DXY is back to chopping wood.

AUD looks defeated at the cliff’s edge.

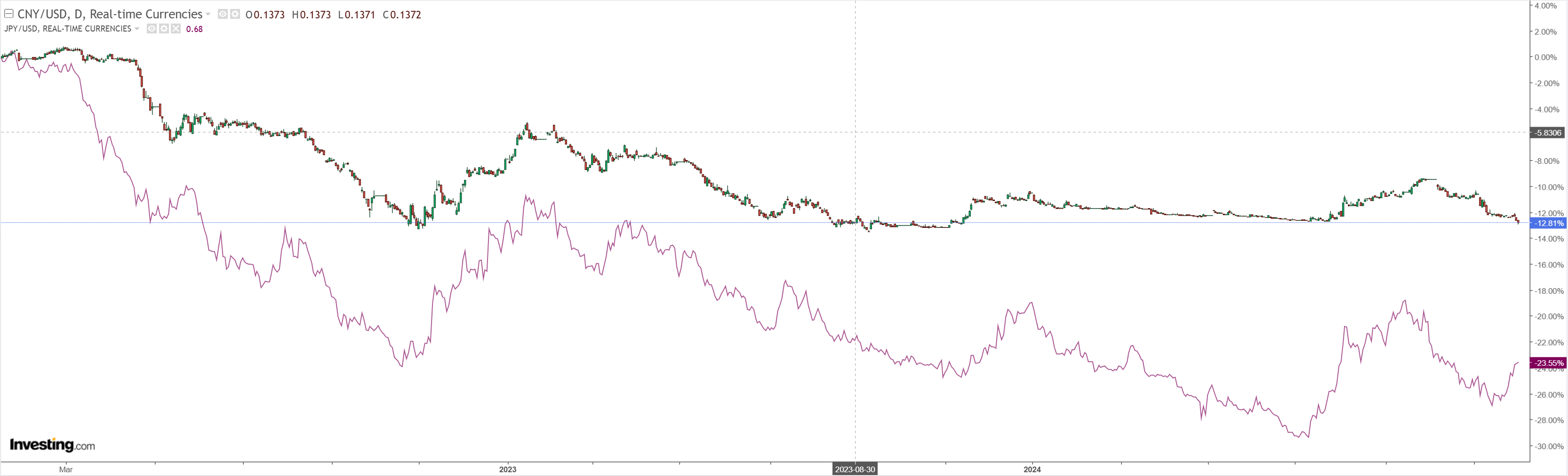

As CNY warms into its task.

Oil should be lower. Gold too.

