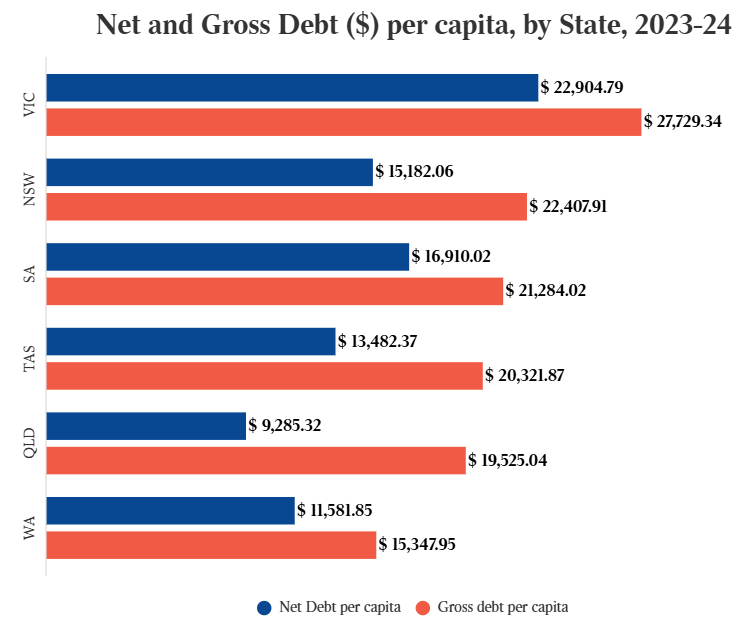

Victoria has the nation’s largest per capita debt and the lowest credit rating.

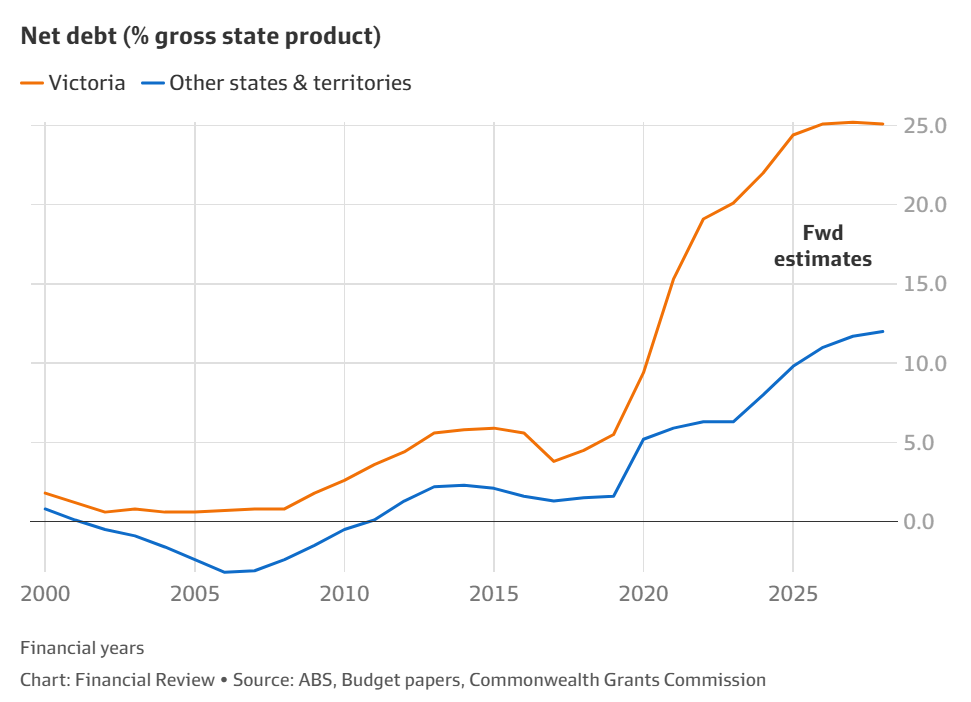

The state’s debt trajectory is worrying. The budget forward estimates project that Victoria’s net debt will peak at 25% of gross state product.

The Victorian Labor government has signed contracts to build the $200 billion Suburban Rail Loop project without locking in funding, so this debt projection is likely to be significantly underestimated.

Data from the Treasury Corporation of Victoria (TCV) shows that the state will need to refinance some $86 billion worth of debt between 2029 and 2034.

Specifically, $14.2 billion of debt will mature in 2029, $12.4 billion in 2030, $16.4 billion in 2031, $15.3 billion in 2032, $15.9 billion in 2033 and $12.4 billion in 2034.

The average interest rate for this debt is about 2.4%, which is relatively low and reflects the “cheap money” that became available globally in response to the pandemic.

However, global interest rates have risen and could average around 4.5% to 5% in the coming years, which could increase the interest bill on Victoria’s debt by about $2 billion.

Ratings agency S&P Global told The Australian that the cost of borrowing is on the rise as the world moves into an “environment of potentially higher for longer interest rates” and this will drive Victoria’s interest bill upwards.

“There is quite a lot of debt maturing beyond the forward estimates and beyond 2028”, S&P director Martin Foo said.

“The weighted average interest expense that the state will pay will continue to rise because all of those low interest bonds issued during the pandemic will roll off”.

“The long story short is weighted average interest expenses will almost certainly increase”.

“When you get to a situation where interest expense starts to consume 8% or 10% of revenues, then it really puts the government in a difficult spot because it’s money that could be spent on other essential government services”.

“It (the interest rate bill) is one of the fastest, if not the fastest, growing operating expense line items”, Foo said.

Foo also warned that the Suburban Rail Loop will push Victoria deeper into debt.

“There is a large component of that project that appears to be unfunded”, he said. “The Victorian government is hoping the commonwealth will chip in a large sum of money but that hasn’t been committed yet”.

“There is a large chunk that relies on so-called value capture and other revenue mechanisms that are yet to be fully explained”.

“When we see a very large infrastructure program like this, it does point to longer term risks to the state credit rating, especially if for whatever reason the commonwealth doesn’t fund as much as the state expects, and then the state has to step in more”, he said.

The world’s two leading credit rating agencies, S&P and Moody’s, recently warned that Victoria faces further rating downgrades if it does not address its financial position.

Based on the above information, credit rating downgrades appear inevitable.