Buying fatigue is setting in on Wall Street while another record high from the German DAX pushed European stocks higher amid the French political imbroglio. The USD is in flux mode after more Trumpian threatening language as Euro sits unsteadily at the 1.05 level while the Australian dollar remained under pressure as it still can’t get back above the 65 handle.

US Treasury 10 year yields edged slightly higher to remain above the 4.2% level while oil markets saw a surge on demand with Brent crude lifting up through the $73USD per barrel level. Gold however remains under the pump following its previous sharp retracement as it stabilises somewhat at the $2630USD per ounce level.

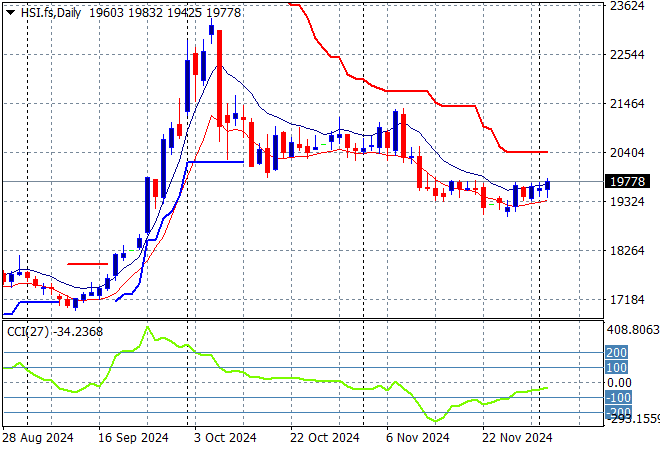

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets were pushing higher with the Shanghai Composite up more than 0.4% to close at 3378 points while the Hang Seng Index was up exactly 1%, closing at 19746 points.

The Hang Seng Index daily chart shows how short term resistance was finally being pushed away with a huge breakout above the 19000 point level that then set up for a run at the 20000 level in the response to PBOC stimulus last month before a massive retracement. Price action however is again setting up for another potential breakdown if short term support breaks:

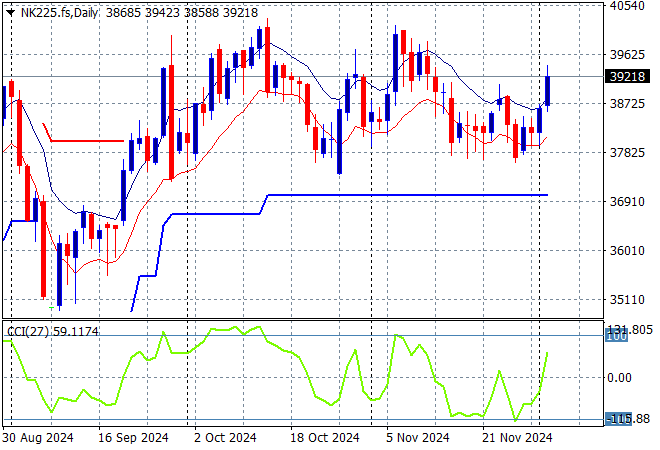

Japanese stock markets were also doing very well with the Nikkei 225 closing nearly 2% higher despite the higher Yen at 39248 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards as positive momentum is building.

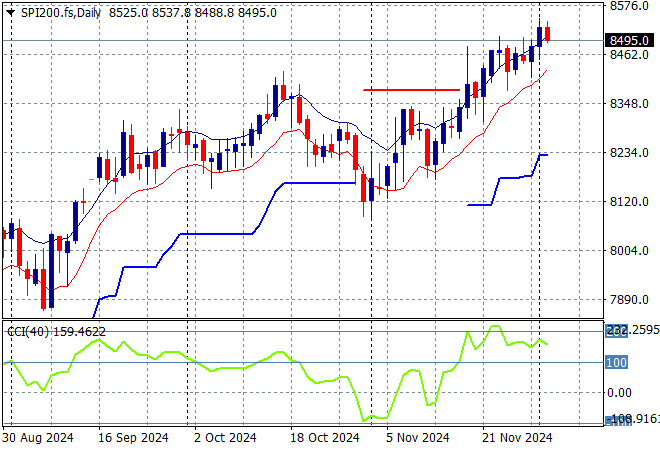

Australian stocks had a better session this time with the ASX200 closing 0.5% higher at 8495 points as it continues its Christmas rally.

