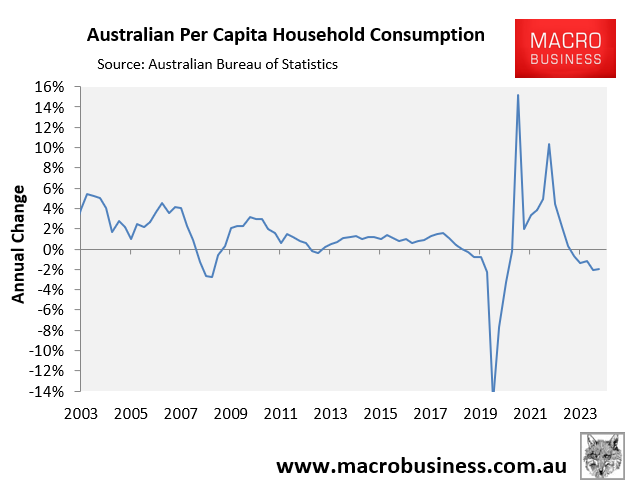

Wednesday’s Q3 national accounts release from the Australian Bureau of Statistics (ABS) revealed that real per capita household spending fell by 0.6% over the quarter to be down 2.0% annually.

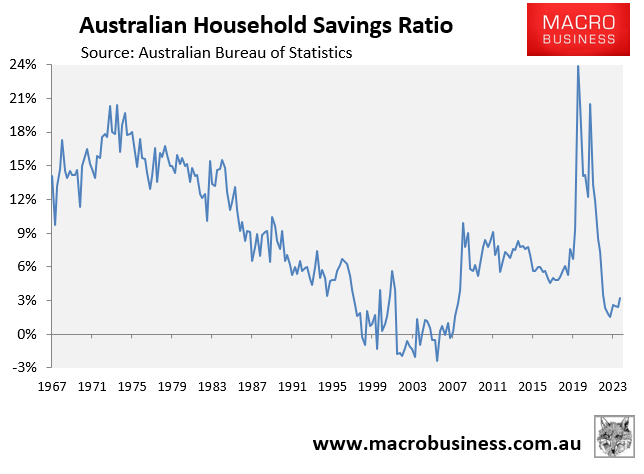

The result suggested that Australian households banked rather than spent the Stage 3 personal income tax cuts.

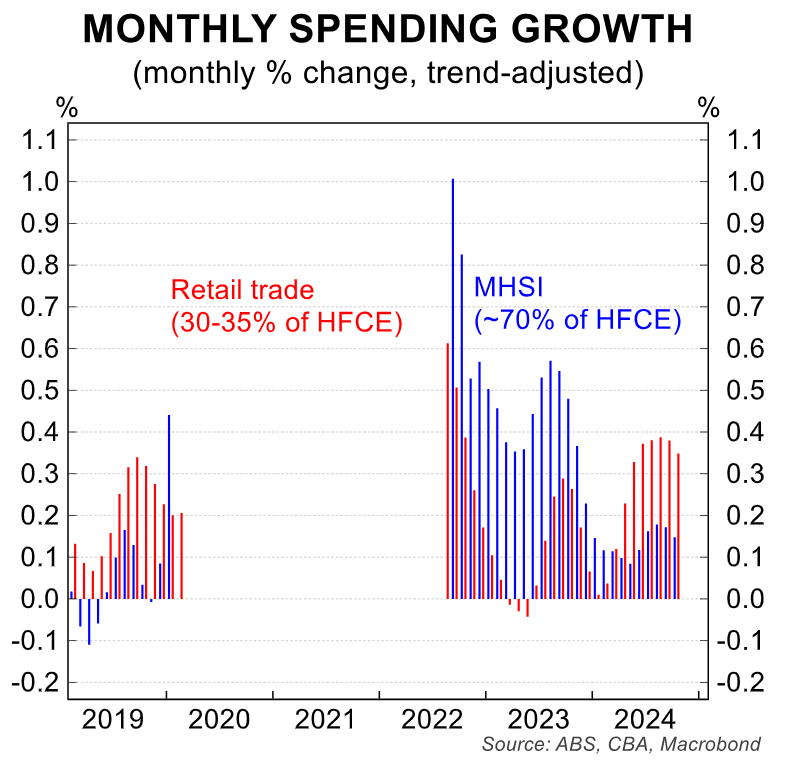

Two pieces of data released on Thursday suggest that household wallets remained closed in Q4.

