The Australian Retailers Association (ARA) labelled the Reserve Bank of Australia’s (RBA) decision to keep the official cash rate on hold at 4.35% a “missed opportunity to provide much-needed relief for households and businesses facing financial pressures across the festive season”.

“Small businesses are particularly vulnerable, grappling with rising costs in all areas, and continuing to feel the squeeze from economic pressures”, ARA Chief Industry Affairs Officer Fleur Brown said.

“With the peak trading period now underway, where many discretionary retailers make up to two-thirds of their annual profit, a rate cut would have provided retailers with renewed confidence across Christmas and the New Year”.

Brown also called for federal government assistance for the retail sector.

“We urgently need action to ensure Australia’s $430 billion retail economy not only survives but thrives”, she said.

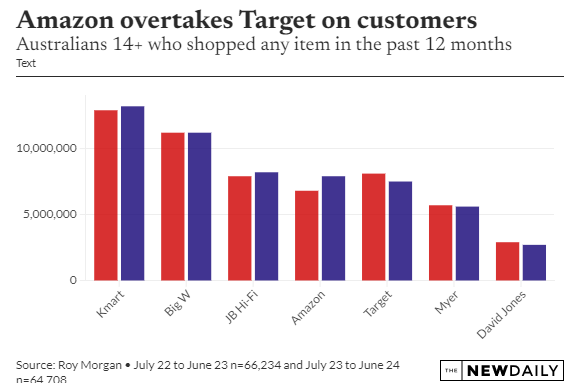

Online sellers like Amazon, Temu, and Shein have negatively impacted discretionary ‘bricks-and-mortar’ retailers.

Amazon joined the Australian market in December 2017 and has quickly expanded its presence.

Amazon Prime offers competitive pricing and unsurpassed convenience, with most goods delivered free within 48 hours.

Roy Morgan believes that Amazon’s customer base grew by 16% last financial year, with 1.1 million more consumers than in 2022-23.

Amazon announced plans to expand its operations and delivery network in Australia, which will increase competition for existing Australian merchants.

Temu and Shein, two Chinese behemoths, are also rapidly expanding their market share in Australia, focusing on the lower end of the retail industry.

Roy Morgan projected that 5.8 million Australians utilised either platform last year, with roughly 80% of them returning customers.

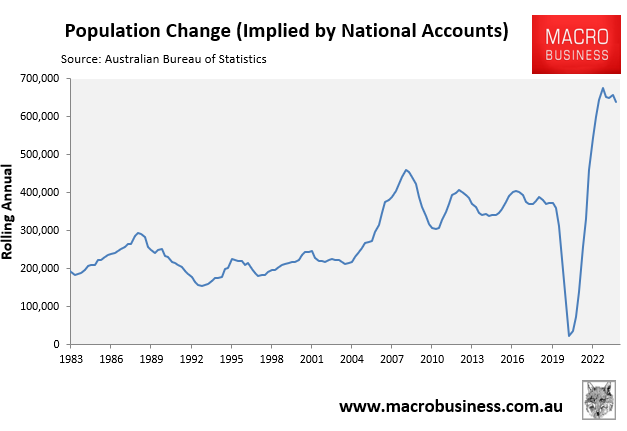

One factor supporting retail is Australia’s unprecedented population growth.

Australia’s population increased by 638,362 in the year to September 2024. This is the equivalent of adding a Canberra and Darwin to the nation’s population in only one year.