SPI futures however are down at least 0.3% due to the lack of a solid lead on Wall Street overnight and perhaps the South Korean tensions. The daily chart pattern and short price action suggests a return to the pre election uptrend, with the lower Australian dollar helping as we head straight into a Santa Rally as daily momentum remains at extreme overbought levels:

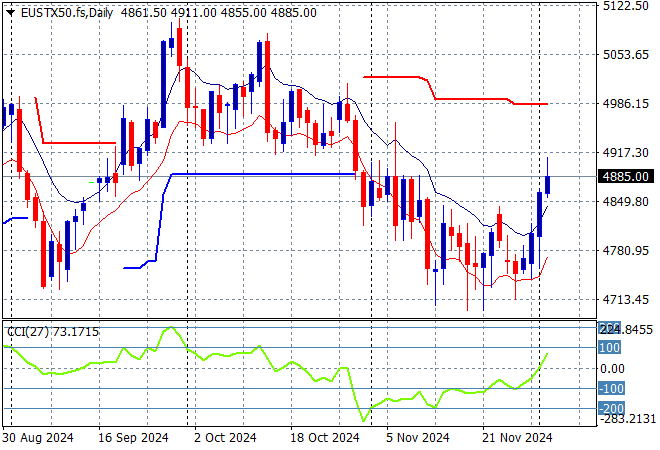

European markets continued their strong rebound with very impressive sessions across the continent led by the German DAX with the Eurostoxx 50 Index closing more than 0.6% higher to finish at 4878 points.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum is now getting out of oversold mode on its way back up to the previous weekly support levels:

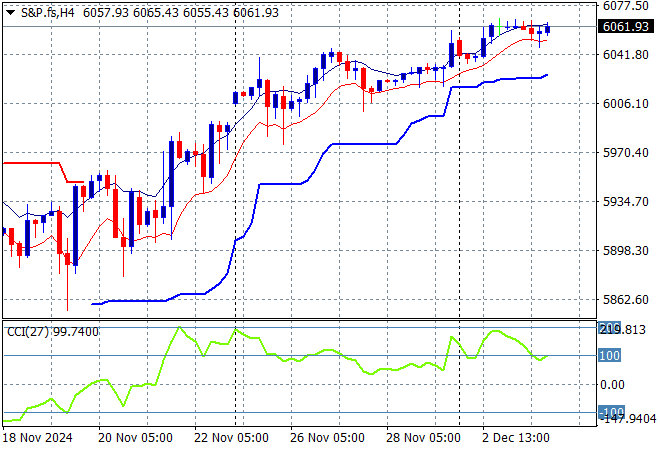

Wall Street was relatively mixed with the headline DOW again in retreat while the tech heavy NASDAQ was only able to put on 0.3% while the S&P500 put in a scratch session to finish at 6045 points.

Price action is still looking extremely positive but perhaps the Trump Santa rally is running out of steam as buying exhaustion sets in above the 6000 point level?

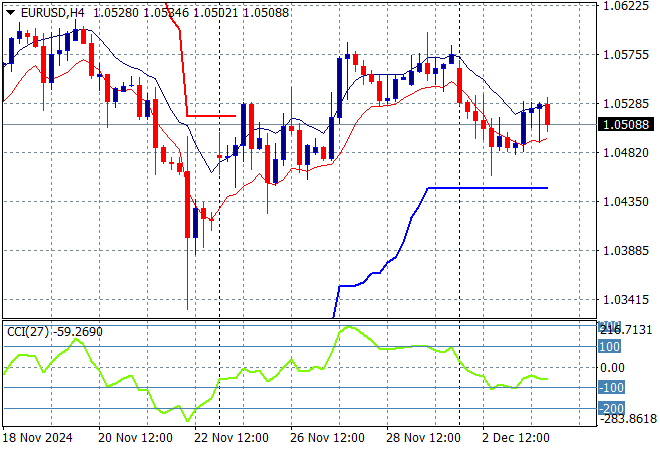

Currency markets are increasing in volatility due to political tensions in France and now South Korea, let alone the random stuff coming out of the US with more Fedspeak also muddying the waters on the direction of the USD. Euro remains on the back foot as it stabilised just above the 1.05 handle overnight but is still well off its previous weekly high.

The union currency had been pushed higher after remaining oversold for weeks in a dominant downtrend, then cleared overhead resistance at the mid 1.08 level in the lead up to the election. I still contend we are still likely on our way back to parity as traders start to price in the now very unclear future for the continent so watch out for this to turn into a dead cat bounce:

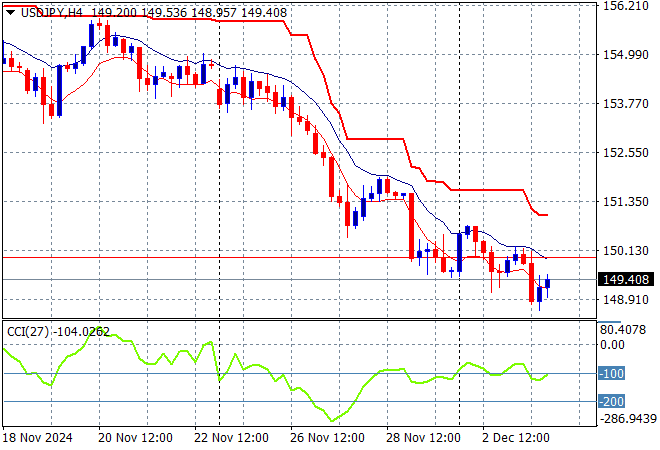

The USDJPY pair is still in full retracement mode after testing the 154 handle on the previous weekend gap as Yen accelerated its strength to cross below the previous weekly low and finish just below the key 150 level this morning.

