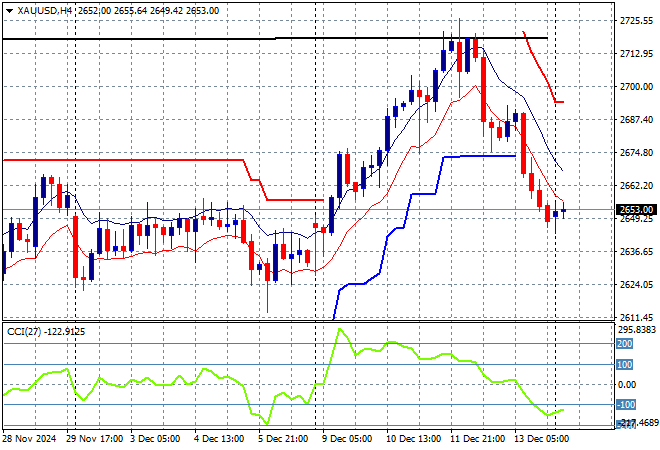

Oil futures are pushing up slightly after pulling back to their recent weekly lows with Brent crude staying above the $74USD per barrel level while gold is also trying to lick its wounds from Friday night, sitting just above the $2650USD per ounce level:

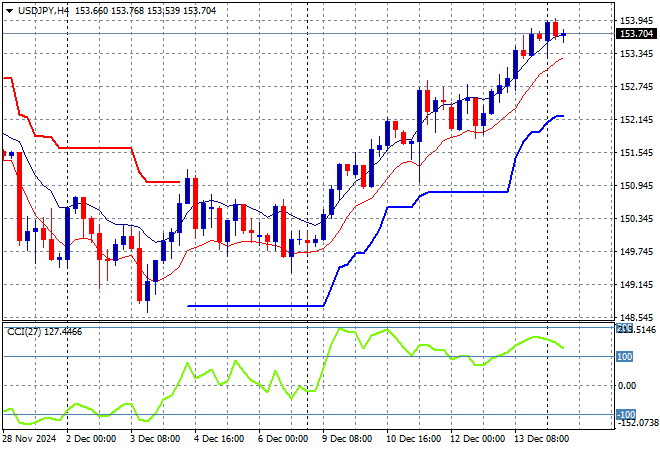

Mainland Chinese share markets are having a poor session to start the trading week with the Shanghai Composite down more than 0.4% in afternoon trade to remain below the 3400 point level while the Hang Seng Index is off by nearly 1% at 19786 points. Japanese stock markets are treading water with the Nikkei 225 closing 0.1% lower at the 39427 point level while the USDPY pair has been able to hold on its Friday night highs above the 153 handle:

Australian stocks remaining in sell mode with the ASX200 closing 0.5% lower at 8249 points while the Australian dollar has also drifted slightly lower to remain well below the 64 cent level:

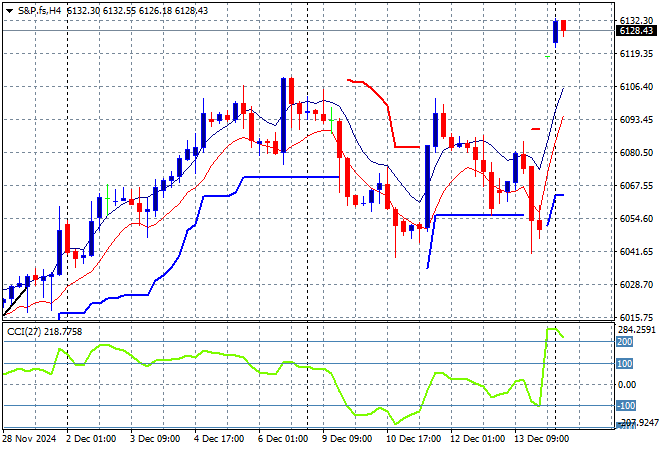

S&P and Eurostoxx futures are gapping higher over the weekend as we head into the London session with the S&P500 four hourly chart showing momentum wanting to reengage to the positive side as price action seeks to breakout above the recent NFP print resistance area:

The economic calendar will focus on a slew of PMI surveys again tonight leading up to this weeks FOMC meeting.