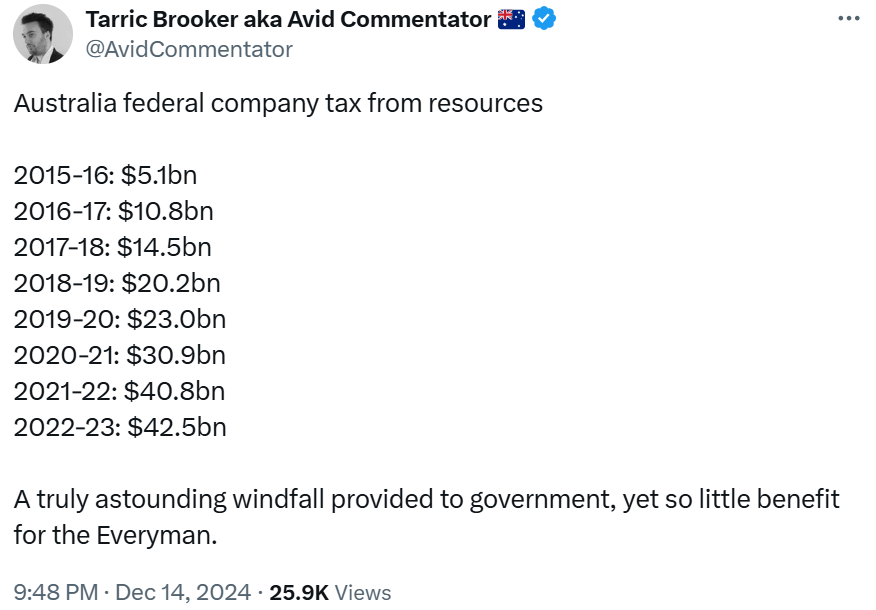

Independent economist Tarric Brooker published the following breakdown of mining company tax receipts between 2015-16 and 2022-23:

The data was derived from a May 2024 Minerals Council Report, which sourced its figures from the ATO and Ernst and Young estimates.

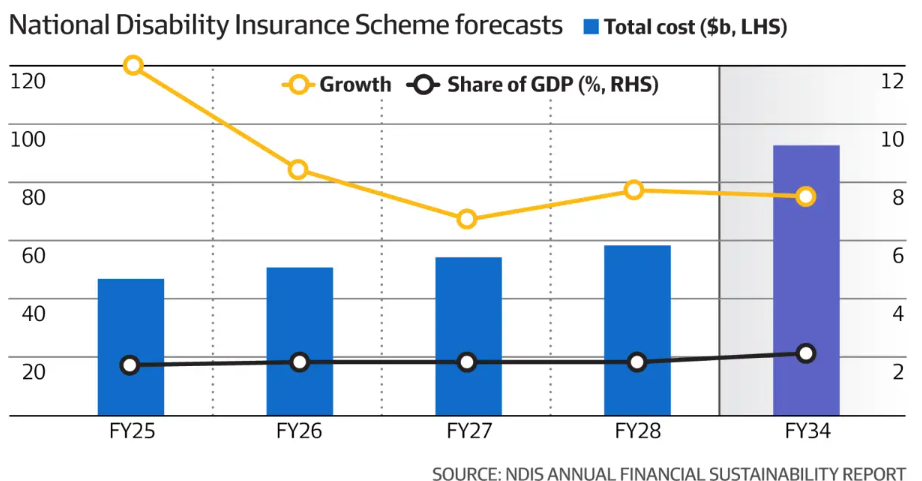

A reader responded to Brooker with the following data showing the cost of the National Disability Insurance Scheme (NDIS) over the same period.

As you can see, the ballooning cost of the NDIS has roughly matched the rise in mining company tax receipts.

The problem for the Australian federal budget should be obvious.

The Parliamentary Budget Office forecasts that the NDIS will roughly double in cost to around $100 billion annually within a decade.

The latest Annual Financial Sustainability Report from the NDIS projects that the scheme’s annual cost will balloon to $92.7 billion by 2033-34, amid annual cost growth of nearly 8%.

“The NDIS was growing at 23% when Labor came to power and the actuary predicts that rate to almost halve to 12% this financial year, fall to 8.4% in 2025-26 and then to 6.7% in 2026-27”, reported The AFR.

“After that, the growth rate will remain between 7% and 8%”.

“The NDIS already costs more to run per year than the aged care system ($36 billion), Medicare ($32 billion), federal government funding for hospitals ($30 billion) and the pharmaceutical benefits scheme ($20 billion)”, The AFR noted.