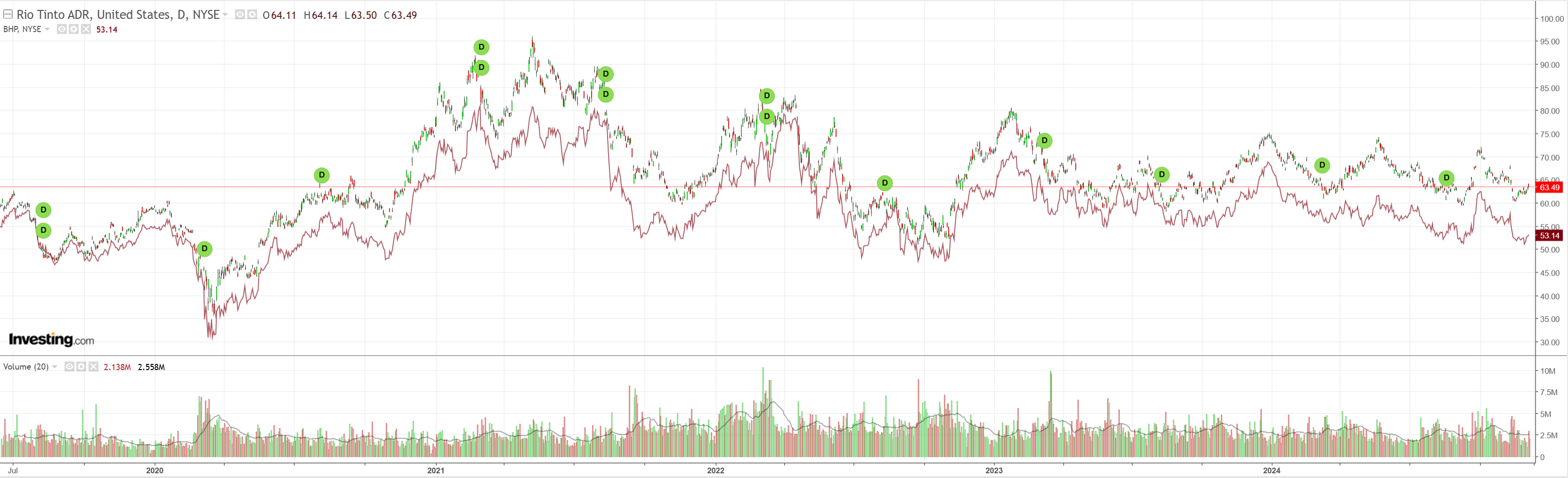

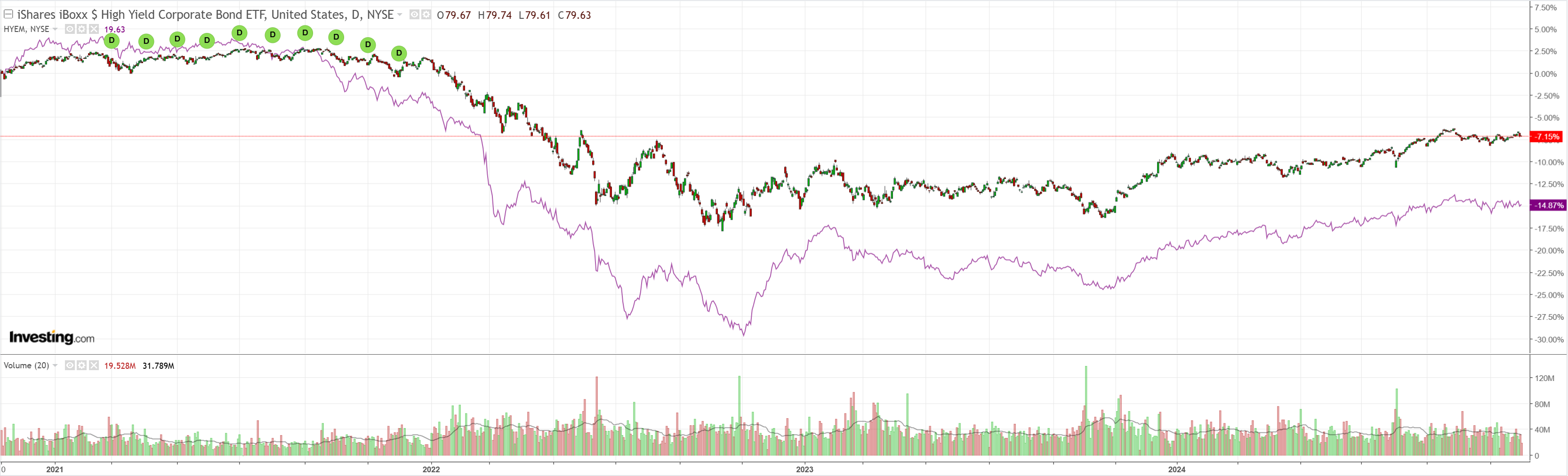

The entire Crap Complex—EM, dirt, miners and junk—is blah.

