Australia’s auction market concluded the spring selling season with a lacklustre performance.

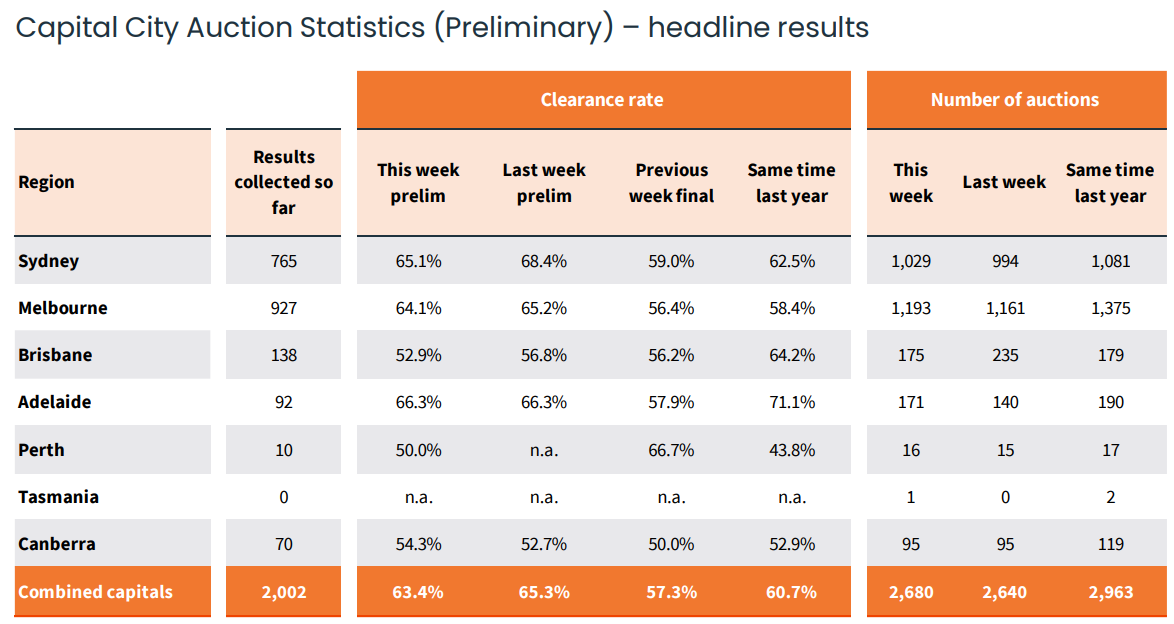

The preliminary clearance rate across the combined capital cities fell to 63.4%, on par with the first week of November as the lowest early clearance rate so far this year.

Source: CoreLogic

Across Melbourne, 64.1% of auctions were successful based on preliminary results, which was the third-lowest result of the spring selling season.

Sydney recorded a preliminary clearance rate of 65.1%. This was the fourth lowest preliminary clearance rate recorded this year, down from 68.4% the previous week, which was revised to 59.0% on final numbers.

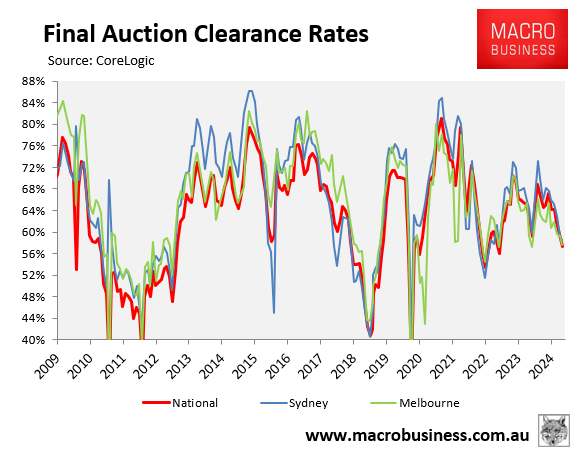

Australia’s auction market has clearly stalled, as illustrated below.

Sydney’s monthly average clearance rate (58%) is the lowest since December 2022; Melbourne’s (58%) is the weakest since December 2023; and the national average clearance rate (57%) is the lowest since August 2022.

