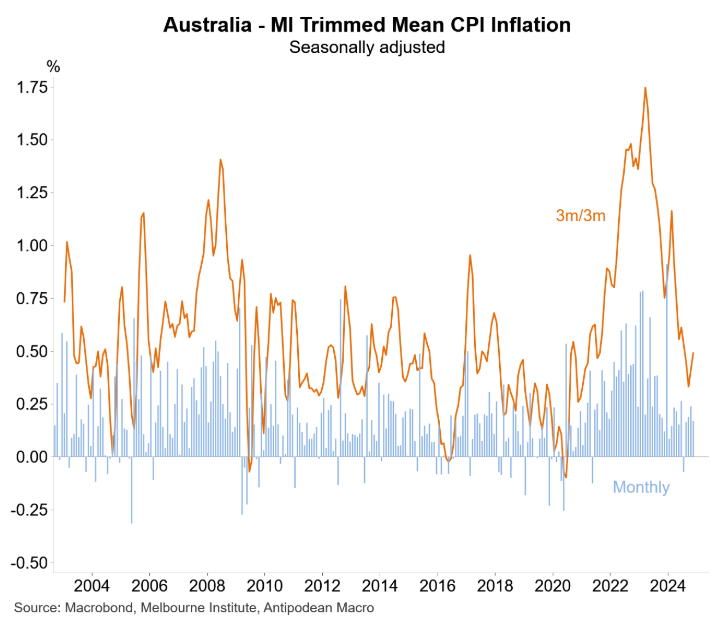

On Monday, the Melbourne Institute (MI) monthly inflation gauge was released, which showed that inflationary pressure remained well contained in November.

As Justin Fabo at Antipodean Macro illustrates below, MI trimmed mean inflation increased by only 0.2% in October but rebounded to 0.5% on a quarterly basis.

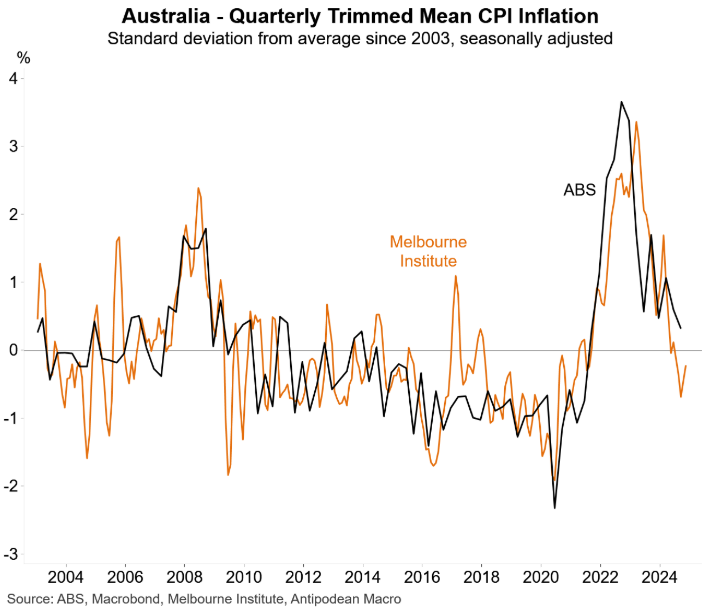

The following chart from Fabo suggests that “the MI measure of quarterly trimmed mean inflation continued to point to some downside in the near-term for the official measure”.

“This is consistent with our preliminary nowcast of Q4 trimmed mean inflation of +0.6% q/q compared with +0.8% q/q in Q3 and the RBA’s Q4 forecast of +0.7% q/q”, Fabo wrote.

