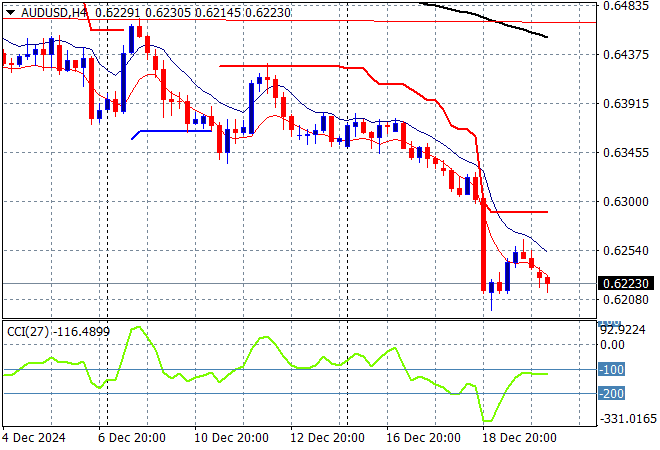

Asian stock markets are having staid sessions going into the end of the trading week with local stocks still selling off. The USD remains King against everything with the BOE hold as expectations for tonight’s PCE inflation print ramp up. The Kiwi and the Australian dollar remain under the pump as the Pacific Peso almost crosses below the 62 cent level again.

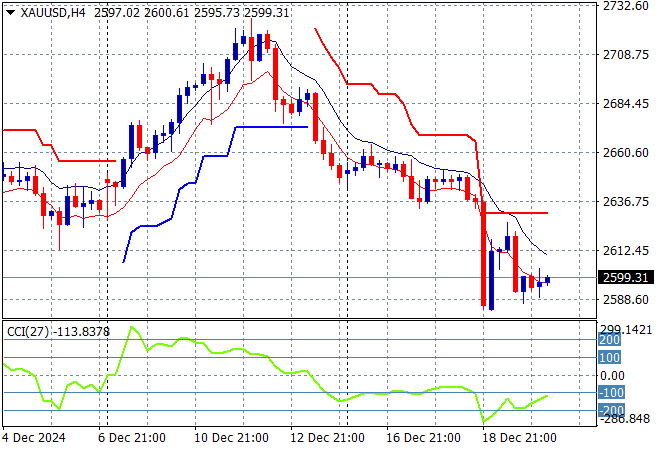

Oil futures are getting pushed down again to almost retreat to their recent weekly lows with Brent crude now well below the $73USD per barrel level while gold is also trying to lick its wounds, still failing to recover back above the $2600USD per ounce level:

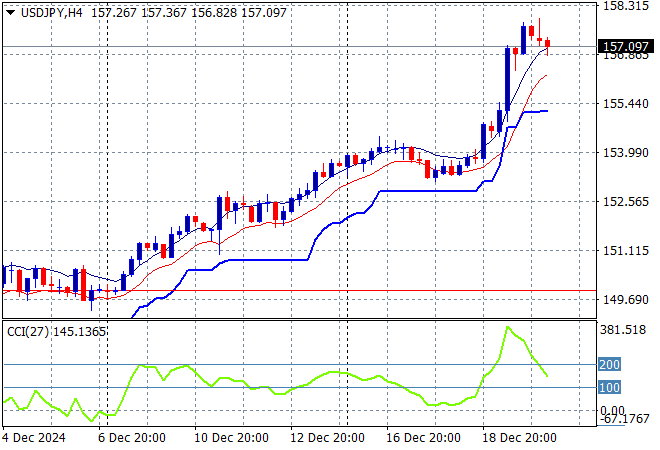

Mainland Chinese share markets are having a much better final session with the Shanghai Composite up 0.6%, almost above the 3400 point level while the Hang Seng Index is barely moving, up 0.1% at 19774 points. Japanese stock markets are also in a stable condition with the Nikkei 225 closing up just 0.2% at 38870 points while the USDPY pair has pulled back on some internal BOJ commentary this afternoon to hold just above 157 handle:

Australian stocks were again the worst in the region with the ASX200 falling more than 1.3% to 8068 points while the Australian dollar sank back to the 62 cent level in afternoon trade to match its year low:

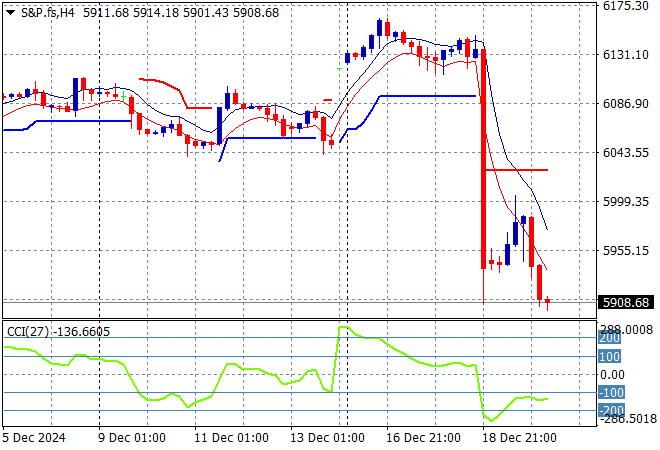

S&P and Eurostoxx futures are swinging lower from their recent steep losses as we head into the London session with the S&P500 four hourly chart showing momentum remaining oversold and still capable of falling further:

The economic calendar includes the latest US inflation PCE data tonight.