At today’s monetary policy meeting, the Reserve Bank of Australia (RBA) left the official cash rate unchanged at 4.35%.

Economists and financial markets widely anticipated the decision.

While the RBA acknowledged that “underlying inflation remains too high”, it did recognise that recent economic data has been weaker than forecast, giving the RBA that the upside risks to inflation have disappeared.

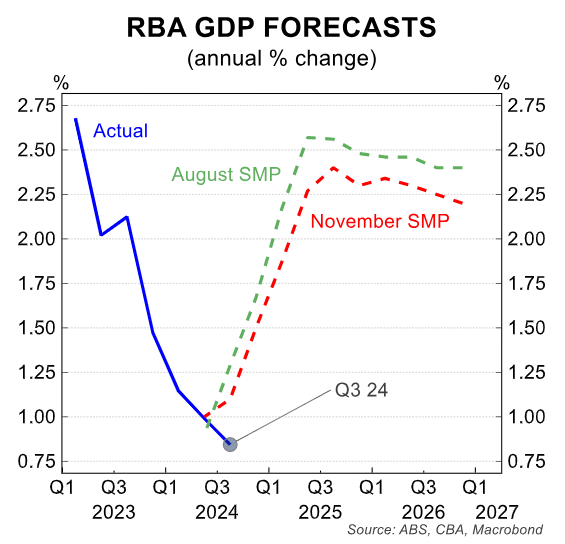

In particular, the RBA statement noted that “growth in output has been weak” and that “wage pressures have eased more than expected in the November SMP”.

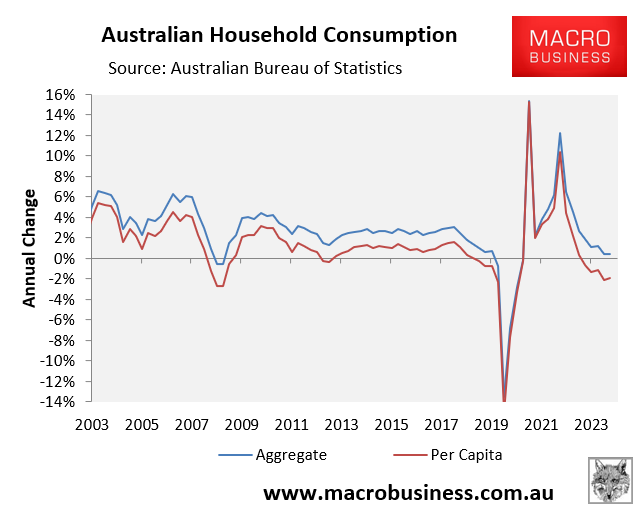

The RBA statement also notes that “incomes and consumption had recovered a little slower than forecast” and “there is a risk that any pick-up in consumption is slower than expected, resulting in continued subdued output growth and a sharper deterioration in the labour market”.

“Taking account of recent data, the Board’s assessment is that monetary policy remains restrictive and is working as anticipated”, the RBA statement notes.

“Some of the upside risks to inflation appear to have eased and while the level of aggregate demand still appears to be above the economy’s supply capacity, that gap continues to close”.

Nevertheless, the RBA notes that “while headline inflation has declined substantially and will remain lower for a time, underlying inflation is more indicative of inflation momentum, and it remains too high”.

That said, “the Board is gaining some confidence that inflation is moving sustainably towards target”.

Overall, the RBA’s decision can be viewed as a mild dovish pivot, as it seems more confident that inflationary pressures are easing.

The November labour force survey will be released on Thursday (i.e., two days after this decision). If the data indicates the labour market has loosened over the month, then the RBA can use the December Board Minutes to provide a more dovish tilt in communication.

The Q4 2024 CPI (due 29 January) could be the ‘smoking gun’ that the RBA needs to green-light for a February rate cut (February Board decision on 18/2).