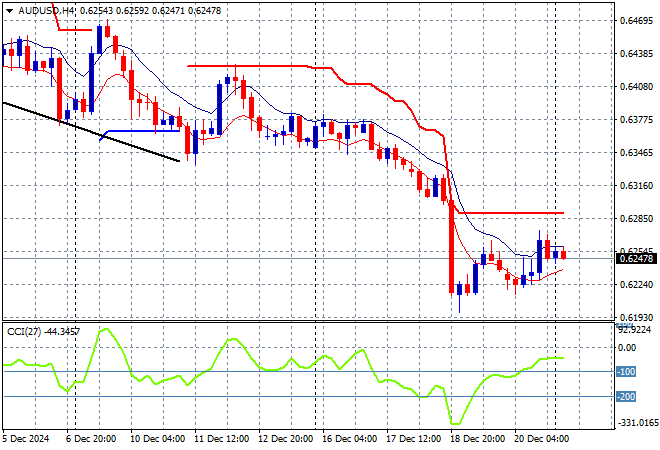

Asian stock markets are having solid sessions going into the Xmas break with local stocks finally seeing a solid bid as speculation around more Chinese stimulus measures grows. The USD is firming up again after pulling back on Friday night on the slightly cooler than expected PCE inflation but Euro is holding above the 1.04 handle. The Australian dollar remains very weak however as the Pacific Peso stays solidly at the 62 cent level again.

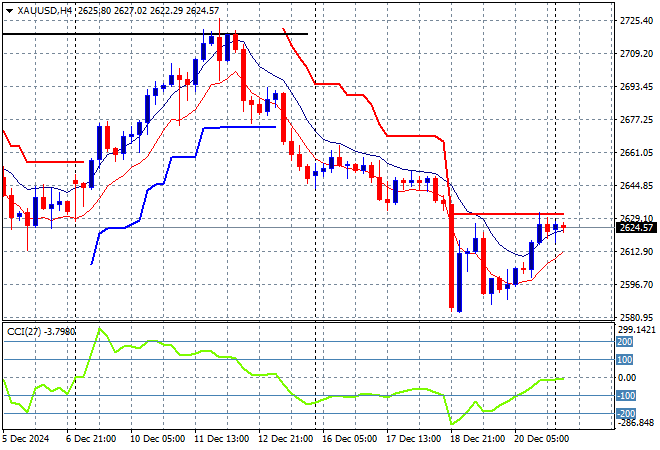

Oil futures are up slightly on some Qatari gas pushback against the EU with Brent crude lifting towards but not above the $73USD per barrel level while gold is trying to lick its wounds as it struggles to get back above the $2600USD per ounce level:

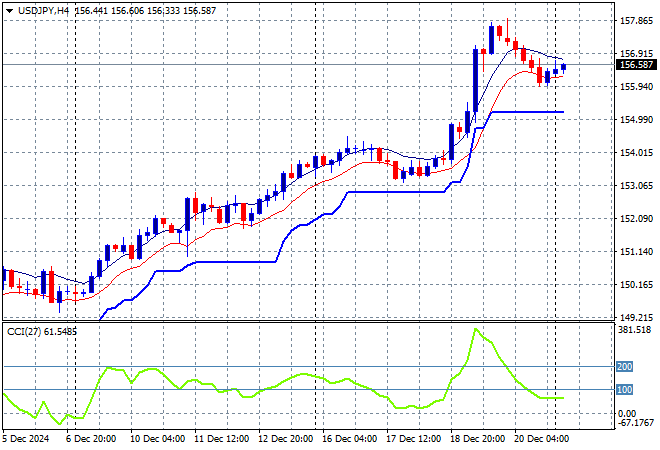

Mainland Chinese share markets are having a wayward session with the Shanghai Composite up just 0.2%, still below the 3400 point level while the Hang Seng Index is up much further, currently 0.6% higher at 19834 points. Japanese stock markets are also advancing on the potential Nissan/Honda deal with the Nikkei 225 up more than 0.9% to 39037 points while the USDPY pair has steadied after its Friday night pullback to the mid 156 level:

Australian stocks are finally the best performing region with the ASX200 up more than 1.3% going into the close at 8181 points while the Australian dollar can’t stop the music, currently churning along just above the mid 62 cent level in afternoon trade, not far above its year low:

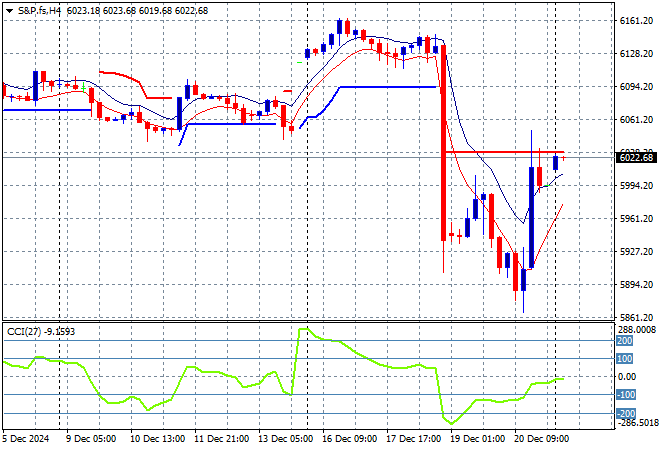

S&P and Eurostoxx futures are swinging higher from their recent steep losses as we head into the London session with the S&P500 four hourly chart showing momentum getting out of its oversold condition but not quite above short term resistance levels:

The economic calendar includes US CB consumer confidence and some UK GDP estimates.