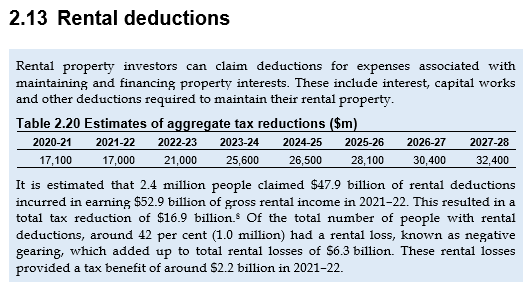

The 2024-25 Tax Expenditure and Insights Statement was released on Wednesday by the Australian Treasury.

It showed that deductions for rental losses on investment properties (i.e., negative gearing) are forecast to rise from $21,000 million in 2022–23 to $32,400 million in 2027–28.

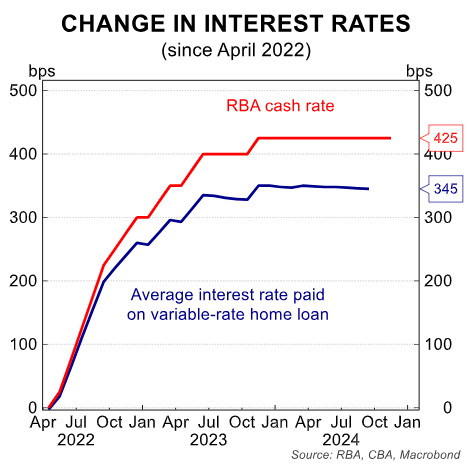

The projected increase in rental deductions follows the sharp rise in mortgage rates, which have roughly doubled since the RBA commenced its interest rate tightening cycle in May 2022.

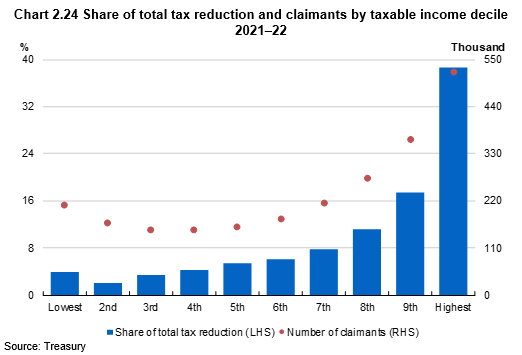

Analysis of the 2021-22 tax year by the Australian Treasury shows that 81% of the total tax reduction from rental deductions went to people with above median income, with 39% of the reduction going to people in the top taxable income decile (Chart 2.24).

Rental losses are most commonly claimed by those with higher taxable incomes, with individuals in the top 30% of taxable income accruing 75% of the total benefit, according to the Treasury.

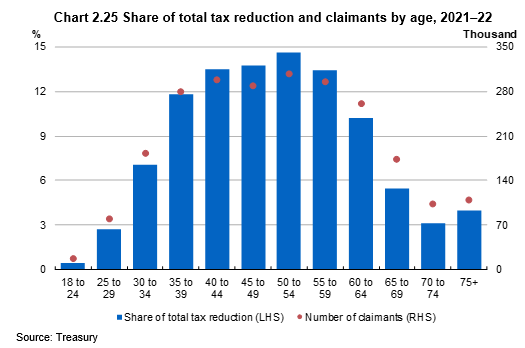

Most deductions are also claimed by generations X and Y, because baby boomers tend to own their rental homes outright or have stopped working.

“More than half of the total tax reduction accrued to those in age cohorts between 40 and 59 years old (Chart 2.25)”, noted the Treasury.

“This reflects a larger number of rental property owners, higher average deductions (including interest deductions – older cohorts are more likely to own property outright or have smaller debt owing) and higher average taxable incomes within these age cohorts”.

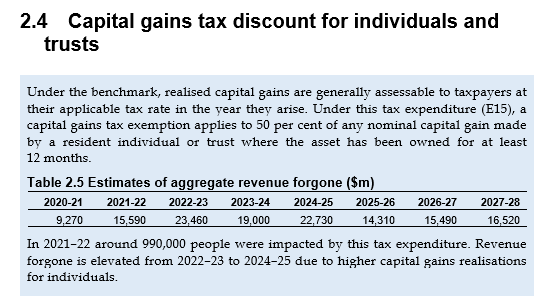

Separate analysis on capital gains tax (CGT) concessions, which applies to property and shares, is projected to fall from 23,460 million in 2022–23 to $16,520 million in 2027–28.

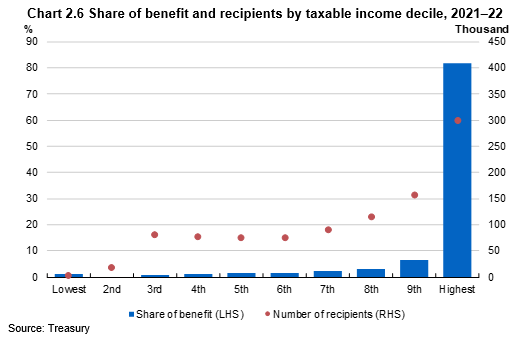

As illustrated below, around 82% of the benefit from CGT concessions was received by people in the top income decile (Chart 2.6).

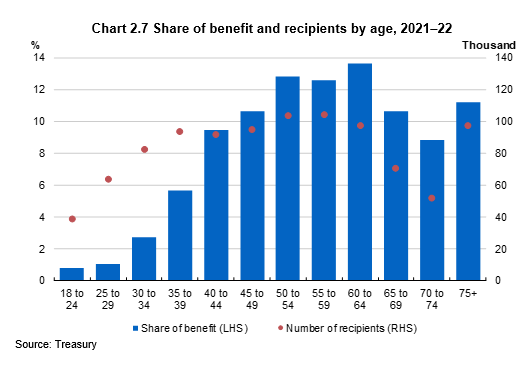

Older Australians also received the greatest benefits (Chart 2.7). Those aged 50 to 64 received the greatest share of the benefit, whereas the largest share of the benefit (13.6%) went to those aged 60 to 64.

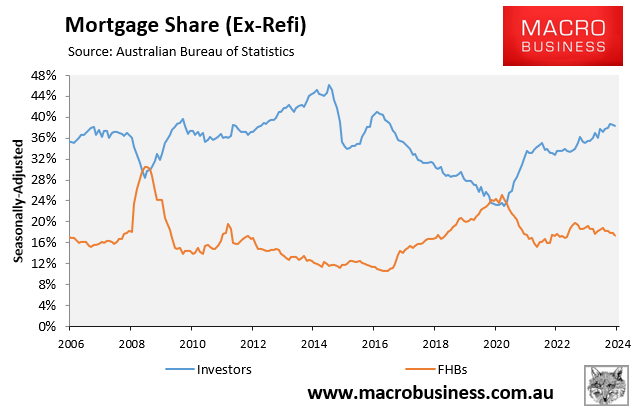

Australia’s property tax concessions are not only costly to the federal budget. They also stimulate investor demand, crowding out first-home buyers and lowering the nation’s home ownership rate.