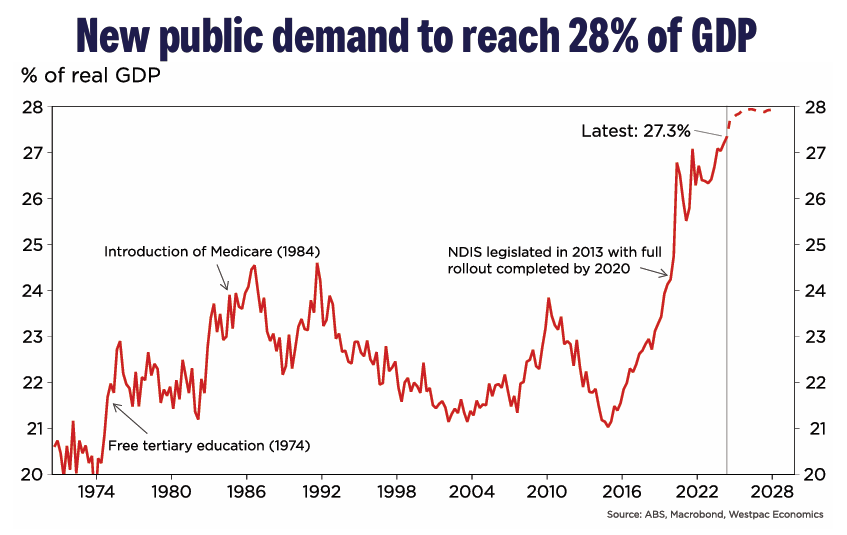

Public spending hit a record high of 27.3% of GDP in Q2 2024, and Westpac projected it to continue growing.

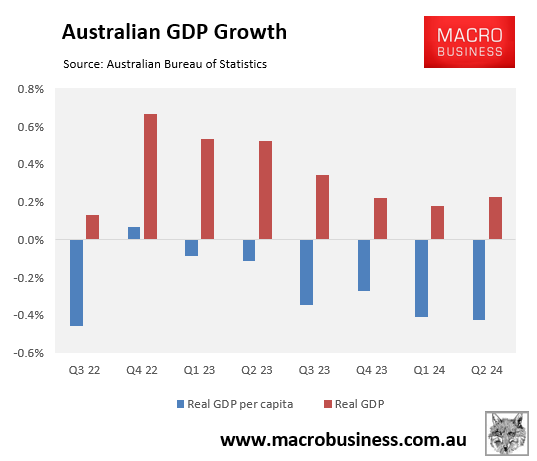

Despite the record public spending, Australians have experienced six consecutive quarterly declines in per capita GDP, the most prolonged contraction on record.

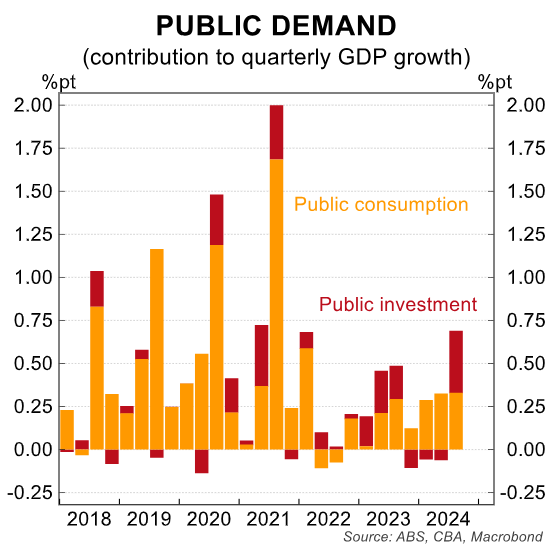

On Tuesday, the Australian Bureau of Statistics (ABS) released government finance for Q3, which showed that public demand rose strongly in the quarter, up by 2.4%, which will contribute a large 0.8ppt to GDP in Q3 24.

“The public sector will again be the dominant driver of economic growth in Q3 24”, CBA reported. “Total volume of public demand was 2.4% higher in the quarter and 4.2% larger than a year ago”.

“This is the largest positive contribution to GDP since Q3 21, when both NSW and Victoria were in lockdown”.

Westpac forecasts that public demand increased to around 27.7% of GDP in Q3 2024, a fresh record high.

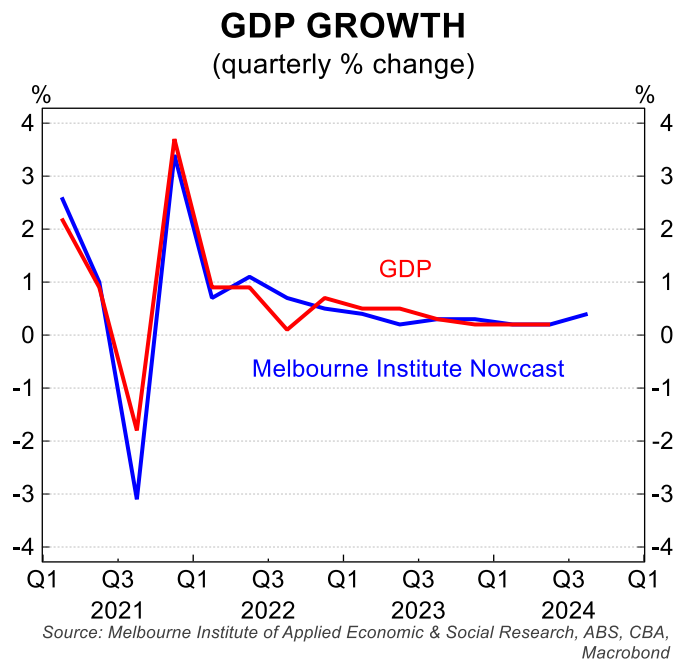

Despite the larger-than-expected contribution from public demand, CBA expects Australia’s GDP to grow by only 0.4% in Q3 and be 1.1% higher year-on-year.

“The misses to our estimates for net exports (lower than we had expected) were largely offset by stronger public demand”, CBA noted. “Stronger government capex occurred with a large lift in defence spend over the September quarter”.

“There remains a lot of uncertainty around household consumption in Q3 24, the largest component of GDP on the expenditure side. This remains the largest source of risk to our estimate”.

According to the latest quarterly ABS retail trade release, Australia’s population grew by 0.6% over the quarter. This would mean that per capita GDP will contract another 0.2% in Q3 2024, marking the seventh consecutive quarterly contraction.

It would also mean that Australia’s private sector contracted in aggregate terms in Q3, led by Australian households.