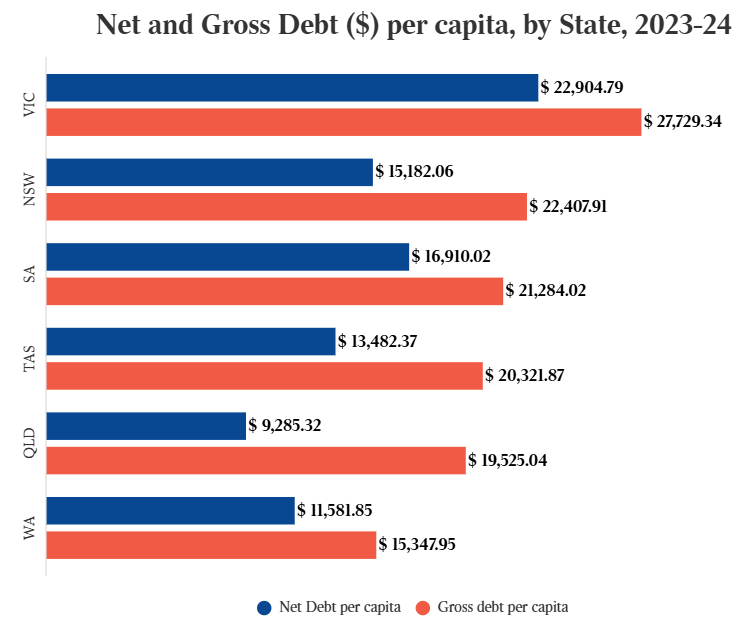

Victoria has the highest per capita debt in the nation and the lowest credit rating.

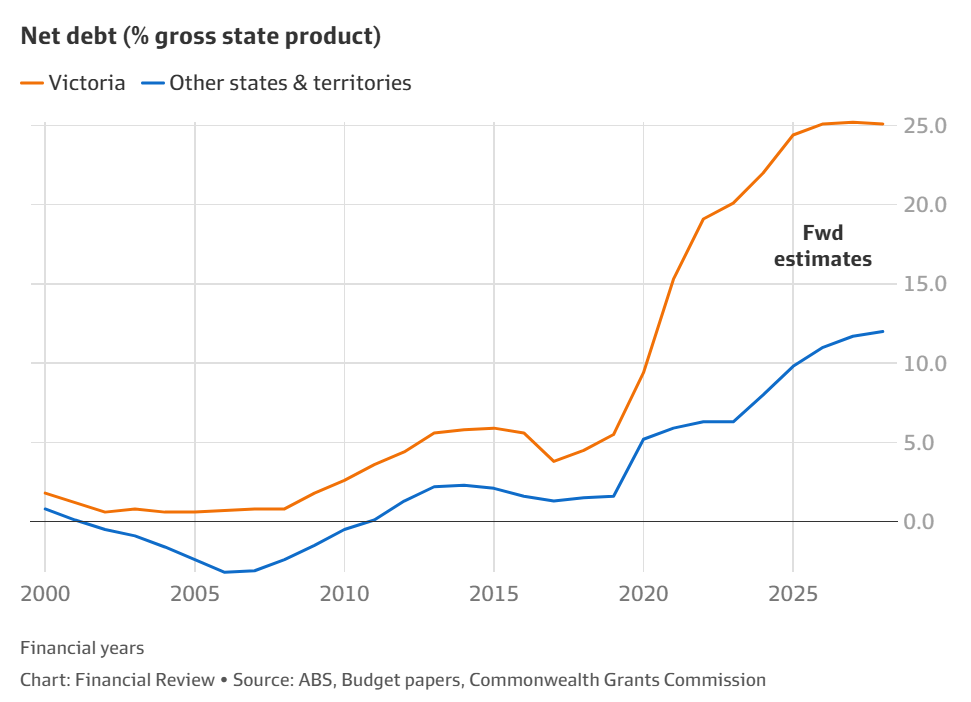

The state’s debt situation is concerning. According to budget forward estimates, Victoria’s net debt will reach 25% of its gross state product.

The Victorian Labor government signed contracts to build the $200 billion Suburban Rail Loop project without securing funds. Hence, this debt estimate is likely to be significantly underestimated.

