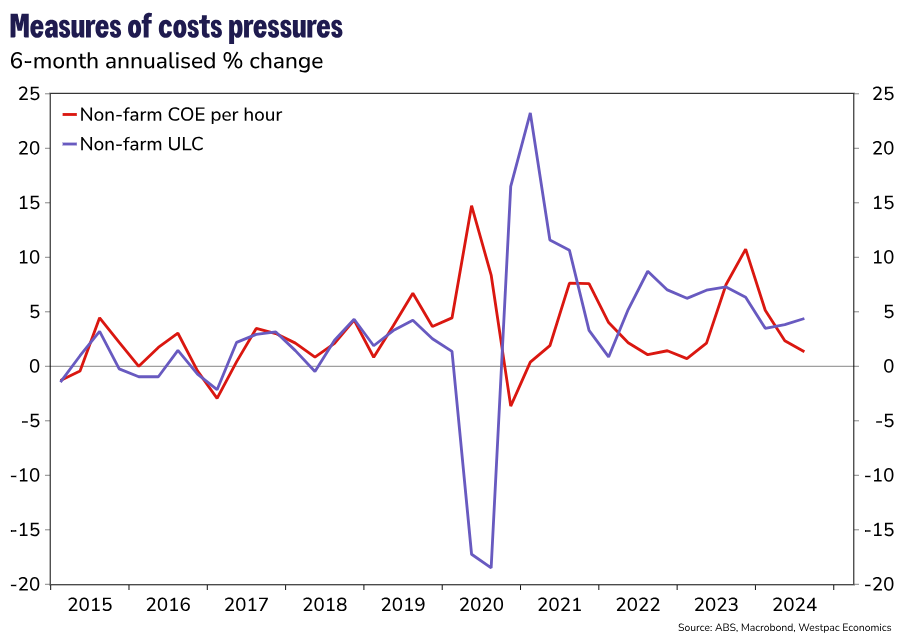

Wages have been pancaked for six months in the national accounts. Westpac.

Cost pressures continue to moderate as the impact of the larger than average 2022-23 minimum and award wage increase roll out of annual calculations. Average (non-farm) earnings per hour moderated to 3.2%yr, from 6.5%yr in the June quarter. Not only was there a step down, but the pace of the decline is gathering speed with average (non-farm) earnings per hour up just 1.3%yr in six-month annualised terms, down from 2.3%yr in the June quarter and well below the pre pandemic average of 1.8%. This is leading to a moderation in unit labour costs (a key measure of domestic cost pressures). ULCs are now running at 3.9%yr, a touch above the outcomes recorded over 2019 when underlying inflation was below the target band

These measures are consistent with the lowflation period of 2012-2020 when the RBA refused to acknowledge that the immigration-led economy does not do wage growth.

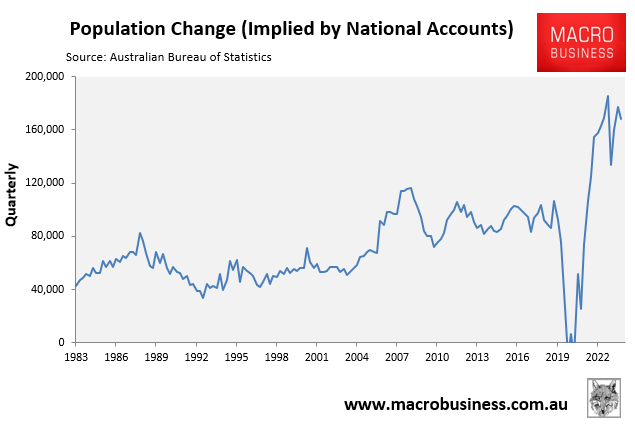

Immigration is much higher today than it was then.

Australian inflation is collapsing as wage growth disappears and the RBA must cut urgently.

Markets appear to agree.

The currency is at new one-year lows.

The short end of the bond curve is flying.

Big pivot ahead.