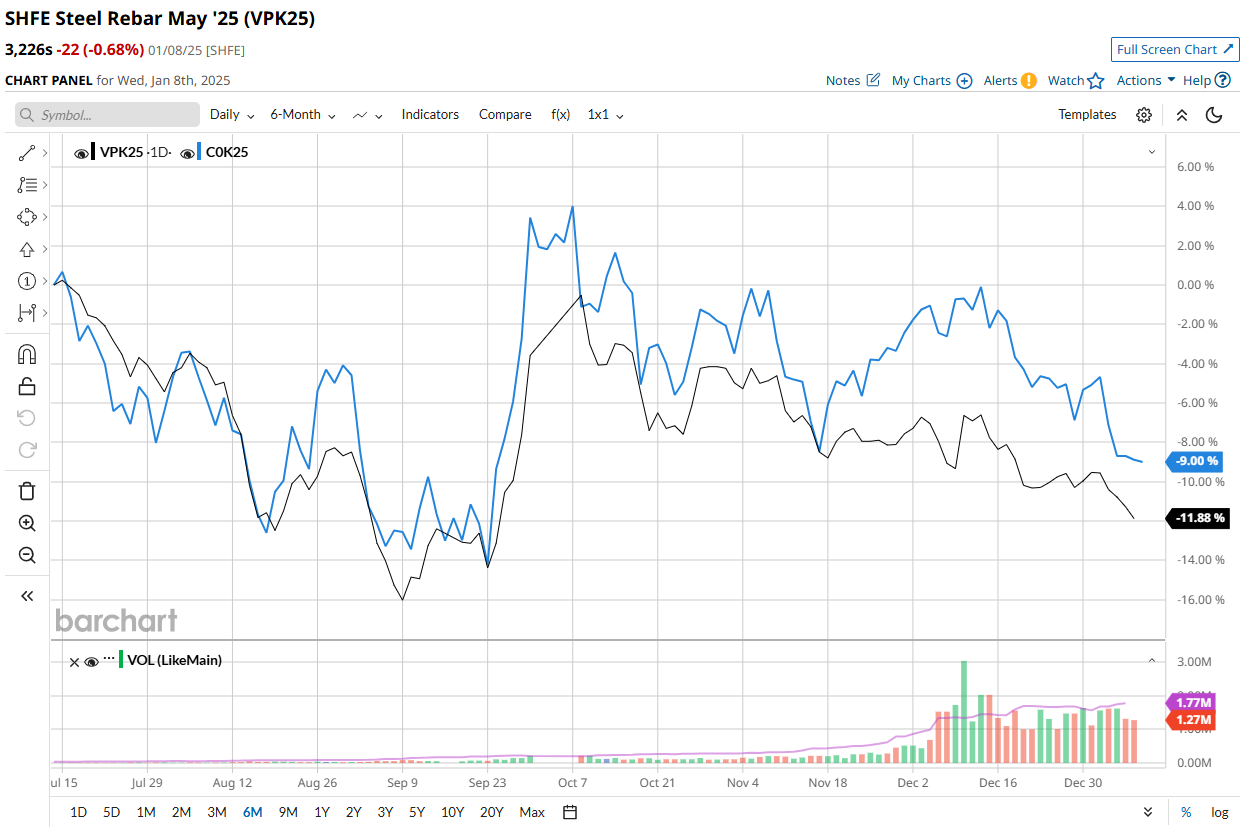

Iron ore spot is hovering around $97 as it chases relentlessly weak rebar futures lower.

This is much weaker than I expected through New Year.

There is a great deal of tariff frontrunning going on which is supporting Chinese steel exports.

As well, seasonal tailwinds are also very strong.

But, instead, here we are in consistent falls.