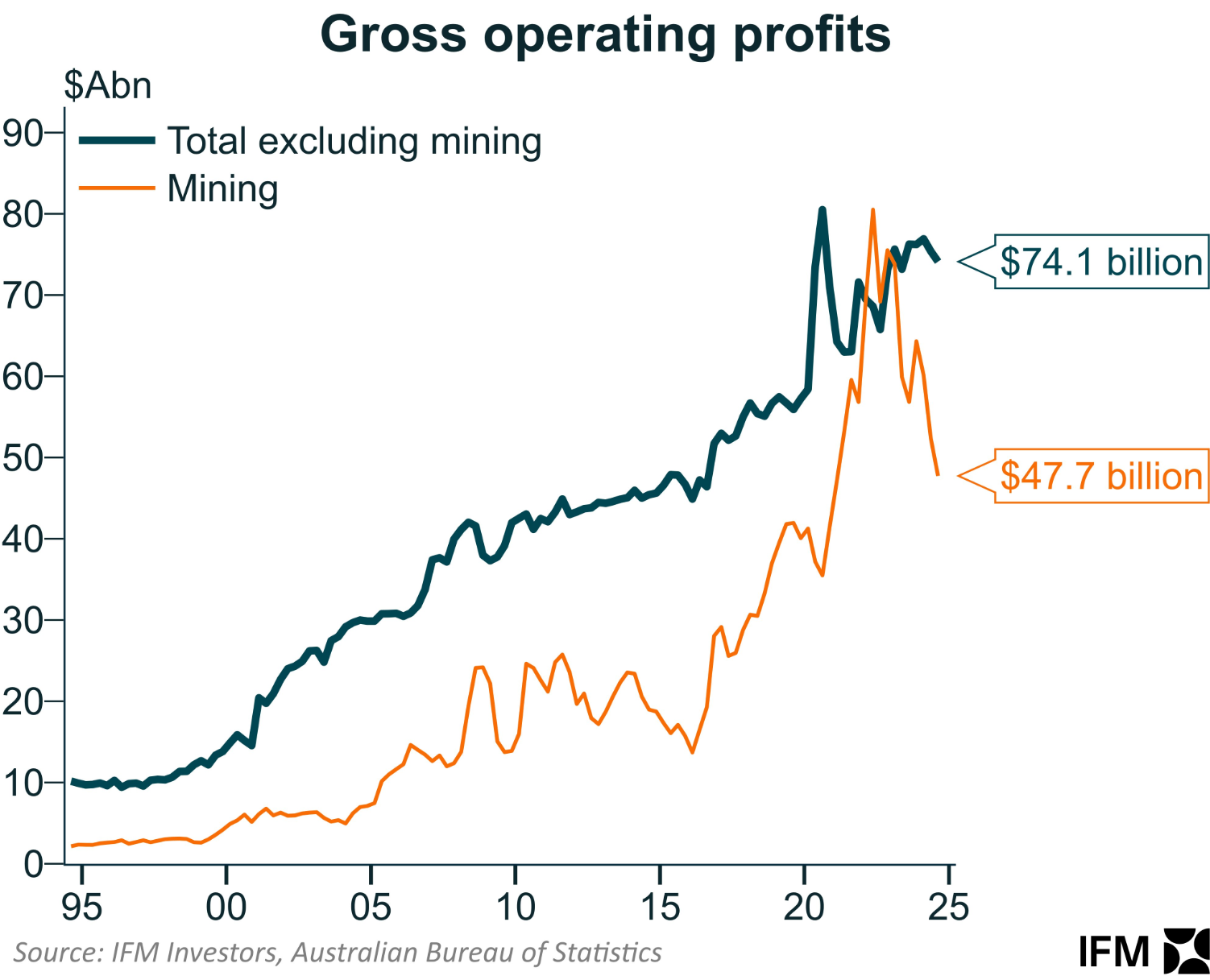

However, mining profits have fallen sharply amid the decline in commodity prices (especially iron ore).

Indeed, Wednesday’s mid-year update to the federal budget will reportedly reveal a $100 billion downgrade in mining exports by Treasury over the four years to 2027-28. This will wipe $8.5 billion of revenue from the federal budget over four years.

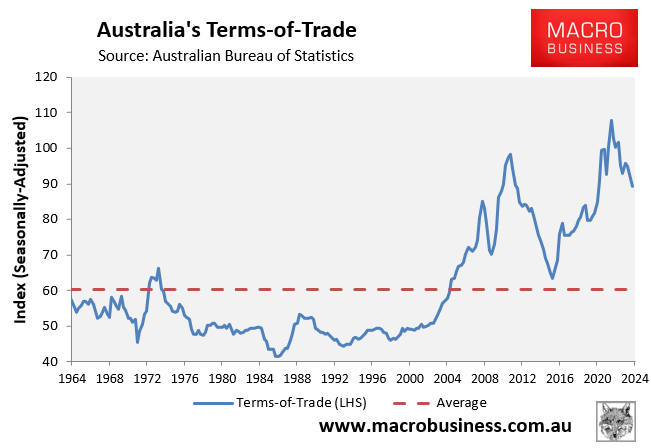

Should Australia’s terms-of-trade revert to anywhere near the historical average, then mining tax receipts will continue to shrink at the same time as the cost of the NDIS continues to expand.

The federal budget and broader Australian economy have been left badly exposed to the whims of global commodity markets.