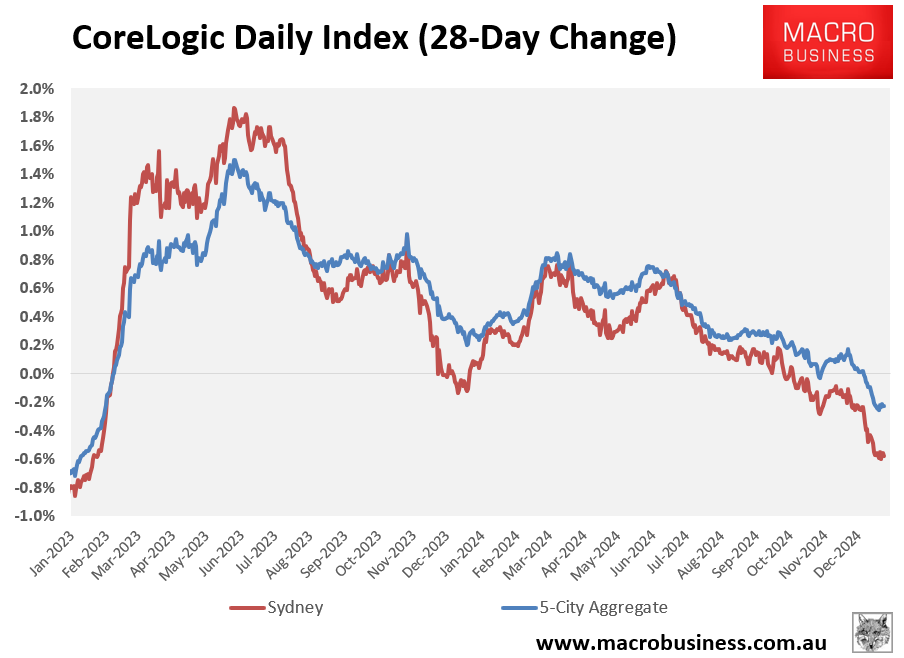

CoreLogic’s daily dwelling values index shows Sydney’s housing market is finishing 2024 in the red.

Over the 28 days to Boxing Day 2024, Sydney dwelling values had fallen by 0.6%.

As shown above, monthly dwelling values in Sydney began falling in early October, and the rate of decline has steepened ever since.

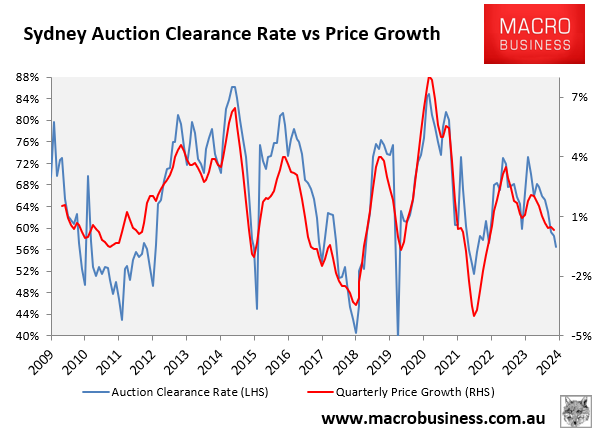

The auction market tells a similar story. In December, Sydney’s monthly average final auction clearance rate fell to 57%, the lowest since December 2022.

As illustrated below, the decline in Sydney’s auction clearance rate is highly correlated with the quarterly decrease in values (shown to the end of November 2024).

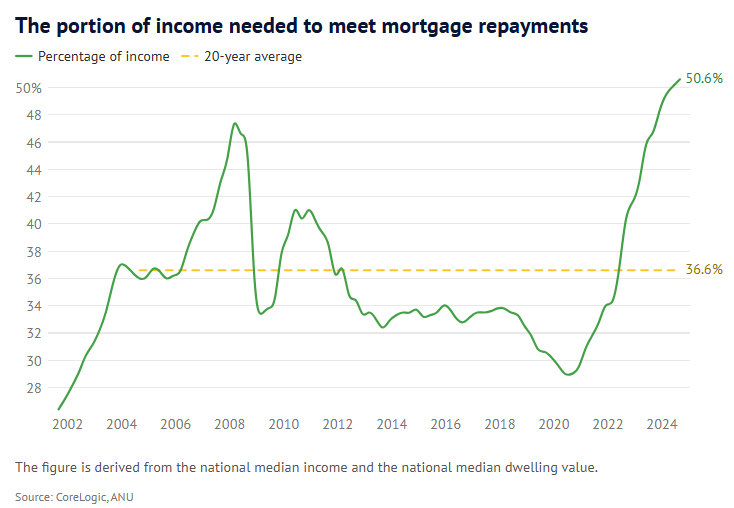

Most analysts, including me, expected home prices to decline in response to the Reserve Bank of Australia’s (RBA) aggressive interest rate hikes, which made housing far more expensive.

However, prices unexpectedly rose due to record net overseas migration and acute stock shortages.

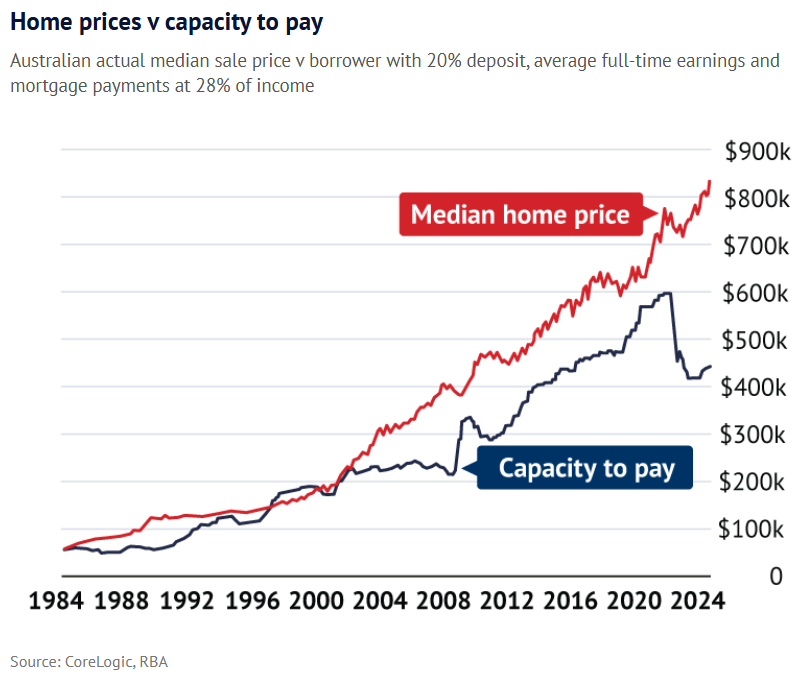

As a result, property values decoupled from borrowing capacity, resulting in record-low affordability.

Now that net overseas migration has slowed and stock levels have recovered, the traditional link between mortgage rates and home values is strengthening.

Sydney is feeling the most price pressure since it is the nation’s most expensive housing market and has experienced the sharpest rise in stock levels.

Source: CoreLogic

Sydney’s home values will most certainly continue to fall unless the RBA lowers interest rates and increases borrowing capacity.