This week, the Reserve Bank of Australia (RBA) will announce its monetary policy decision, which is likely to be a straightforward hold.

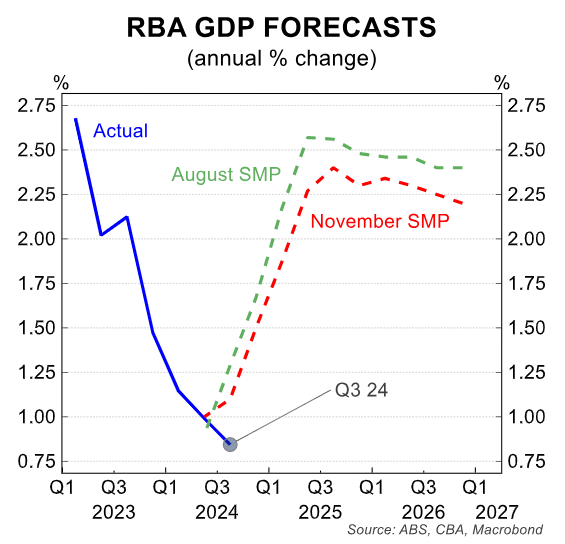

However, given the weaker-than-expected Q3 national accounts result and the sharper-than-expected decline in wage growth, this month’s monetary policy minutes are likely to set the stage for a potential rate cut at the first meeting in February 2025.

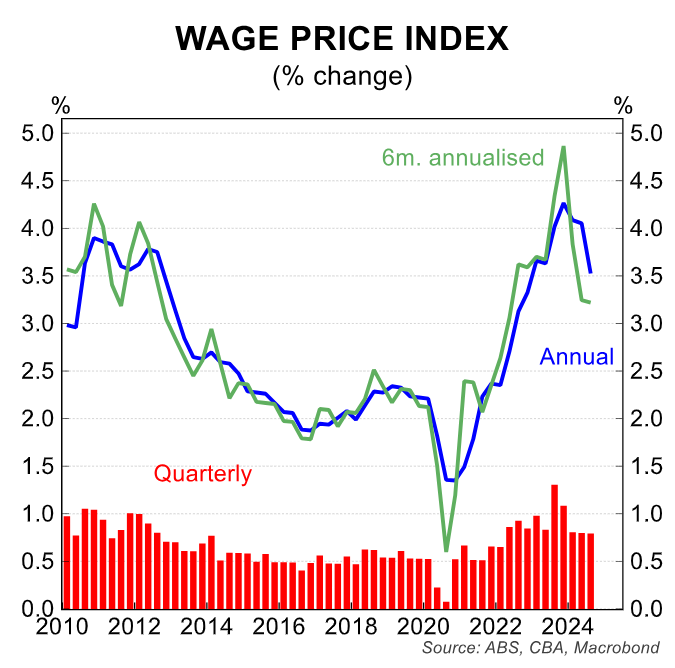

As shown above by CBA, on a six-month annualised rate, wage growth is tracking at 3.2%, consistent with returning inflation sustainably to the RBA’s 2-3% inflation target.

The RBA forecast the Q4 24 wage price index was 3.4% for the year. However, achieving this outcome would require the quarterly wage growth pace to accelerate to 1.0% in Q4 24, a highly improbable scenario.

“By extension, this means the Board’s continued concerns around sticky services inflation appear overdone”, Geareth Aird from CBA. “And it suggests the non-accelerating inflation rate of unemployment (NAIRU)is likely to be comfortably below the RBA’s implied estimate of 4.5%”.

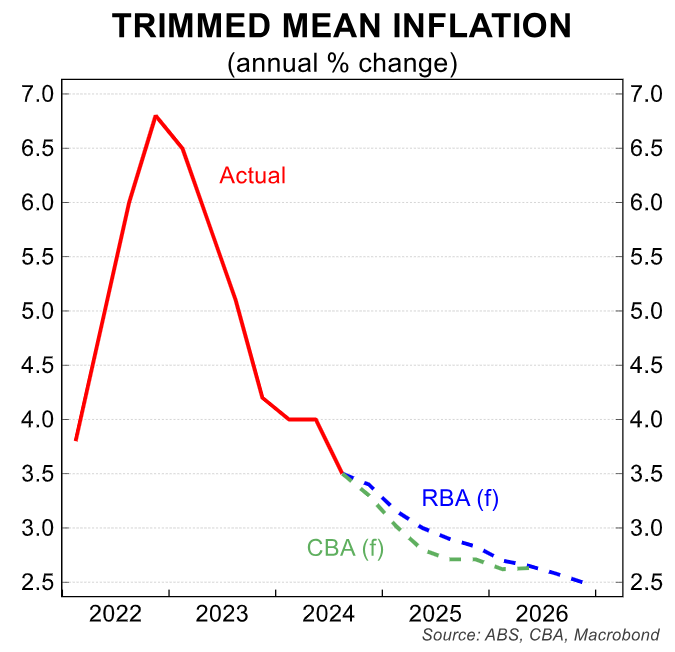

CBA also downgraded its forecast for the Q4 24 trimmed mean CPI to 0.6% for the quarter following the release of the October CPI indicator.

