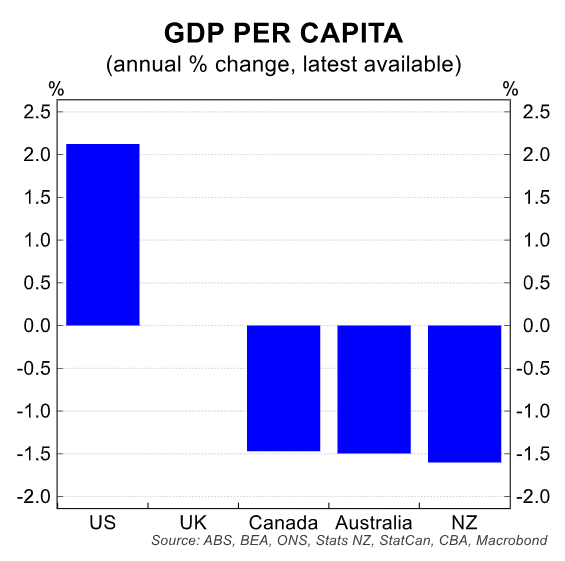

New Zealand has experienced the most significant decline in per capita GDP in the English-speaking world over the past year.

In the seven quarters to Q2 2024, New Zealand’s per capita GDP fell 4.6%. This represented a larger per capita decline than was experienced after the Global Financial Crisis.

Statistics New Zealand will release the Q3 national accounts on Thursday. The accounts are expected to show that the economy recorded its fifth quarterly contraction out of the last eight.

Indeed, the Reserve Bank of New Zealand has forecast a 0.2% decline in Q3 GDP, following the 0.2% fall in Q2. ANZ and Westpac have both forecast a 0.4% decline.

David Hargreaves from Interest.co.nz pointed to three partial indicators pointing to falling Q3 GDP.

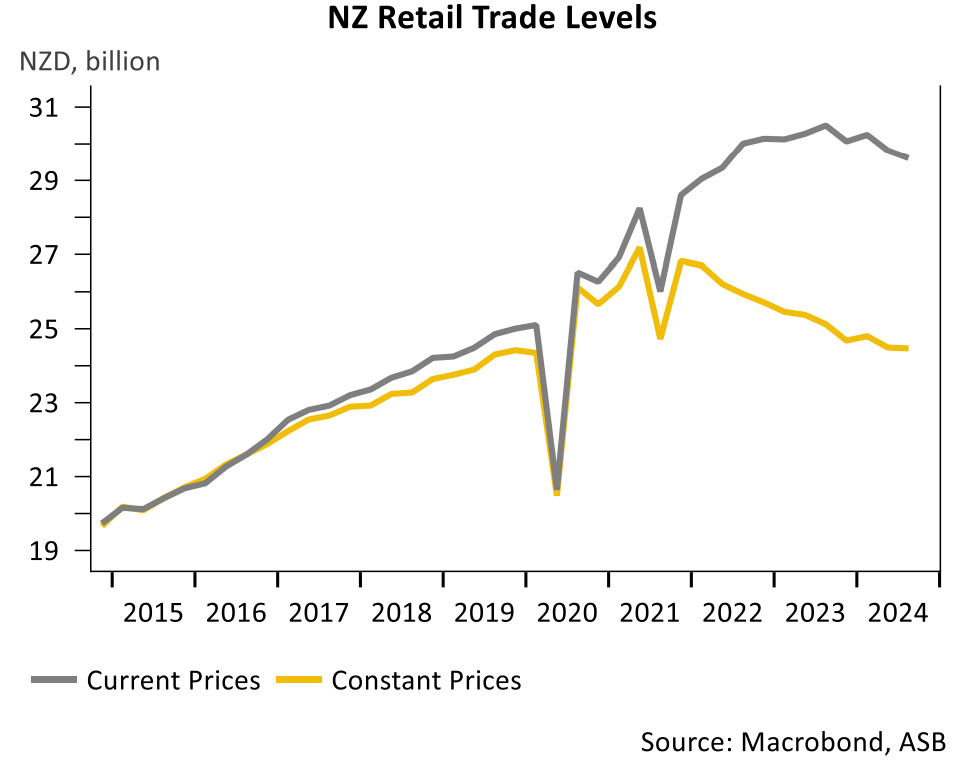

Retail sales volumes decreased 0.1% on a seasonally adjusted basis in Q3. Over the year, sales volumes were 2.5% lower than in Q3 2023.

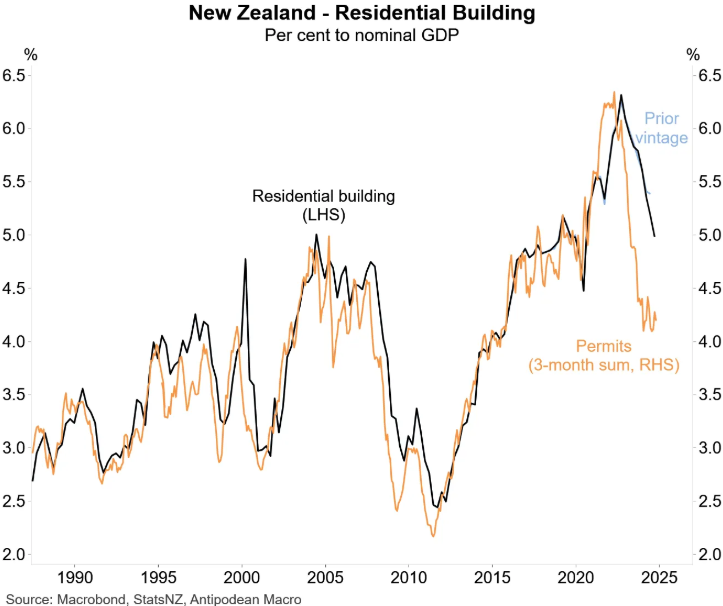

The volume of building work completed declined by 3.2% in Q3 2024, which was a larger drop than anticipated. Residential construction activity declined by 3.5% to its lowest level in four years.