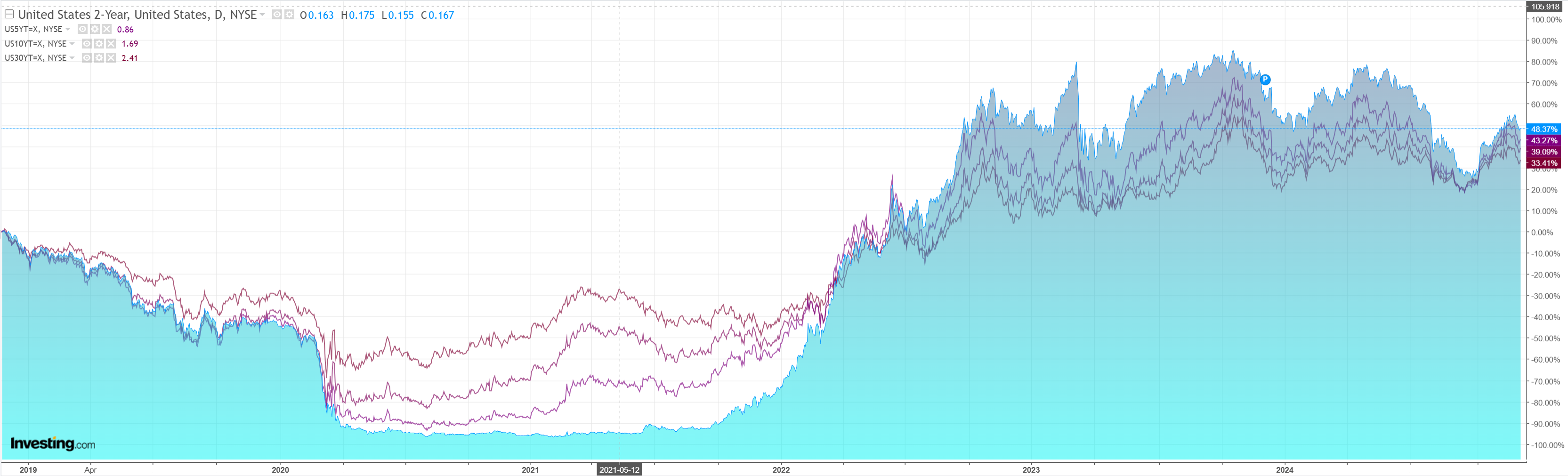

Curve steepening returned as US job openings were strong.

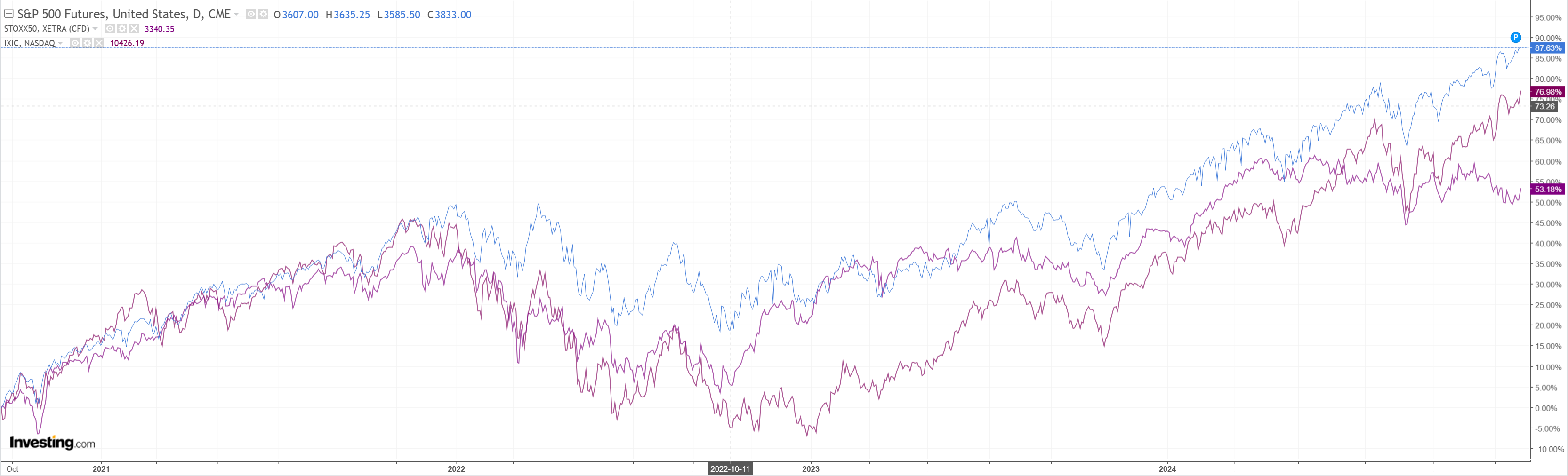

Stocks always go up.

Another major bank has forecast a crash in the AUD. From CBA.

We forecast the Australian dollar will fall materially further in 2025 … possibly testing US60¢.

The Australian dollar could fall further and/or faster if the trade war is more disruptive than we expect.

The outlook for the world economy will likely be more uncertain in coming years. Uncertainty typically supports safe haven currencies such as the US dollar.

The more the US and Europe seek to constrain China, the more the Chinese government will seek to support its economy with positive spillover to commodity prices that support the Australian dollar.

That all makes good sense.

All that bothers me is that the majors are piling in so fast behind my bearish outlook that I should turn bullish!