Illion with the note.

New data released this week by credit bureau illion, an Experian company, suggests that after three months of hotly anticipated Stage 3 tax cuts, they are working as intended, however the economy is still shaky.

Implemented to offer cost of living relief and support stretched households, money from the tax cuts appears to have gone to paying down consumer debts, rather than increasing discretionary spending – which could have had an inflationary effect.

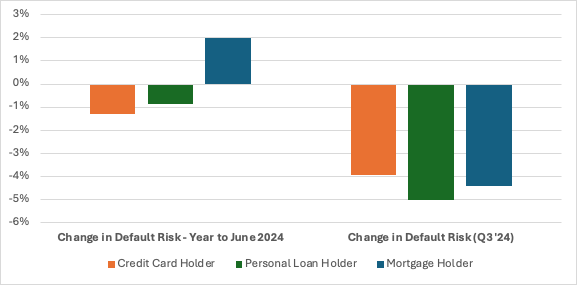

“illion’s Consumer Credit Stress Barometer for the September quarter showed that, for the first quarter of this financial year, credit stress improved, shoring up the finances of struggling households

Money has gone to the areas consumers need the most, which is great news for most families, and good news for Australia’s fight against inflation. Things could have been different, if debt stayed high and people started spending the money in other ways,” said Barrett Hasseldine, illion’s Head of Modelling.

illion’s September quarter data showed that, overall, Australian householders were more able to control their budgets. This was likely buoyed by wage increases and end-of-financial-year tax refunds, but also by the additional financial support received from stage 3 tax cuts.

However, illion’s data also shows that, although the tax cuts may have helped many average households service their debts, it hasn’t yet had the same impact on high risk and vulnerable groups – those with more debt.

In addition, illion’s data showed that the economy is still weak in places. “Economic stresses are still evident, especially amongst 30-something Mortgage holders,” Barrett added. “The outlook for lower income, mortgage-belt Australia and for the small business sector is still uncertain, and this is a large number of people.”

The Psycho RBA is torturing households for fun.