While Bitcoin pulls back from its recent new high, Asian stock markets are generally lower across the board although Chinese shares want to believe the PBOC will actually move on their stimulus promise. Locally the latest Budget news hit the Australian dollar hard, now at a yearly low but most of this is timing around tonight’s FOMC meeting where a small cut is expected.

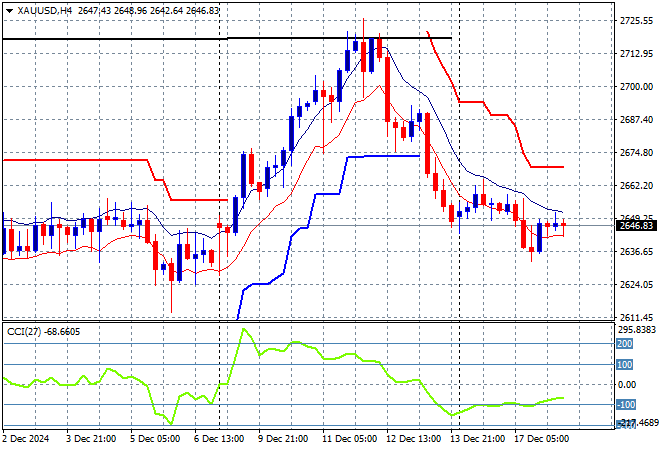

Oil futures are getting pushed down again after pulling back to their recent weekly lows with Brent crude now down to the $73USD per barrel level while gold is also trying to lick its wounds from Friday night and the weekend gap selloff, now sitting just below the $2650USD per ounce level:

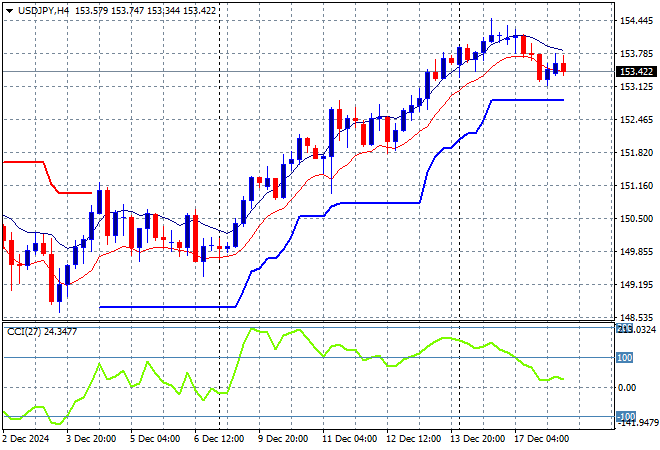

Mainland Chinese share markets are having a much better session with the Shanghai Composite up 0.8% in afternoon trade, almost breaking through the 3400 point level while the Hang Seng Index is following, up by over 0.9% at 19877 points. Japanese stock markets are dropping instead with the Nikkei 225 closing 0.5% lower at the 39179 point level while the USDPY pair has remained slightly above the 153 handle:

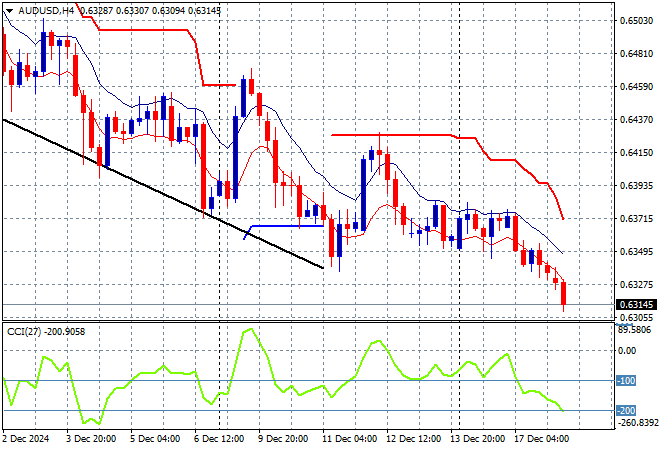

Australian stocks put in a scratch session with the ASX200 closing 0.1% lower at 8309 points while the Australian dollar drifted lower to almost break the 63 cent level on the Budget news:

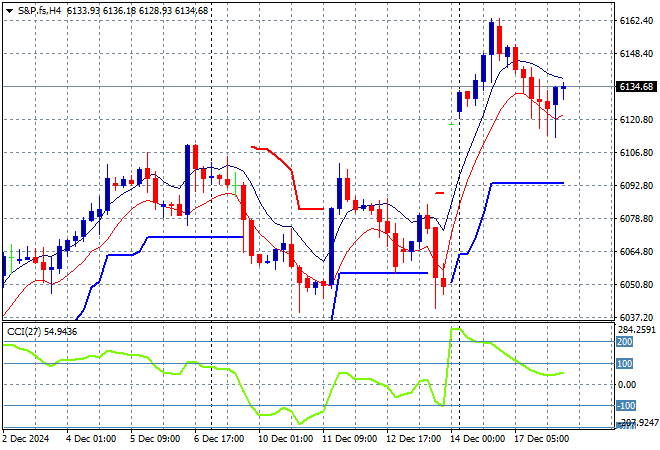

S&P and Eurostoxx futures are barely holding on to losses from overnight as we head into the London session however the S&P500 four hourly chart showing momentum wanting to reengage to the positive side as price action seeks to solidify above the recent NFP print resistance area:

The economic calendar will be dominated by tonight’s FOMC meeting.