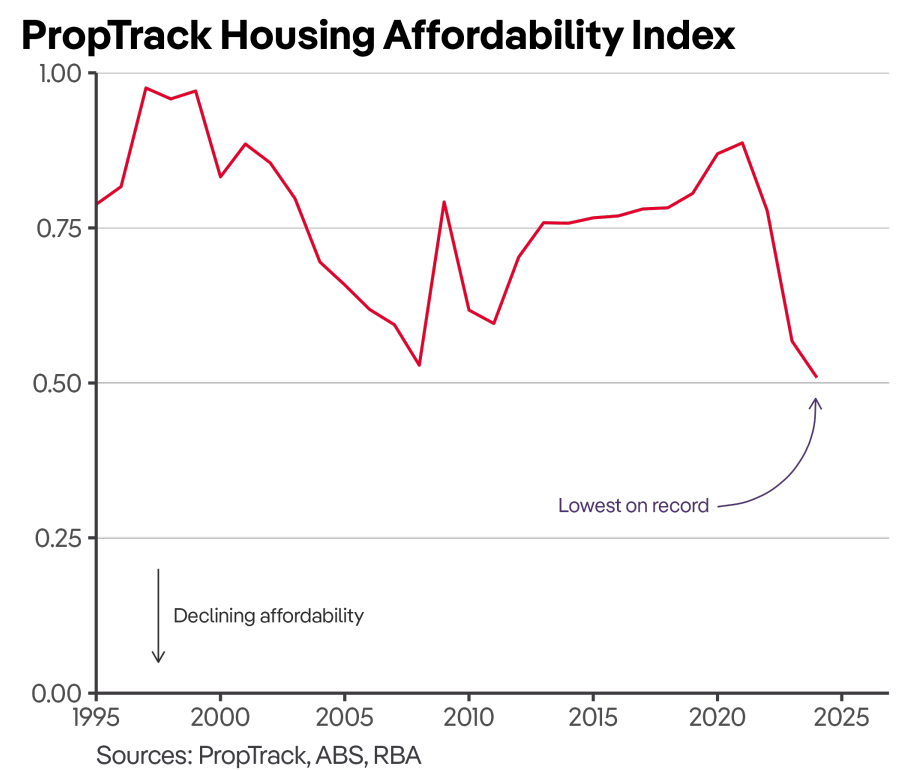

The latest housing affordability data from PropTrack was an unmitigated disaster for Australian first home buyers.

Purchase affordability collapsed to a record low, according to Proptrack.