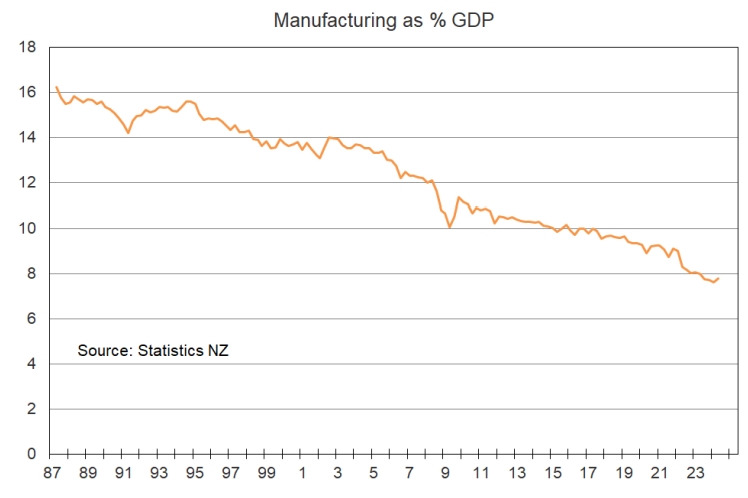

Overall manufacturing sales also declined by 1.2%, seasonally adjusted.

As a result, New Zealand’s economy would slide into another technical recession, although revisions to past data could change the picture.

Statistics New Zealand has indicated that annual GDP growth for the year to March 2023 will be revised up from 2.7% to 3.5%. The figures for the year to March 2024 will also be revised from 0.3% to 1.4%.

The Labour market’s decline is the Reserve Bank’s more significant concern.

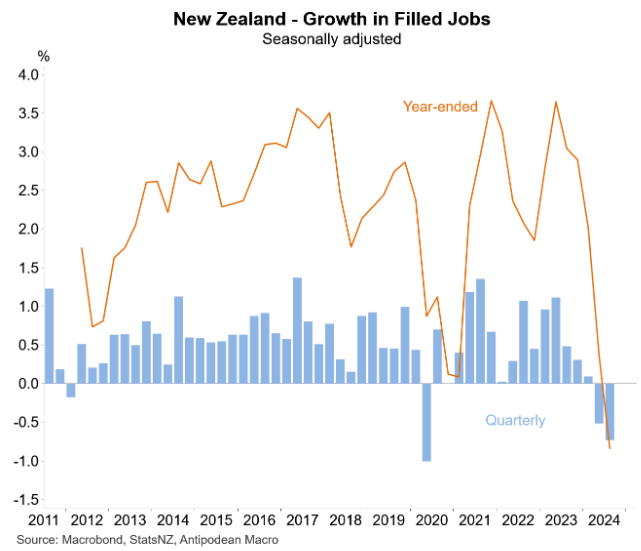

Filled jobs fell by 0.7% in Q3, the second consecutive quarterly decline. Filled jobs also recorded their first annual decline in more than a decade.

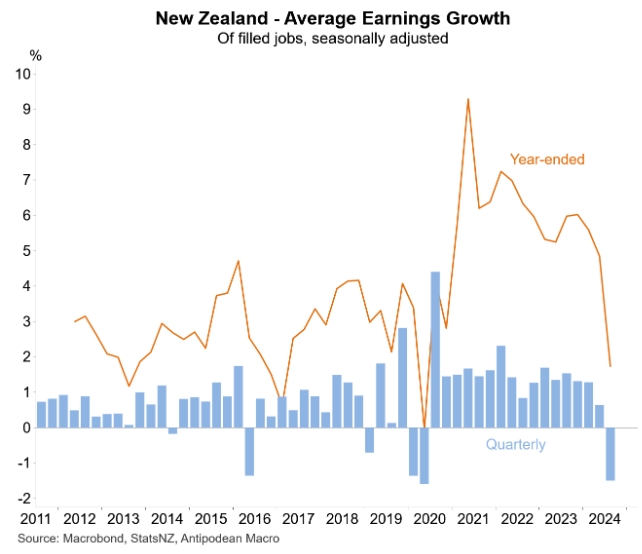

Average earnings growth declined in Q3, taking annual growth below 2%.

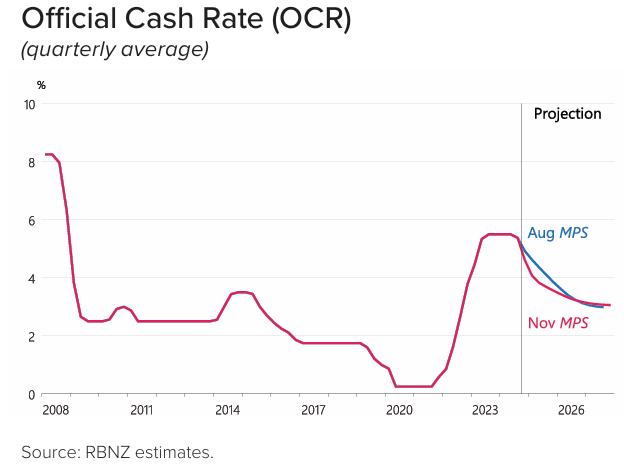

The above data highlights why the Reserve Bank has cut the official cash rate by 1.25% over the last three monetary policy meetings.

The Reserve Bank’s forward guidance suggests a 50% chance of another 0.50% cut in February—the first monetary policy meeting of the year.

Major bank ASB has also forecast a 0.50% cut to the cash rate in February 2025.