According to the most recent PropTrack home price data, Melbourne has been left well behind the other major capital cities.

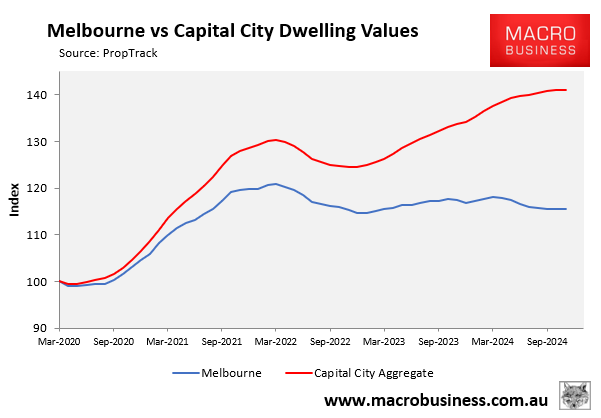

Since the start of the pandemic in March 2020, Melbourne dwelling prices have increased by only 16%, compared to a 41% growth across the combined capital cities:

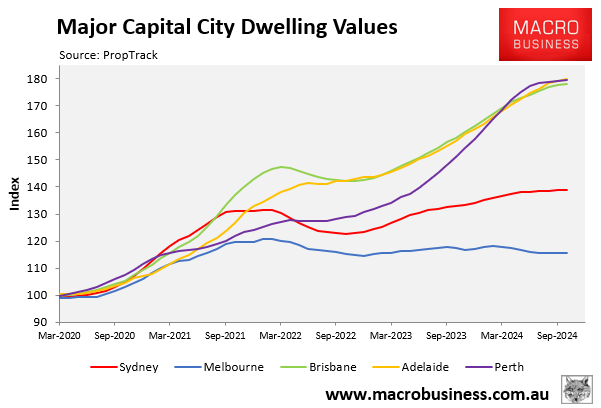

The following chart displays price growth across the five major capital city markets in index form:

Adelaide (80%), Brisbane (78%), and Perth (79%), lead the nation in home value growth. Sydney follows with a 39% increase, followed by Melbourne (16%) well behind.

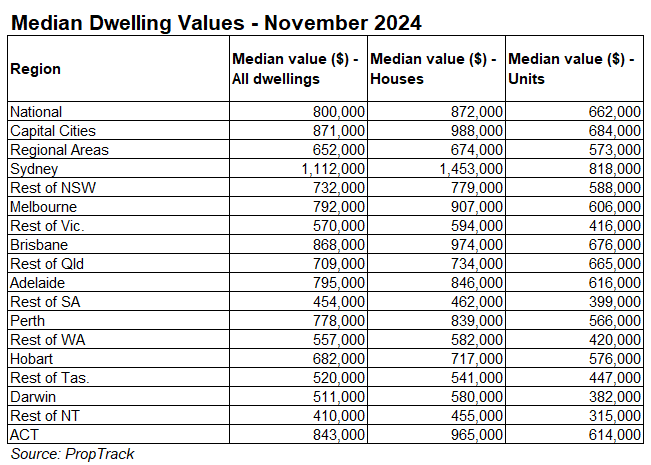

The following table from PropTrack shows that Brisbane’s ($868,000) and Adelaide’s ($795,000) median dwelling values have risen above Melbourne’s ($792,000):

Melbourne’s median dwelling value ($792,000) has also fallen behind the national ($800,000) and capital city ($871,000 average).

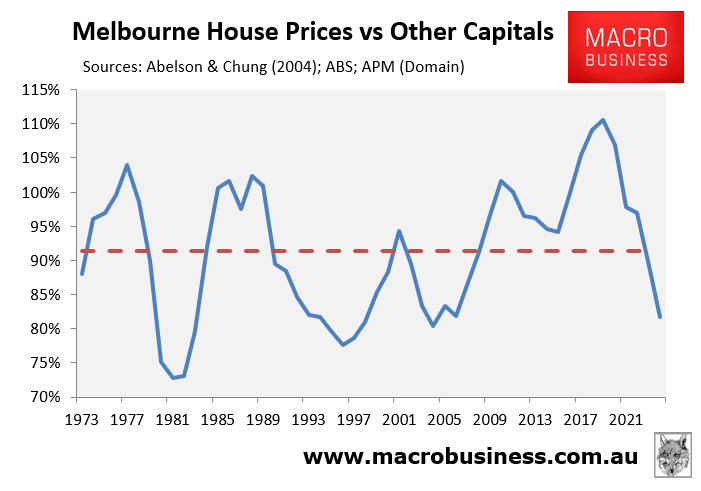

The next chart derived from Domain data also reveals that Melbourne’s median house price has fallen well below the other capital cities, making the city relatively inexpensive.

The Victorian state government’s additional land taxes and penalties on property investors have undoubtedly depressed price growth.

These reforms have compelled some investors to sell, driving demand interstate.

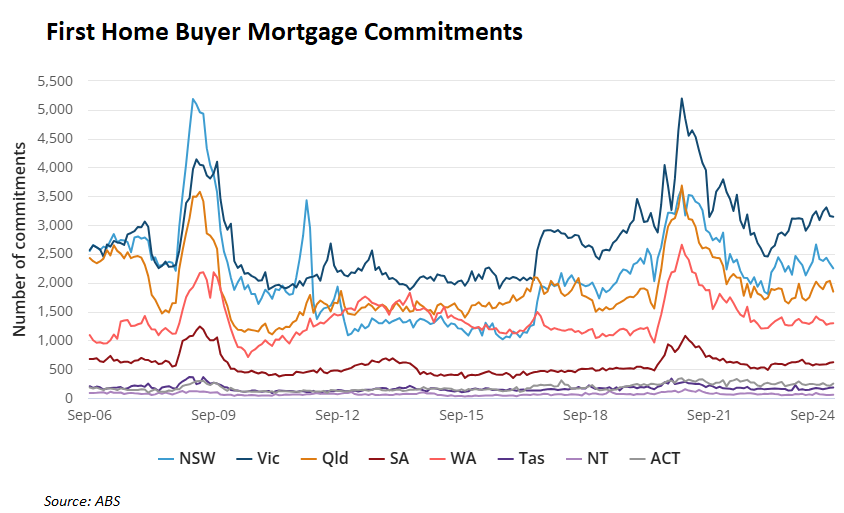

The approved affordability has benefited Victorian first-time home buyers, as evidenced by the state having the highest share of first home buyers in the country.

Victorian first home buyers are also benefiting from a high number of for-sale listings, which are tracking well above the decade average.