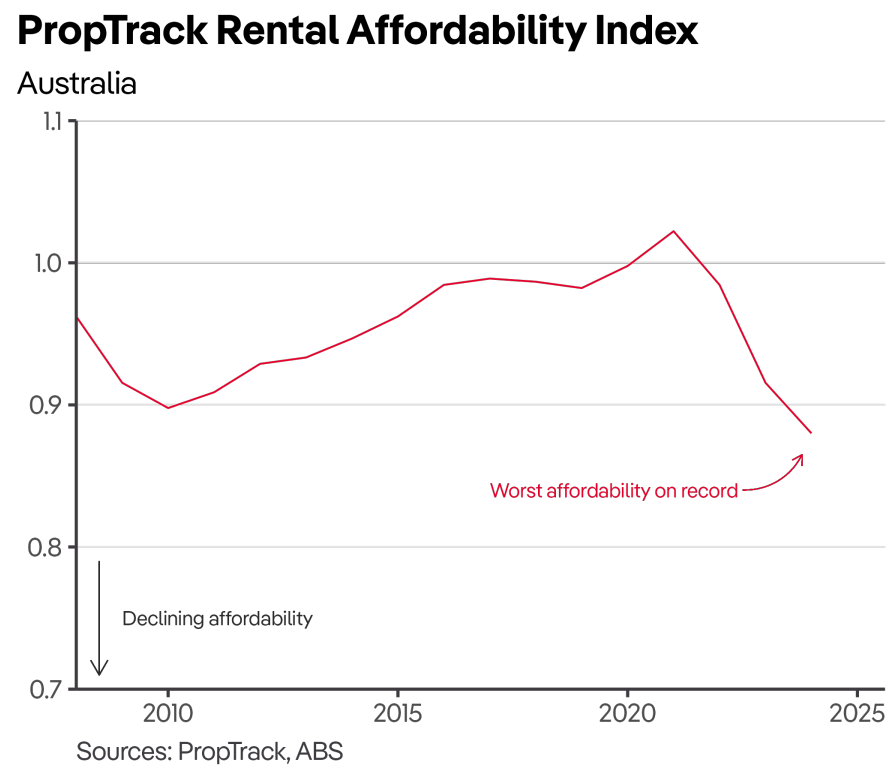

Rental affordability also fell to an all-time low.

The above situation is especially detrimental for first home buyers because rising rents make it harder to save a deposit at the same time as prices continue to rise further out of reach.

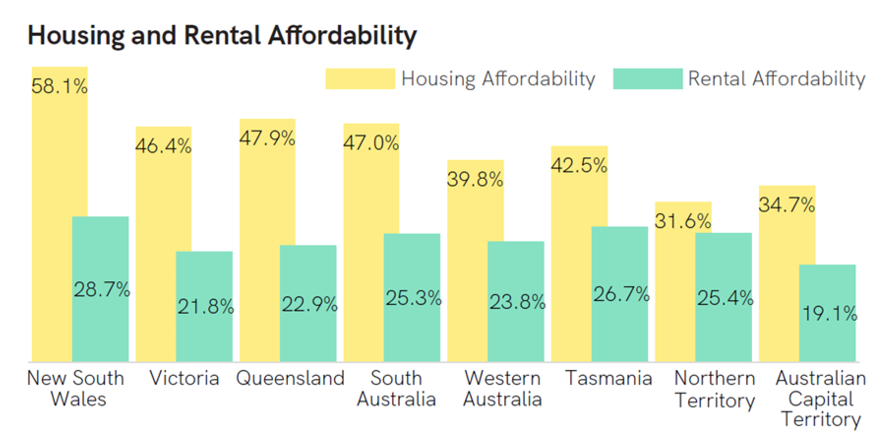

The REIA’s Housing Affordability Report (the REIA HAR) for the September 2024 quarter painted a similar picture.

The REIA HAR found that the proportion of median family income required for average loan repayments climbed to 48.6%, an increase of 0.4 percentage points from the previous quarter.

“The figures underscore the persistent challenges faced by families striving to enter the housing market or manage their existing commitments”, noted REIA President Leanne Pilkington

“Rising mortgage sizes coupled with stagnant variable interest rates continue to push affordability further out of reach”.

At the same time, rental affordability declined over the same period, with the proportion of income required to cover median rents increasing to 24.9%.

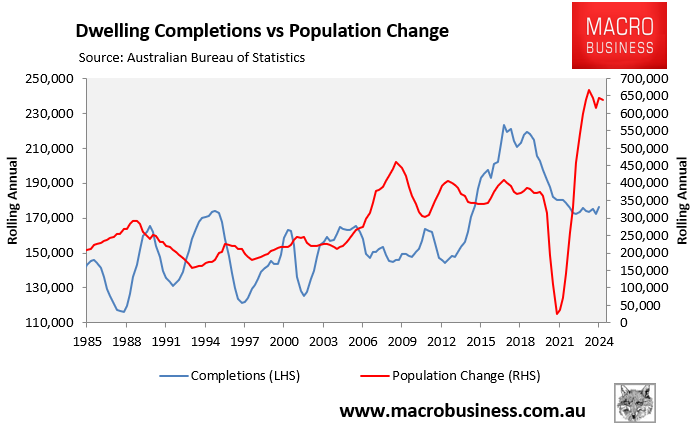

The first and most effective solution to Australia’s housing crisis is to slash net overseas migration, thereby ensuring that the supply of housing exceeds the demand.

Significantly lower net overseas migration would reduce rents, making it easier to save a deposit. It would also put downward pressure on prices, making housing more affordable to purchase.