Australian renters have experienced a sharp decline in living standards over recent years.

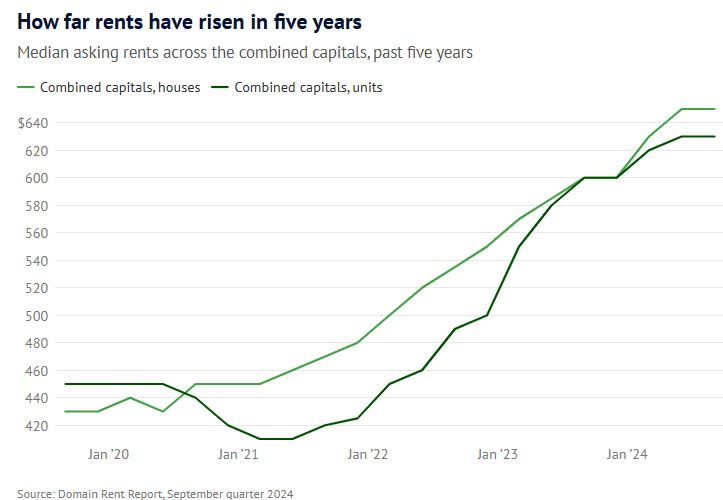

According to Domain, national median house rents increased by $180, or 38%, from $470 to $650 between September 2021 and September 2024.

Over the same period, national median unit rents increased by $210, or 50%, from $420 to $630.

The rent rise has reduced tenants’ disposable income, lowering consumption spending.

This week, CBA released its November Household Spending Insights (HSI) survey based on customers’ spending habits.

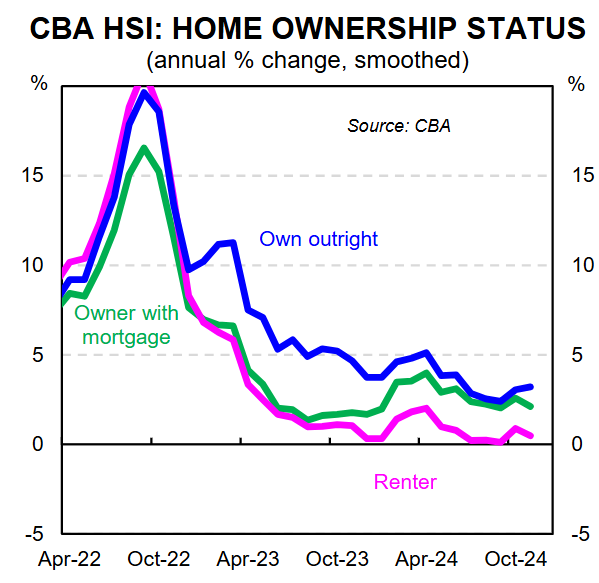

As illustrated below, tenant households experienced easily the largest decline in spending in the year to November.

The annual rate of spending increase for tenant households slowed to only 0.4% in November, versus 1.6% for mortgage holders and 2.7% for households who own their homes outright.

This data is in aggregate nominal terms; therefore, it does not reflect circa 2% population growth and 2.8% headline inflation.

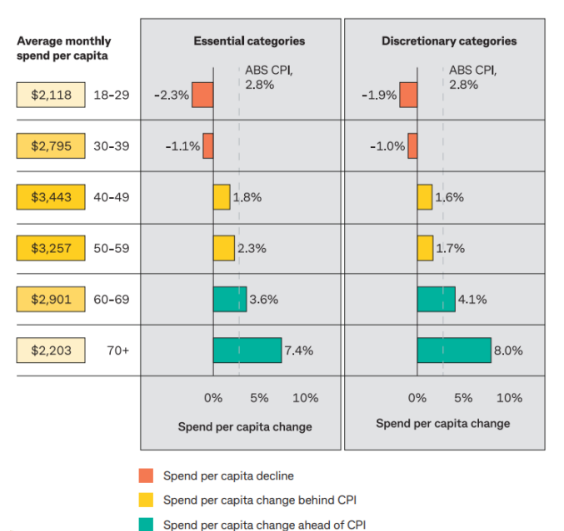

Separate data from CBA showed that households aged under 40 outright cut their essential and discretionary expenditure in the year to November 2024. These younger households are most likely to be renters.

By contrast, older households aged 60-plus are more likely to own their homes outright and increased their essential and discretionary spending by more than the inflation rate in the year to November 2024.

The cost of living crisis is clearly hitting younger Australian renters the hardest.