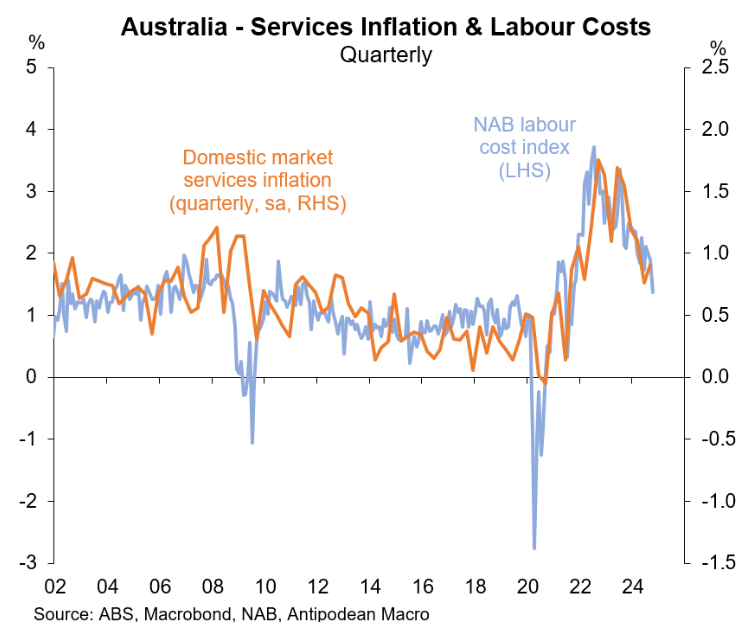

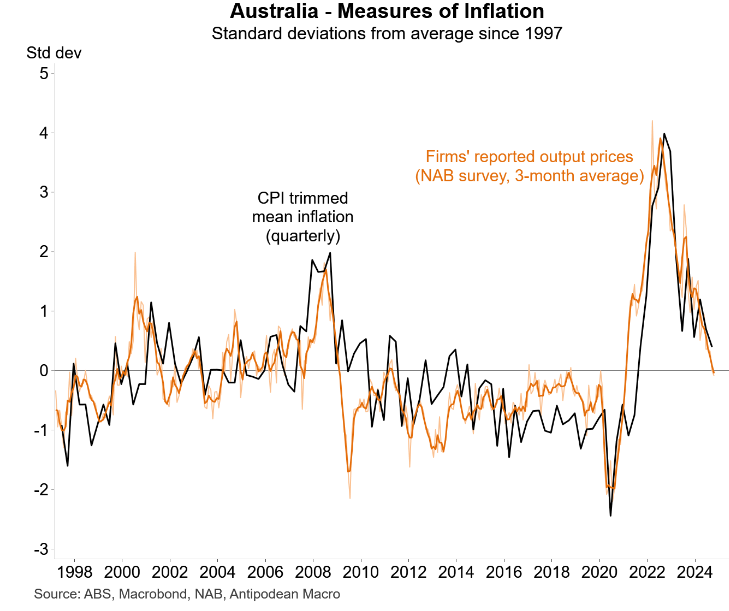

The latest NAB business survey, released in mid-November, suggested that labour cost growth is slowing, which points to further disinflation of domestic market services prices.

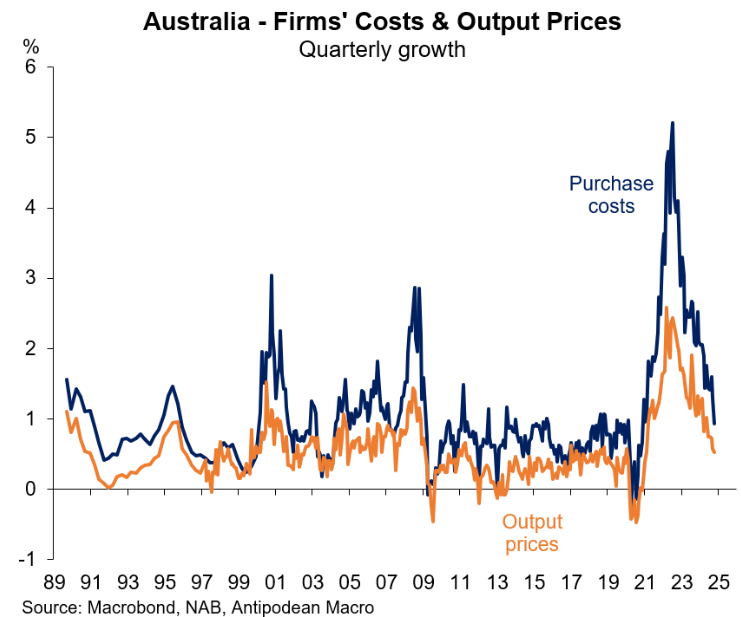

Australian businesses have also reported slower growth in output prices and purchase costs, which declined to the 2000-2019 average.

This disinflation in firm output prices also augers well for underlying inflation.

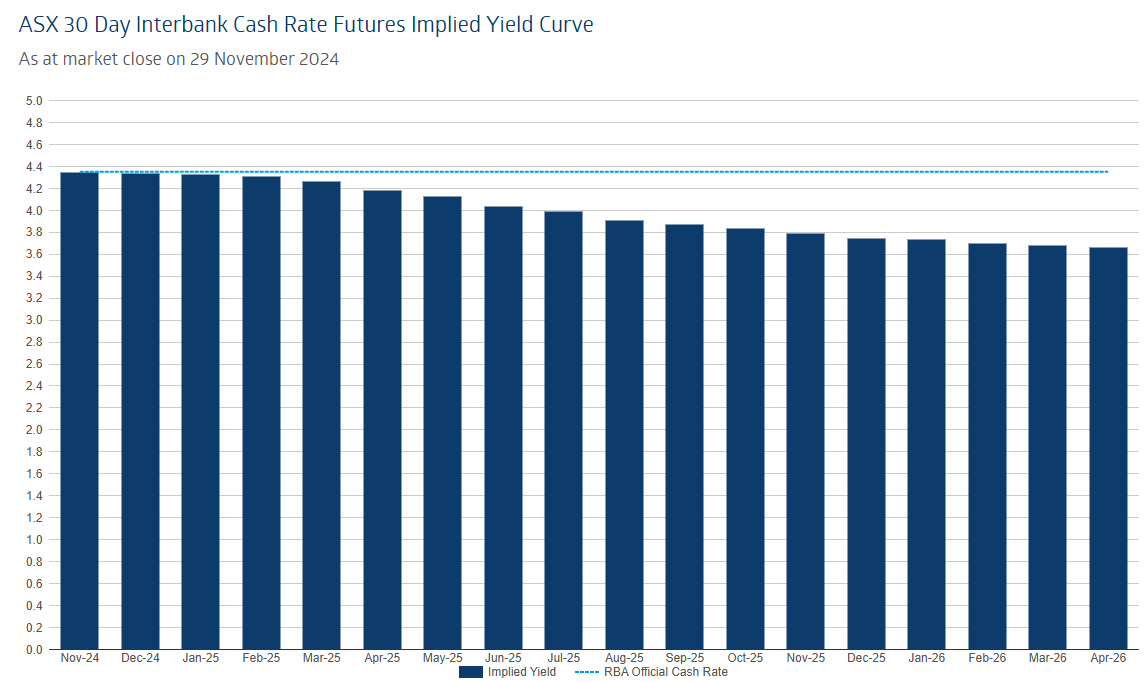

Financial markets have tipped rate cuts to arrive in Q2 2025.

The Albanese government will be hoping that the MI inflation gauge and NAB business survey are replicated in the official CPI inflation data, prompting the RBA to cut rates well ahead of the May 2025 election.