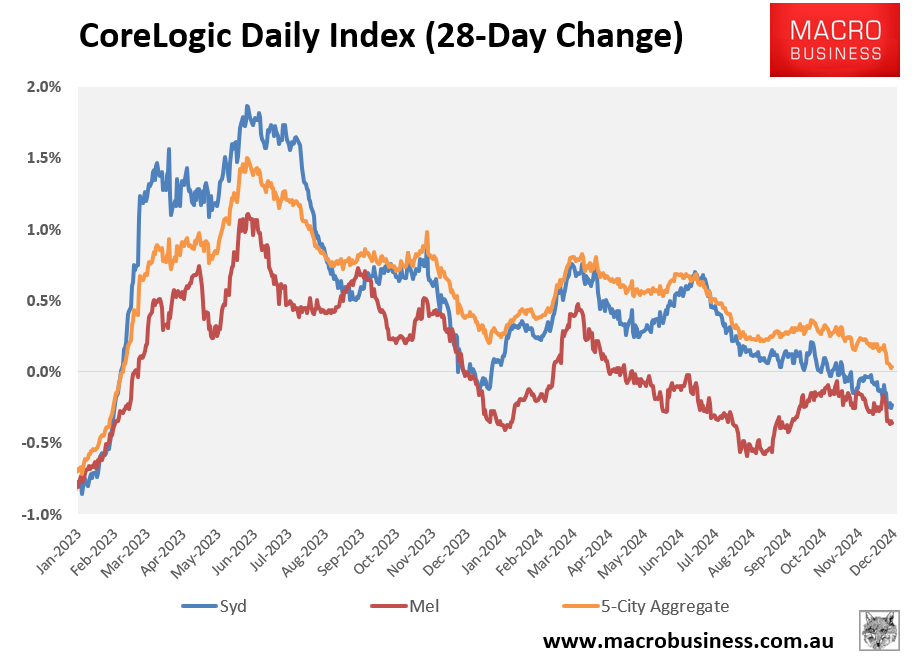

The decline in the auction market has been reflected in prices, with Sydney and Melbourne recording falls over the past month and prices at the 5-city aggregate level flatlining.

In his weekend market wrap following Saturday’s auctions, prominent Sydney auctioneer Tom Panos said that urgency has left the market and the outlook for Sydney and Melbourne prices is poor.

“The forecast is really clear that we’re going to have a challenging period and it will probably remain challenging until there’s an interest rate change”, Panos said.

“The urgency in the marketplace has gone in Sydney and Melbourne… It is getting harder and auctions are taking a lot longer”.

Price momentum is projected to slow until the Reserve Bank of Australia commences its monetary easing cycle next year.

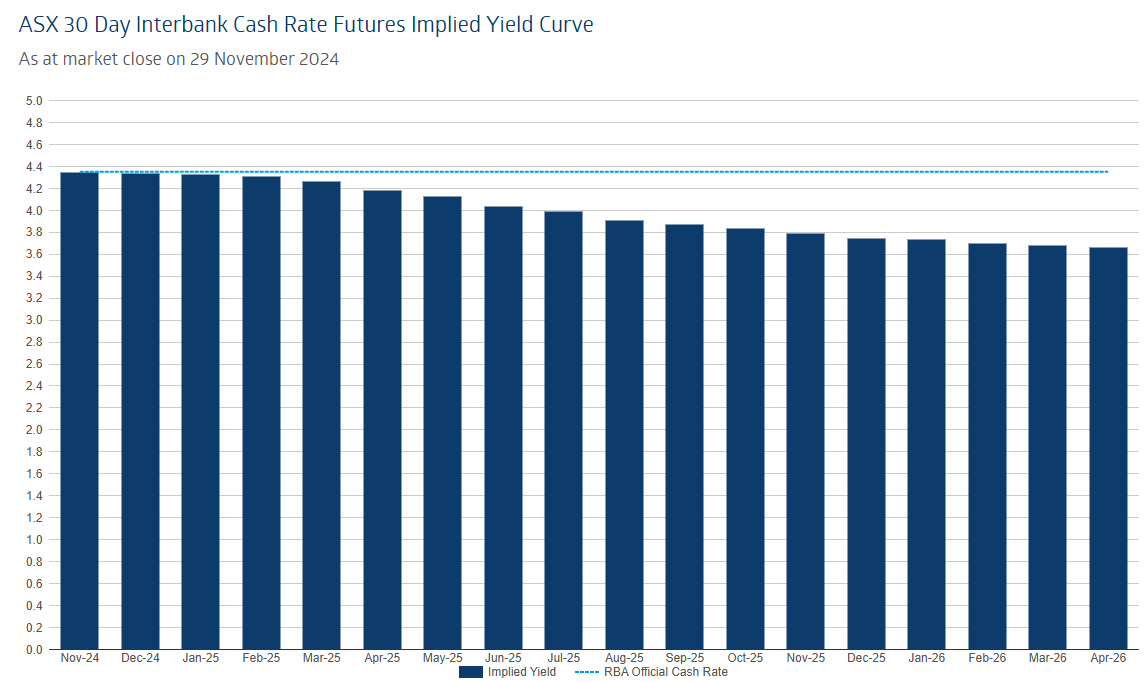

As shown below, financial markets have projected the first interest rate cut for Q2 2025.