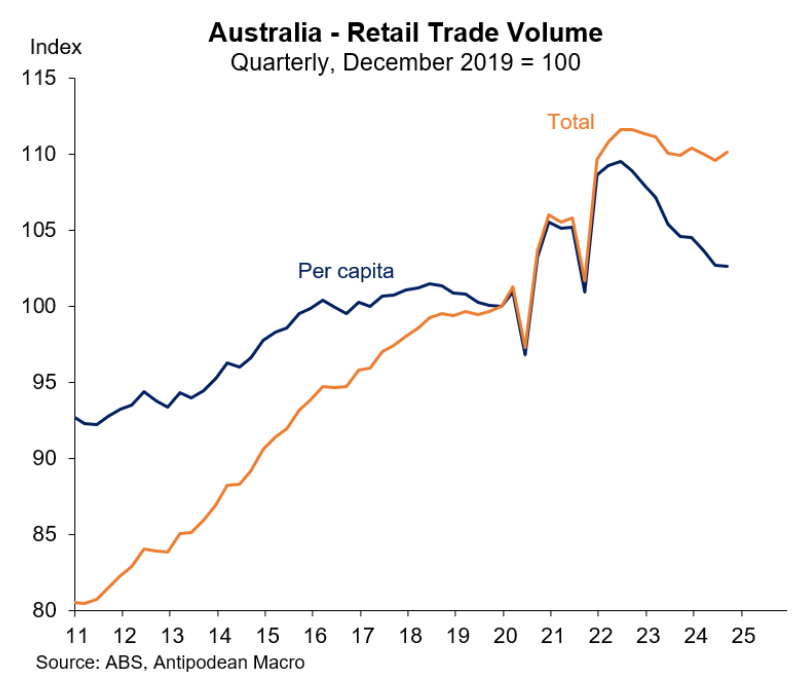

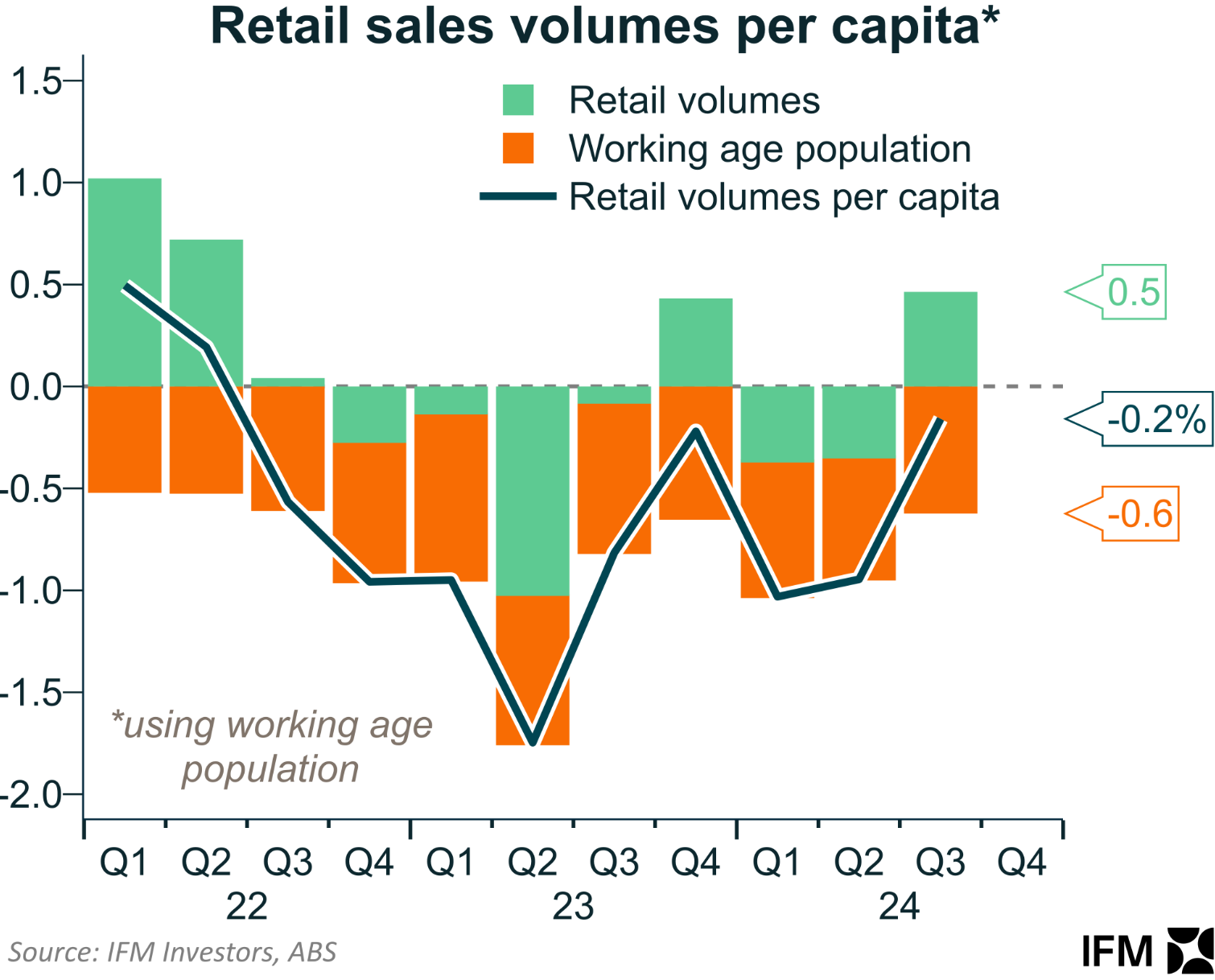

The impact of this population growth is illustrated clearly by the following charts.

While overall retail sales have held steady, per capita sales have tanked.

In fact, retail sales volumes per capita declined for nine consecutive quarters based on the growth in the working-age population.

Australia’s retailers would face a difficult adjustment if the federal government followed the wishes of the electorate and slashed net overseas migration.