Short term momentum remains quite negative with price action unable to make new short term highs so this is setting up for a further breakdown here below the 150 level in the coming sessions, but watch for a potential recovery bounce:

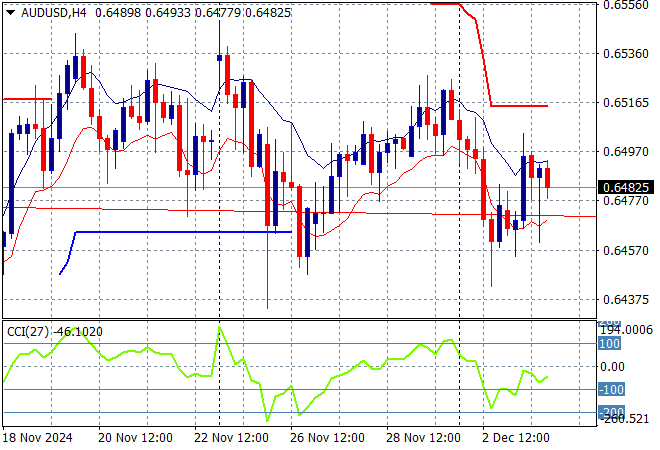

The Australian dollar is facing more pressure on the upcoming trade war, although yesterday saw it build back to the its start of week position just below the 65 cent level in what I still think looks like a relatively weak move.

The Pacific Peso could come under more pressure here on reweighting risks and the lack of action from the RBA as it wants to hold through to Feb/March next year, and this move had been already with a retracement back to the 64 handle most likely next:

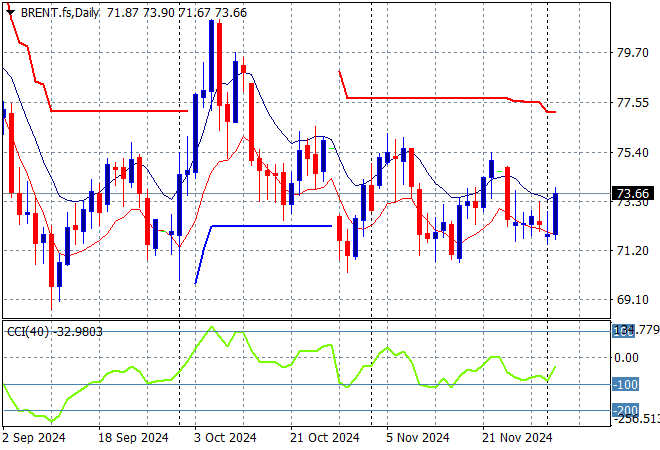

Oil markets had been reducing in volatility which always precludes a volatile breakout and here we have it as the OPEC meeting comes up as amid potential peace talks/ceasefires in the Middle East as Brent crude was pushed back above the $73USD per barrel level.

The daily chart pattern continues to tighten like a spring and while short term momentum remains in negative territory, medium term price action still supports a downtrend with my contention of another sharp retracement forthcoming if the $70-72 zone is not defended:

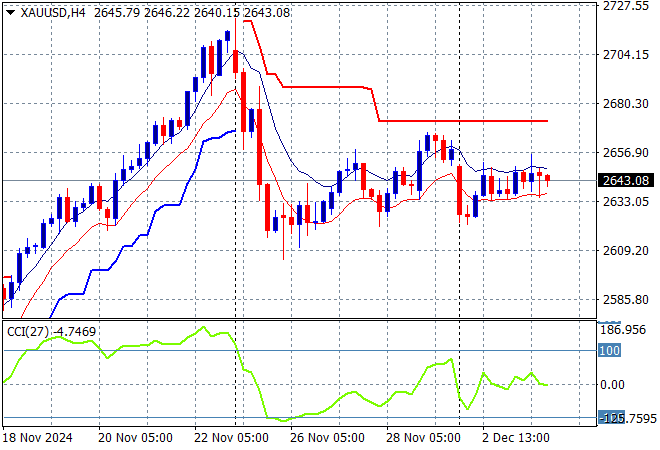

Gold remains under pressure following its swift selloff down below the $2700USD per ounce level in previous weeks but its now trying to hold on to the mid $2650 level as the USD is pulled in both directions across the currency complex.

Price action had been accelerating in confidence as new levels of support were being created for the shiny metal regardless of USD strength but this pullback and rebound both are fighting too much under the $2700 zone so I’m skeptical of a new breakout here:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!