The latest data surrounding wage growth provides further evidence that Australia’s inflationary pressures are easing.

SEEK’s latest advertised salary index for November revealed that salaries grew by 0.2% over the month, 0.7% over the quarter, and 3.5% annually.

SEEK senior economist Blair Chapman commented, “If monthly growth remains at this rate, by this time next year, annual advertised salary growth will be back at pre-covid levels”.

Chapman added that “the slowdown in advertised salary growth likely reflects a steady easing in the labour market, alongside weaker inflation growth”.

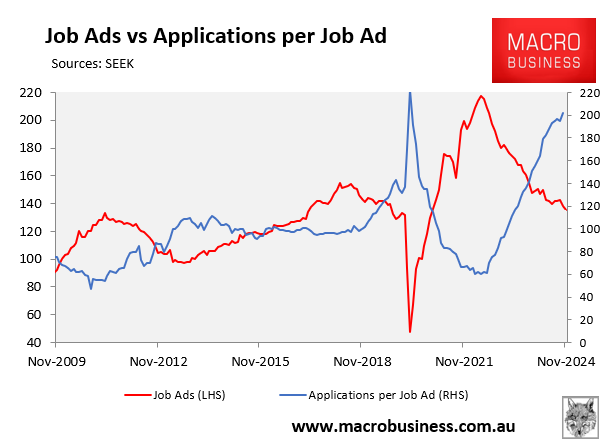

Indeed, the number of jobs advertised on SEEK continued to decline, down another 1% in November to around pre-pandemic levels.

Applications per job ad, which indicate candidate interest in the jobs available, have surged to near pandemic highs.

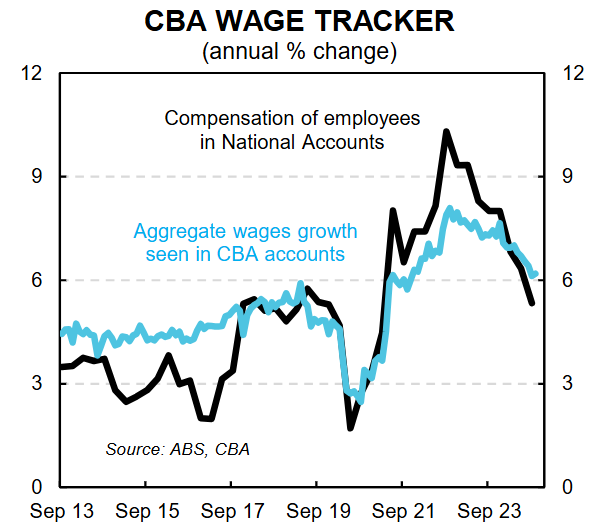

The Q3 ABS national accounts and CBA’s wage tracker also reported a sharp decline in wage growth.

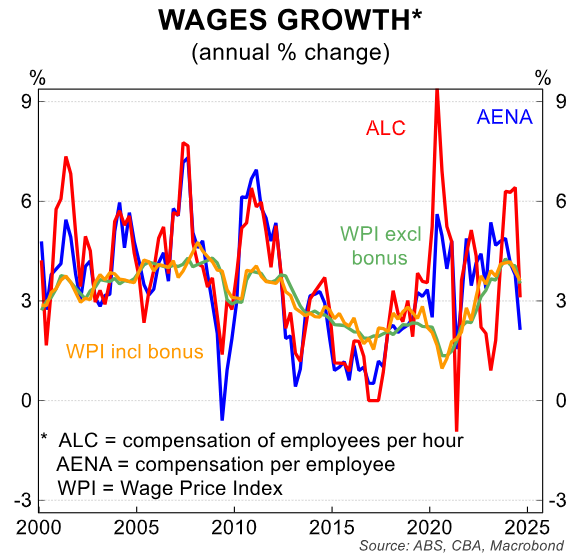

So have various other wage measures, compiled below by CBA.

1

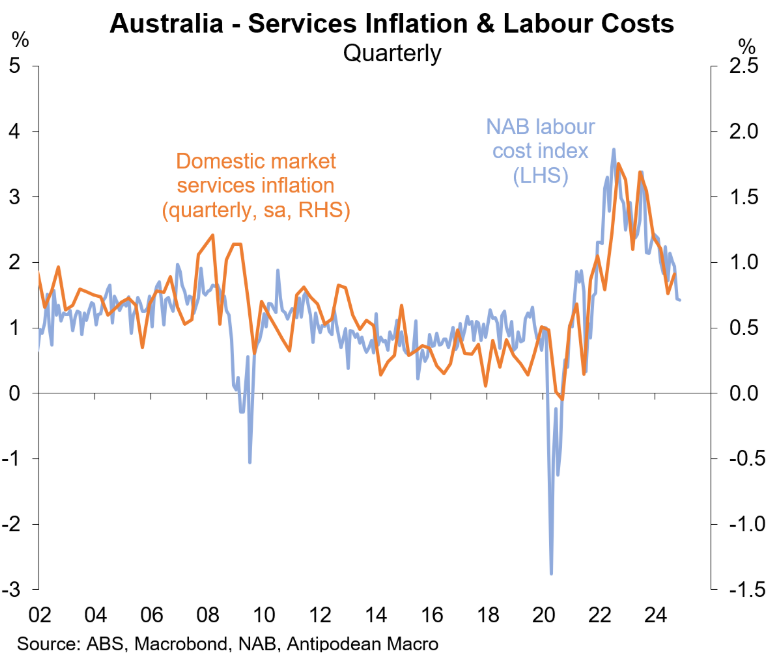

1 The latest NAB Business Survey also reported significantly lower labour costs, which points to moderating domestic services inflation.

The Q3 ABS wage price index was already tracking below the RBA’s forecasts.

Source: Alex Joiner (IFM Investors)

Therefore, the above wage measures suggest that the wage price index will moderate further in Q4, giving the RBA more confidence that inflationary pressures have eased.