The 2024-25 Tax Expenditure and Insights Statement was released on Wednesday by the Australian Treasury.

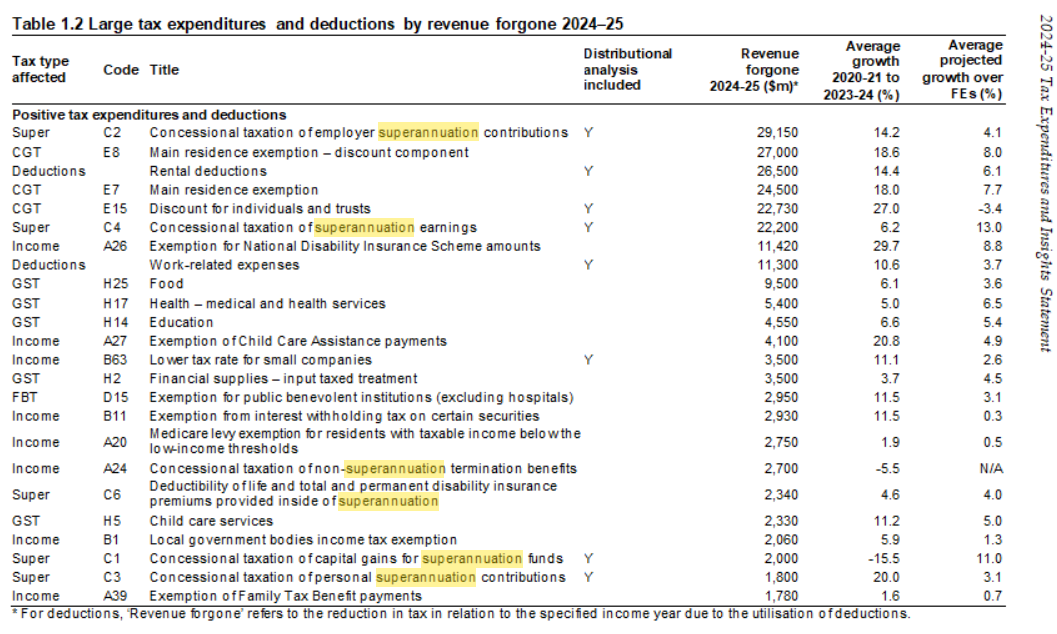

As illustrated below, total superannuation tax expenditures are estimated to total around $60 billion in 2024–25.

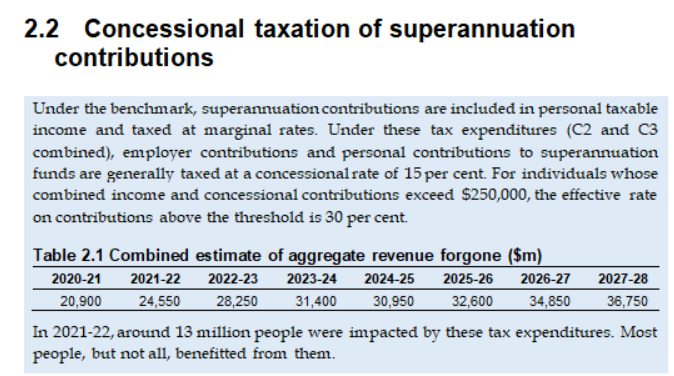

The most significant component of superannuation tax expenditures relates to the concessional taxation of contributions.

These are forecast to be $30,950 billion in 2024–25, rising to $36,750 billion in 2027–28.

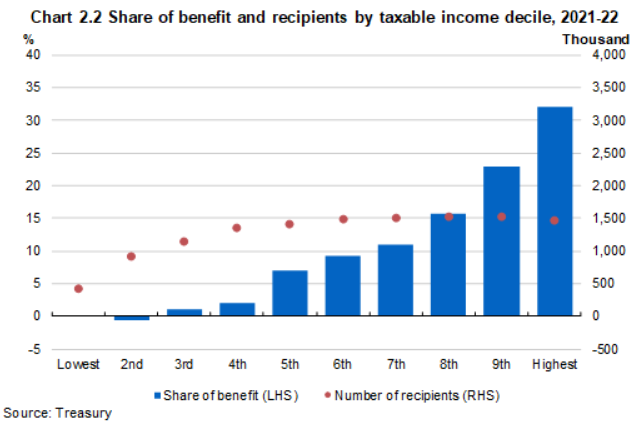

The overwhelming bulk of these concessions go to high-income earners.

