The Australian Bureau of Statistics (ABS) today released retail sales data for October, which posted a third consecutive rise.

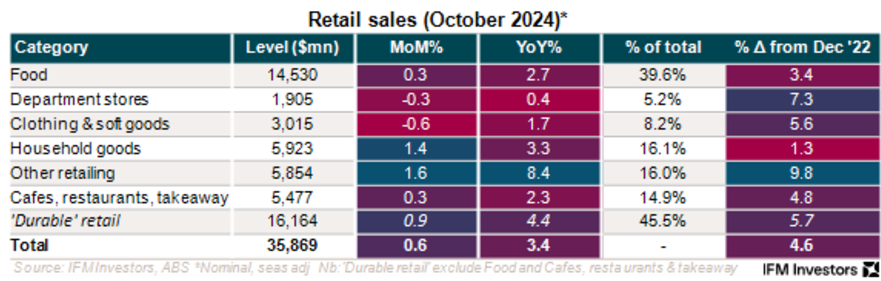

As illustrated in the table below from Alex Joiner, chief economist at IFM Investors, retail sales rose by 0.6% in October to be 3.4% higher year-on-year.

The 0.6% rise in October follows growth of 0.1% in September and 0.7% in August.

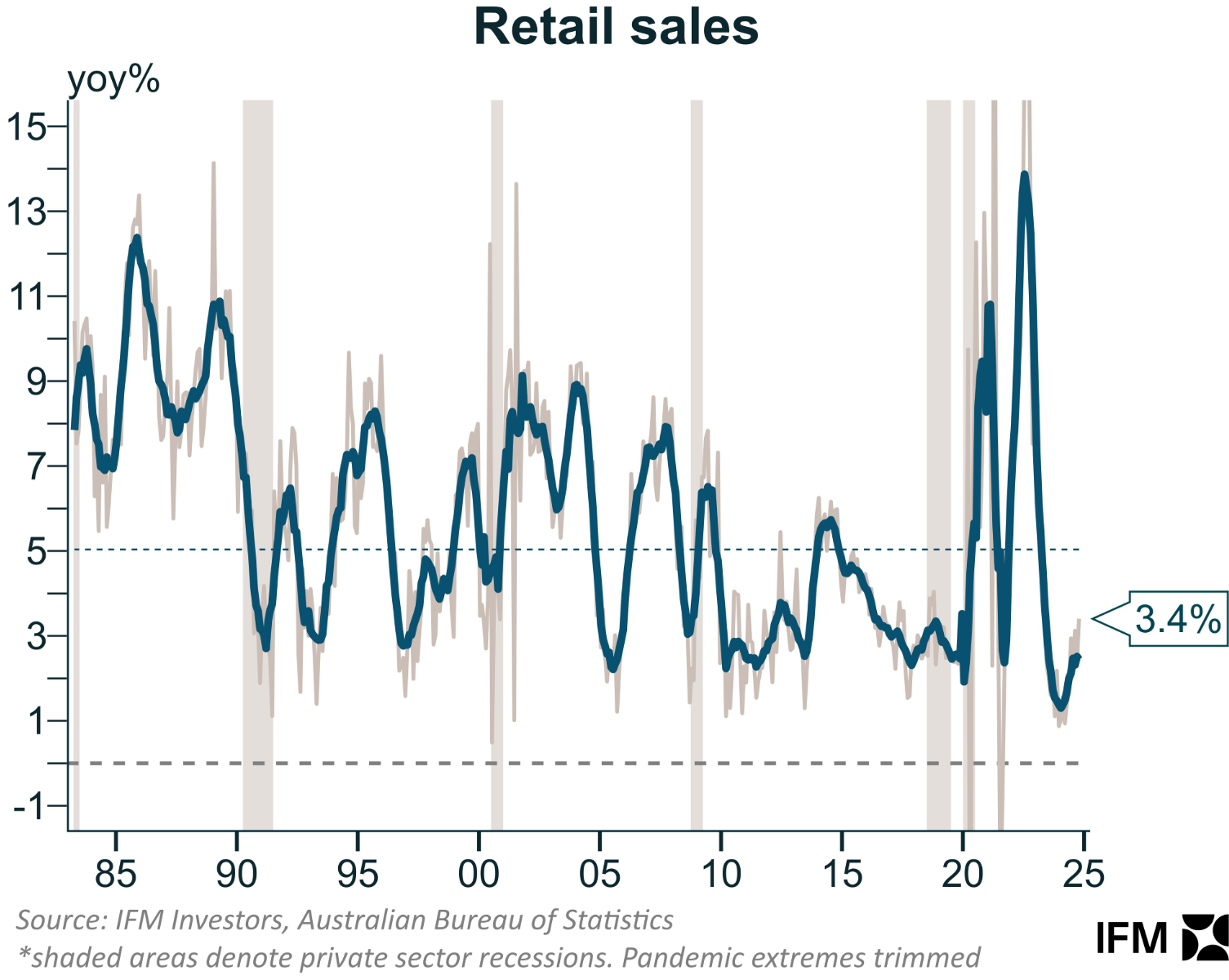

The following annual growth chart clearly illustrates the sales bounce.