“The component level detail was more favourable than we had anticipated and further removes some upside risks”, noted Aird. “Indeed, we think the risks sits with a 0.5%/qtr Q4 24 trimmed mean outcome”.

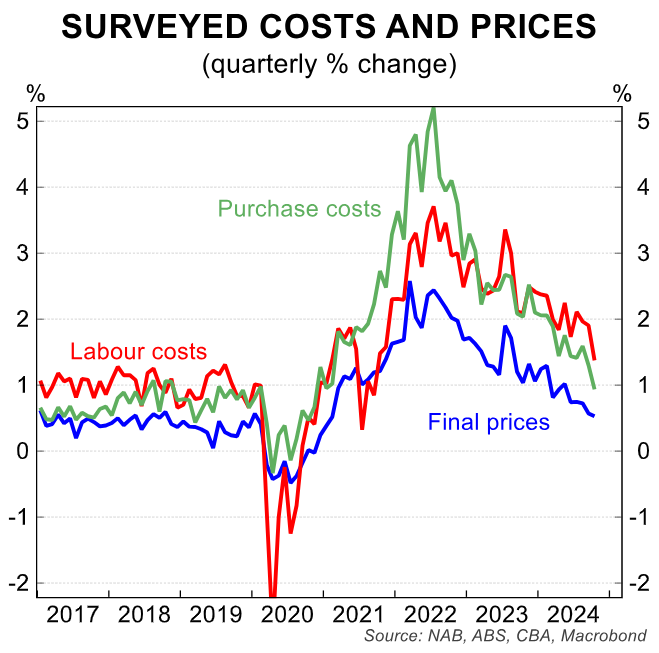

“Prices gauges from the NAB business survey and S&P Australian PMIs have also moved favourably over the past month”.

Aird predicts that the statement accompanying this week’s decision from the RBA will include some “subtle shifts in language in the dovish direction to acknowledge the recent run of data”.

“We think that the statement accompanying the December on-hold decision is likely to reiterate that ‘the Board is not ruling anything in or out’. Governor Bullock also struck this tone at her most recent speech on 28 November, albeit the speech preceded the Q3 24 national accounts”.

The next major data release is the November labour force survey, which will be out on Thursday, 12 December, two days after the RBA Board’s decision.

“If the data indicates the labour market has loosened over the month, as we anticipate, the RBA can use the December Board Minutes to provide a more dovish tilt in communication”, notes Aird.

Following that, “the Q4 24 CPI (due 29 January) could be the ‘smoking gun’ that gives the green light for a February rate cut (FebruaryBoard decision on 18/2)”.

“That is our expectation and we continue to hold our base case that the RBA will commence an easing cycle in February 2025”, notes Aird.

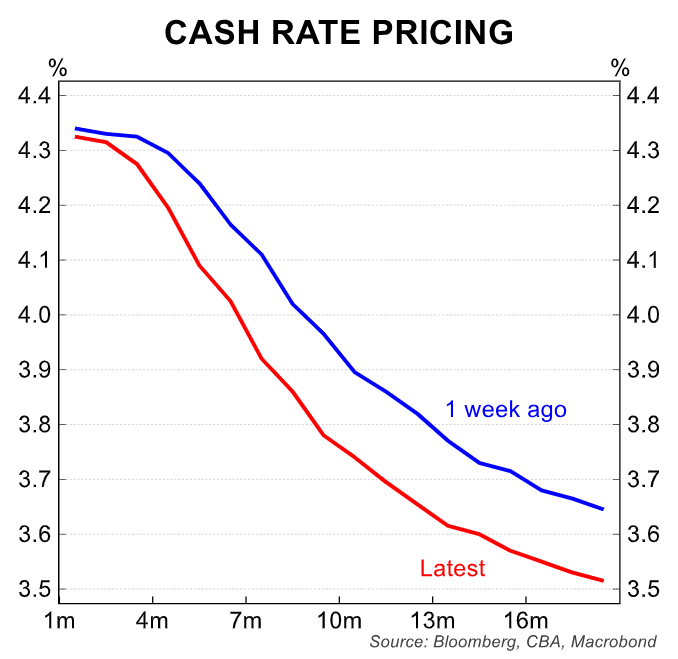

Indeed, after last week’s poor Q3 national accounts data, financial markets brought forward their forecasts for the first interest rate cut.

They now assign a roughly even chance of a 0.25% cut in February.