In normal circumstances, Australian households would be about to enjoy an interest rate easing cycle without end.

But that is no longer assured because, instead, they will be smashed by the East Coast gas export cartel.

An off-peak season gas price shock has been building for months owing to cold start to the European winter.

Now, gas prices here are reaching for the stars!

Prices are now roughly 500% above where they should be for the low season.

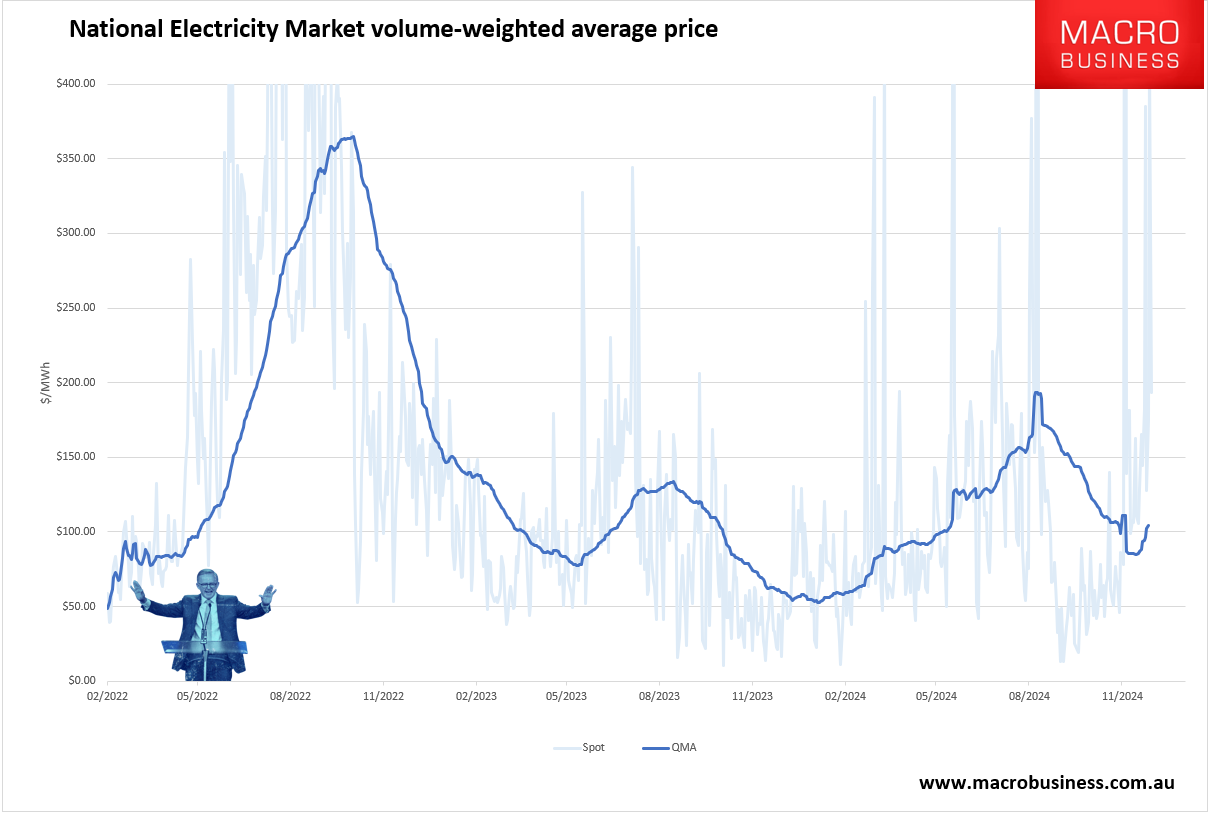

The direct consequence is wholesale electricity prices are double year on year

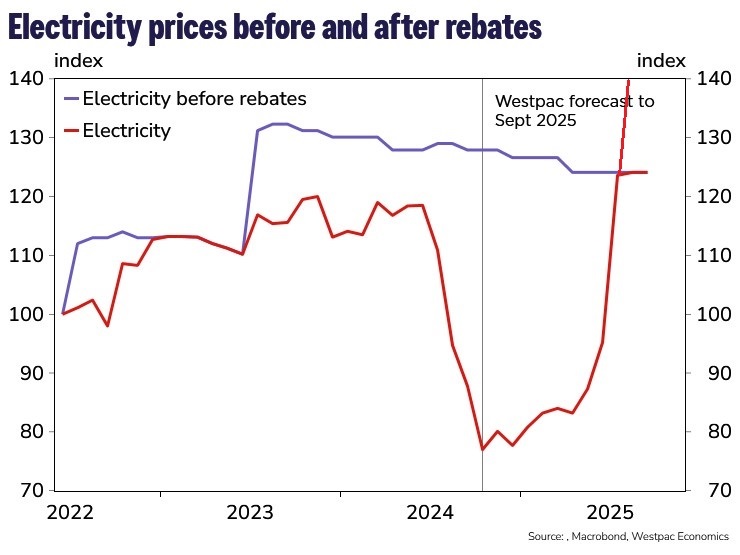

Again, I can only warn that the AER will have to hike retail tariffs 10-20% in March for 2025/26.

Just as the old energy rebates roll off, delivering a gigantic inflation shock in the realms of 4% of CPI.

Of course, this won’t happen. Instead, the Albanese government will supersize its energy rebates.

However, by doing so, what it is actually doing is encouraging the gas cartel to gouge even harder via taxpayer subsidies.

This ‘can kicking’ is risking economic disaster.

The Aussie industrial economy has already been gutted to make room for gas profiteering. Just as we are supposed to be repatriating supply chains because we can’t rely on China. IEEFA has more.

Gas demand on Australia’s east coast – excluding gas used for LNG production – has fallen by 32% since its peak in FY2012-13.

This fall follows a 40-year period of continuous increase; the turnaround coincided with the start of LNG exports from Queensland in 2015, which drove a tripling in gas prices.

Gas demand for power generation is down almost 60% while gas demand for manufacturing has fallen to a 31-year low, mostly due to plant closures.

The fall in demand happened as gas production rose by a factor of 2.8, with LNG production soaking up new gas supplies. Across Australia, the LNG industry uses 80% of all gas produced.

As well, Australian households and the entire private sector has been in recession for the past year to make room for the gas cartel profiteering.

It was only when the federal government stepped in with in with rebates that inflation fell enough to pivot the RBA to interest rate cuts.

Now, as we approach 2025, LNG imports are scheduled to begin mid-year.

At current Asian prices, that gas will land at around $25Gj, up another 50% on today’s runaway gouge.

Have no doubt, the gas export cartel will respond by rationing supply further to ensure that imported LNG price becomes the marginal price setter.

Energy rebates will have to triple to $10bn just to keep pace and something else will have to make room for this ungodly gas cartel profiteering.

The $10bn will either be cut from elsewhere in the budget, borrowed, or interest rates will rise again.

This is national economic suicide.