The Treasury Corporation of Victoria (TCV) estimates that the state will need to refinance $86 billion in debt between 2029 and 2034.

Debt maturities include $14.2 billion in 2029, $12.4 billion in 2030, $16.4 billion in 2031, $15.3 billion in 2032, $15.9 billion in 2033, and $12.4 billion in 2034.

The average interest rate on this debt is only 2.4%, reflecting the “cheap money” available during the pandemic.

However, global interest rates have risen sharply and are expected to average between 4.5% and 5% in the future, potentially increasing the interest cost on Victoria’s debt by $2 billion.

Martin Foo from rating agency S&P also warned that the Suburban Rail Loop would push Victoria deeper into debt.

“There is a large component of that project that appears to be unfunded”, he said. “The Victorian government is hoping the commonwealth will chip in a large sum of money but that hasn’t been committed yet”.

“There is a large chunk that relies on so-called value capture and other revenue mechanisms that are yet to be fully explained”.

“When we see a very large infrastructure program like this, it does point to longer-term risks to the state credit rating, especially if for whatever reason the commonwealth doesn’t fund as much as the state expects, and then the state has to step in more”, he said.

S&P Global’s latest subnational debt report has also concluded that Victoria is now the fourth-most-indebted state government from advanced economies outside the US in absolute dollar terms, up from seventh position in 2022.