Robert Ewing, head of business statistics at ABS, observed that discounting drove sales forward.

“After a steady result last month retailers told us that sales activity grew in October ahead of the Black Friday sales”, he said.

“The stronger than usual October month saw some retailers enticing buyers to spend early with discounting, particularly on discretionary items”.

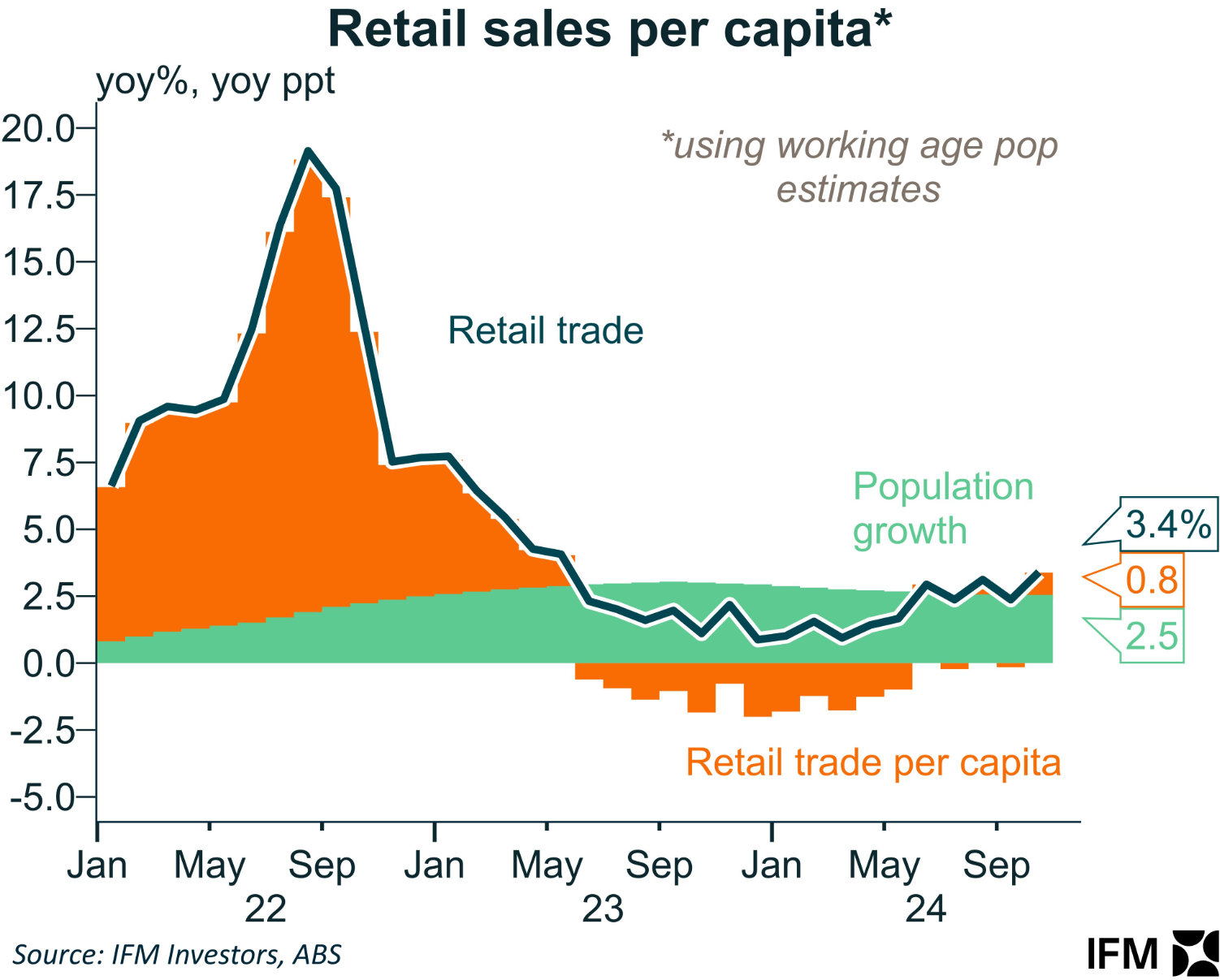

Alex Joiner produced the following chart showing that nominal retail sales are now tracking 0.8% ahead of population growth:

However, sales are still declining in real per capita terms.

Nevertheless, Joiner believes that the stronger than expected result, if maintained, could dissuade the RBA from cutting rates.

“If this continues underpinned by a relatively tight labour market the RBA will remain concerned about the inflationary outlook and won’t see the opportunity for a rate cut any time soon”, Joiner said via Twitter (X).

In a similar vein, CBA economist Harry Ottley noted:

“The totality of the data is suggesting the spending is recovering. This is likely in response to the income boost from the State 3 tax cuts, the prospect of further rate rises dissipating and lower inflation as well as cheaper utilities and petrol. Consumer sentiment is rising in response to these factors”.

However, Ottley cautioned that the ABS Monthly Household Spending Indicator (MHSI) “has remained softer than both retail trade and our own HSI. The MSHI will replace retail trade next year, and is much wider in scope”.