First, the Australian Bureau of Statistics (ABS) Monthly Household Spending Indicator (MHSI) for October revealed that nominal consumer spending in trend terms eased to 0.1% in October from 0.2% in September, with the annual growth rate also easing to 1.9% from 2.3%.

As shown above by CBA, momentum in the MHSI is far softer than for retail trade (which is overweight on goods).

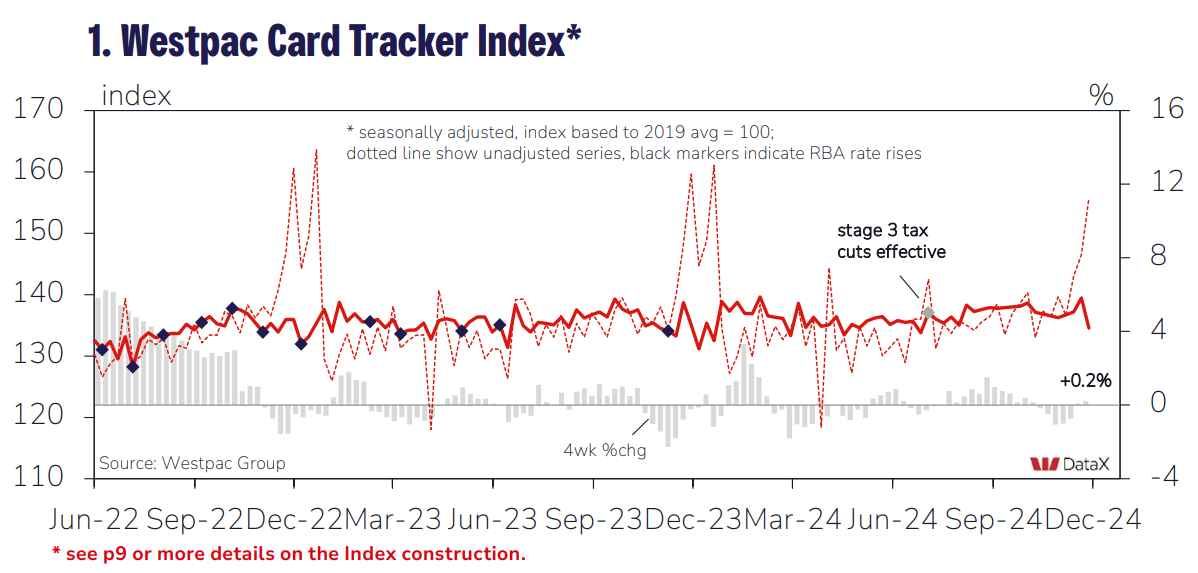

Westpac’s monthly card tracker reported a sharp fall over the two weeks to November 30, declining 2.6pts to 134.6.

In its commentary, Westpac noted that “the underlying quarterly and monthly growth pulses remain relatively subdued”.

“The quarterly growth pulse eased further to +0.6%qtr, down from +1.2%qtr recorded four weeks ago. Momentum has slowed back to the sluggish pace seen in late-August”.

While noting that this could reflect seasonal patterns, Westpac concluded that “there is little evidence that Black Friday is boosting quarterly or monthly card momentum”.

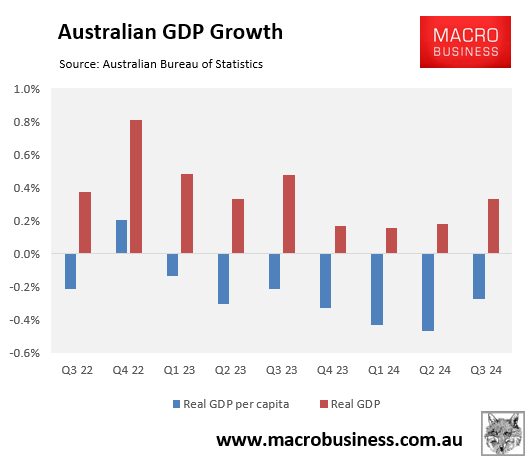

If these trends continue, Australia will record an eighth consecutive decline in per capita GDP in Q4.