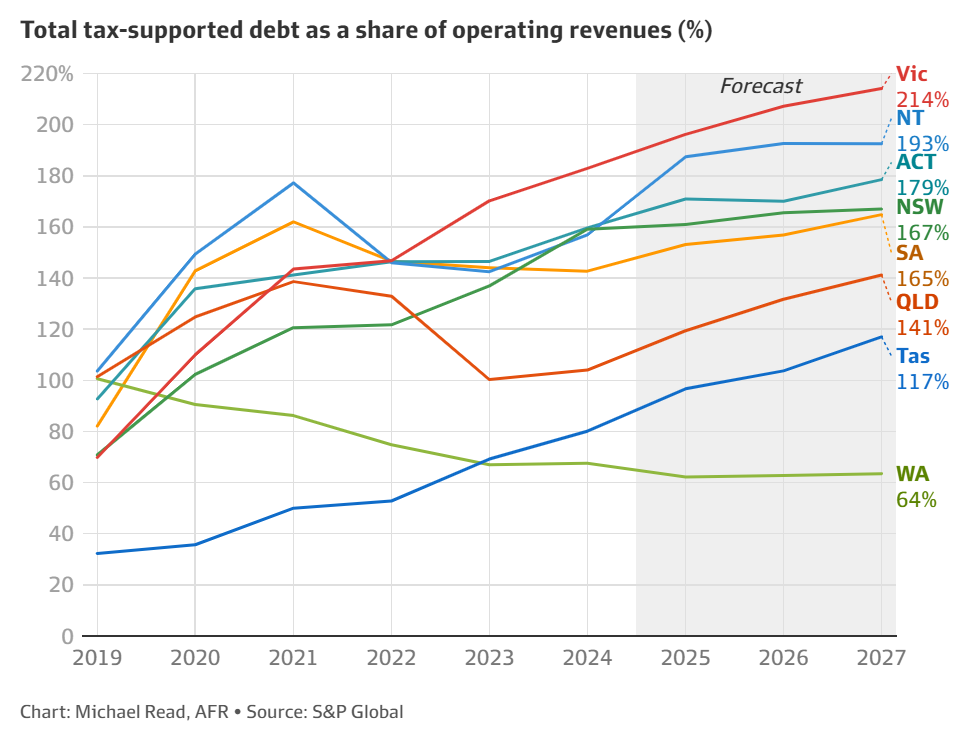

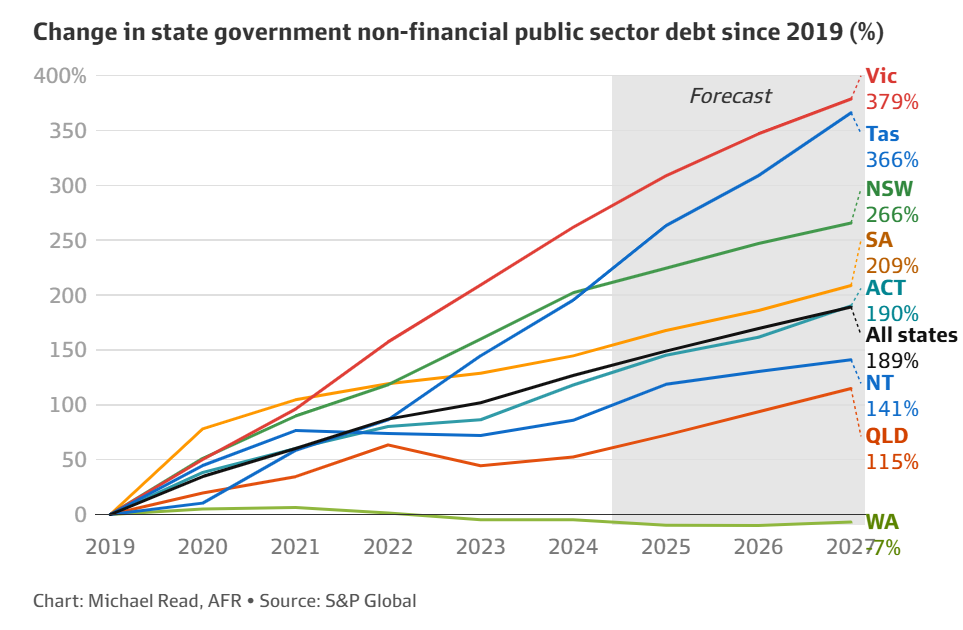

S&P estimates Victoria’s debt will increase to 214% of operating revenues by 2027, up from just 70% in 2019, while NSW’s debt will rise to 167%.

“On current projections, Victoria should soon overtake North Rhine-Westphalia, and could catch the Province of Quebec in a few years’ time [on a debt to operating revenue basis]”, S&P Global Ratings analyst Martin Foo says.

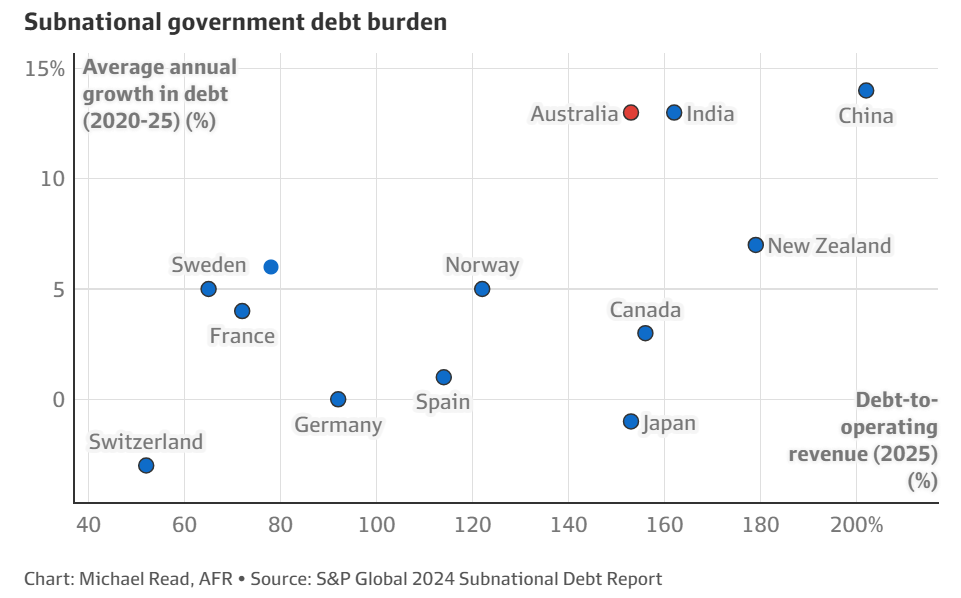

S&P estimates that Australian state gross debt will have risen by an average rate of 13% per year between 2020 and 2025, more than any other advanced economy provincial or state governments.

As a result, Australian states’ collective debt bill will hit $780 billion, almost triple pre-pandemic levels.

Martin Foo contends there are several reasons why Australia’s states are so much more indebted than their foreign peers.

