Asian stock markets have done relatively well given the near crash on Wall Street overnight on the latest Fed rate cut and subsequent inflation notes that implied a lot less cutting to be going on in 2025 – that is until the Trumpians mess everything up. The USD remains King against everything with the BOJ hold adding to the Yen’s demise while locally the latest NZ GDP print came in much worse than expected, pulling Kiwi back and then the Australian dollar as well as the Pacific Peso craters below the 62 cent level.

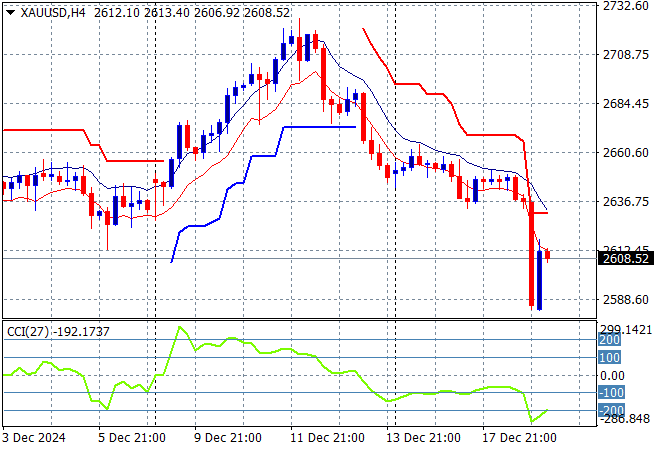

Oil futures are getting pushed down again after pulling back to their recent weekly lows with Brent crude now below the $73USD per barrel level while gold is also trying to lick its wounds from overnight, recovering to just above the $2600USD per ounce level:

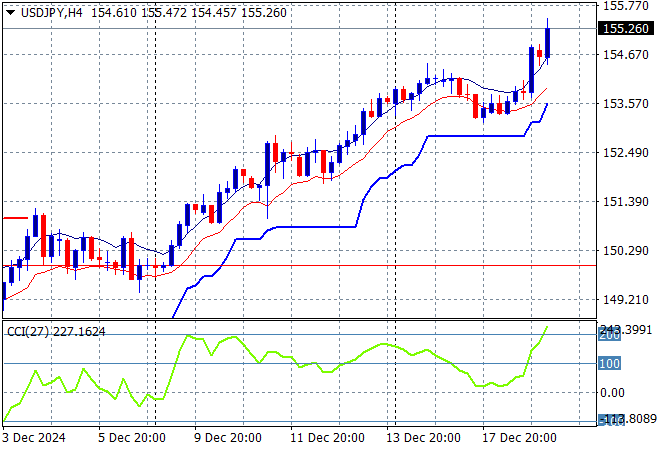

Mainland Chinese share markets are having a poor session with the Shanghai Composite down 0.4% in afternoon trade, still unable to break above the 3400 point level while the Hang Seng Index is down 0.7% at 19729 points. Japanese stock markets are also in the red, but its all relative with the Nikkei 225 closing just 0.5% lower at the 38870 point level while the USDPY pair has edged even higher on the BOJ hold, currently well above the 155 handle:

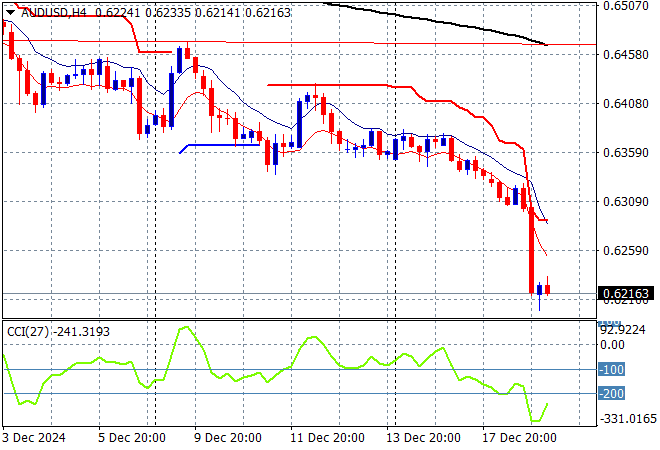

Australian stocks were the worst in the region with the ASX200 falling more than 1.7% to 8168 points while the Australian dollar sank below the 62 cent level on the NZ GDP print and has only barely recovered in afternoon trade to its year low:

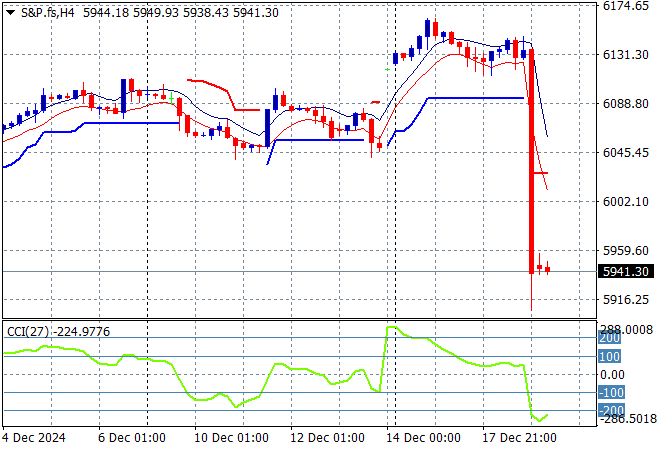

S&P and Eurostoxx futures are barely holding on to losses from overnight as we head into the London session however the S&P500 four hourly chart showing momentum extremely oversold but still capable of falling further from last night’s rout:

The economic calendar switches to the Bank of England rate meeting tonight.