“In 2021-22, 91% of the benefit went to people with above median income, and 32% of the benefit went to people in the top income decile”, noted the Treasury.

“There were fewer recipients in lower income brackets because government payments, for which compulsory superannuation contributions are not required, were the main source of income for a large proportion of individuals in these deciles”.

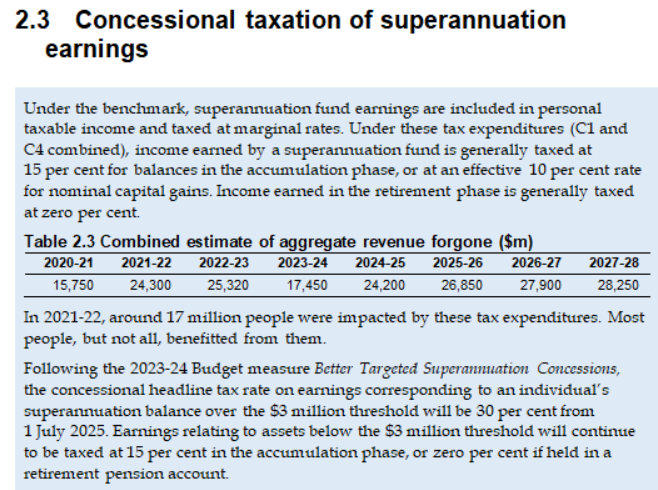

The other major superannuation tax expenditures relate to the concessional taxation of earnings.

These are forecast to be $24,200 billion in 2024–25, rising to $28,250 billion in 2027–28.

Again, the overwhelming bulk of these concessions go to high-income earners.

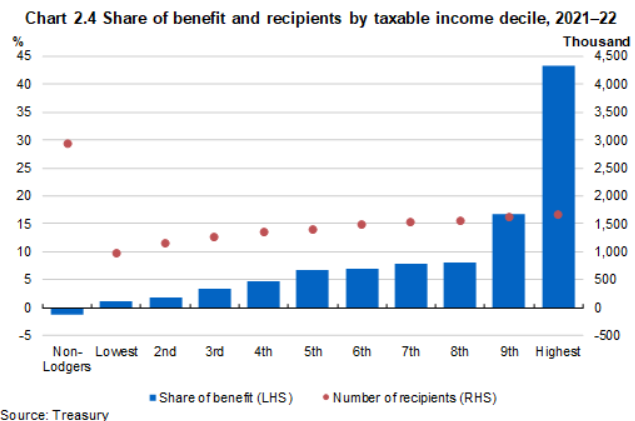

“In 2021–22, people with above-median income received 83% of the benefit from the concessional taxation of superannuation earnings, with those in the top taxable income decile received 43% of the benefit (Chart 2.4)”, noted the Treasury.

“People in higher taxable income deciles received a larger share of the benefit due to having larger superannuation balances and paying higher marginal tax rates, which made the flat rate of tax on superannuation earnings more concessional”.

“The share of the benefit for people in the lowest taxable income decile was close to zero because on average they faced a marginal personal income tax rate that was close to 15%”.

“However, the benefit for non-lodgers was negative as, on average, the earnings tax they paid was higher than what they would have paid if their superannuation earnings were subject to personal income tax rates”, the Treasury said.

Separate long-term projections from the Australian Treasury showed that superannuation concessions are projected to cost the federal budget more than the aged pension by 2050:

Worse, as shown above, superannuation tax concessions are unequally distributed, overwhelmingly benefiting those on the highest incomes.

Given the enormous fiscal cost and the detrimental effects on equity, the federal government should take action to rein in the superannuation system.

The reality is that superannuation has evolved into an expensive and inequitable tool for wealth building and inheritance, amplifying gaps in working-life wages into retirement.

Prudent public policy necessitates unwinding these concessions and redirecting the savings into the aged pension, which is far more efficient and equitable.