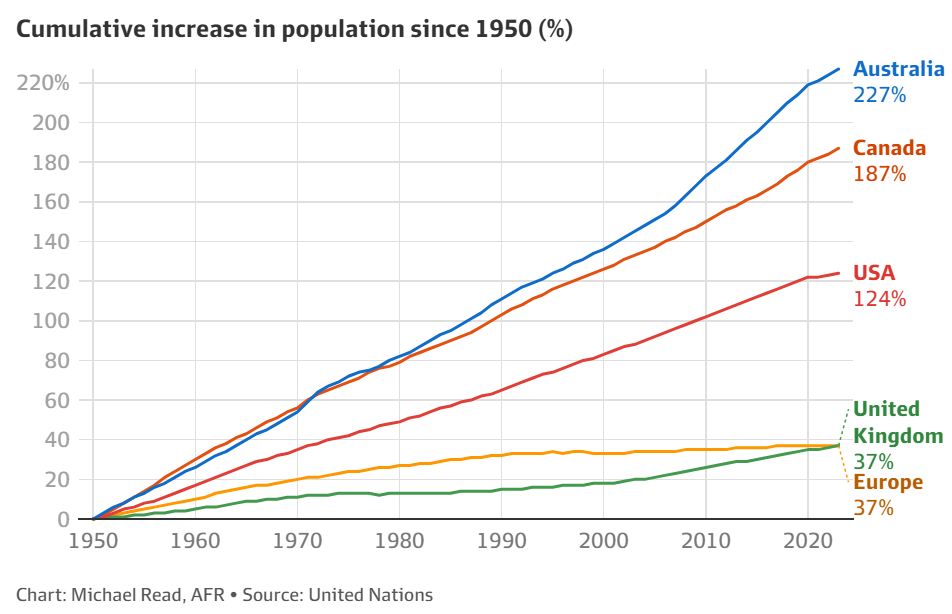

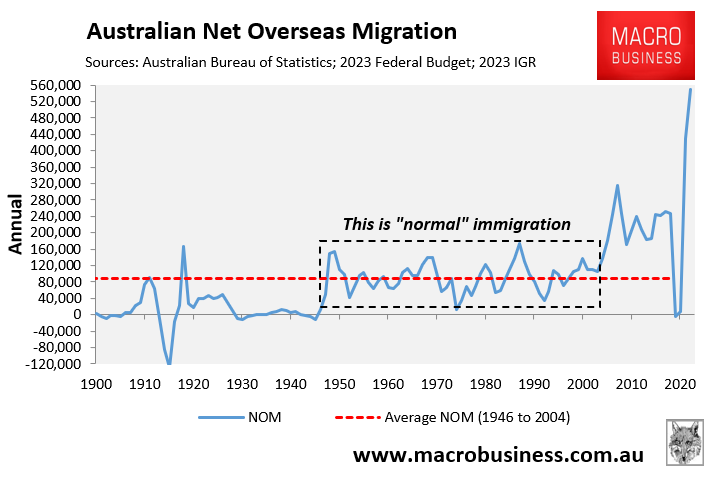

“Australia’s population has more than tripled since 1950, while Europe’s population has grown only about 30% over the same time frame. This has created intense pressure on state governments to build and renew infrastructure, which is mostly debt-financed”, Foo says.

“State revenue bases have also expanded, but their major taxation lines such as payroll and gambling taxes tend not to be as responsive to population growth”.

In contrast to other developed nations, Australia’s states bear the primary responsibility for service delivery and infrastructure, including schools, hospitals, roads, and rail, yet they only manage to collect approximately 13% of the nation’s tax revenue.

This has exposed Australia’s states financially to the federal government’s mass immigration policy.

Martin Foo also contends that fiscal discipline among Australian state governments has waned.

This is evidenced by large increases in state government workforces and wage bills, infrastructure blowouts, and cash giveaways.

“Victoria pivoted to a very large infrastructure investment program, and some of its major projects have incurred big cost escalations”, Foo says.

Accordingly, by 2027, Victoria’s debt will have increased almost five-fold compared with 2019.

S&P and Moody’s recently warned that Victoria faces further credit rating downgrades if it does not manage its debt.

Based on the above data, credit rating downgrades seem inevitable.