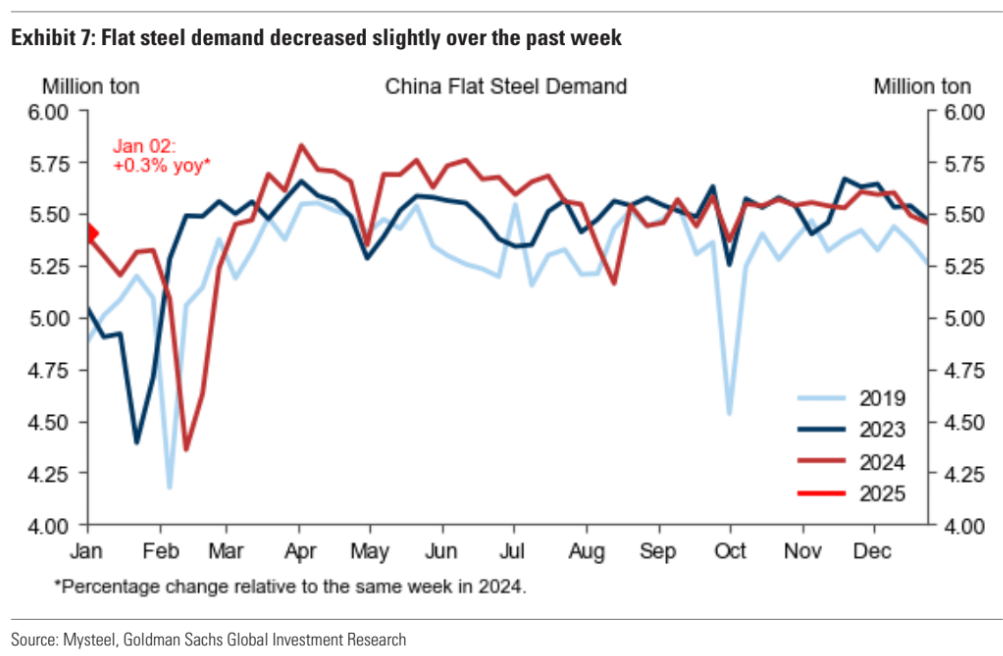

Flat steel demand is decent, supported by exports.

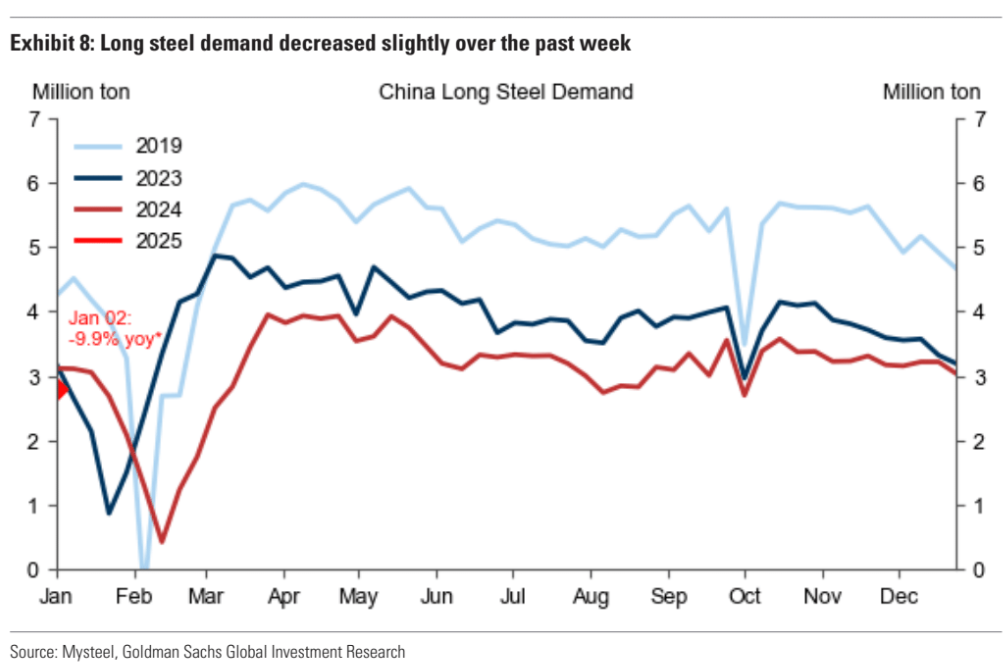

But long steel demand is terrible, dragged down by ongoing construction activity falls in China.

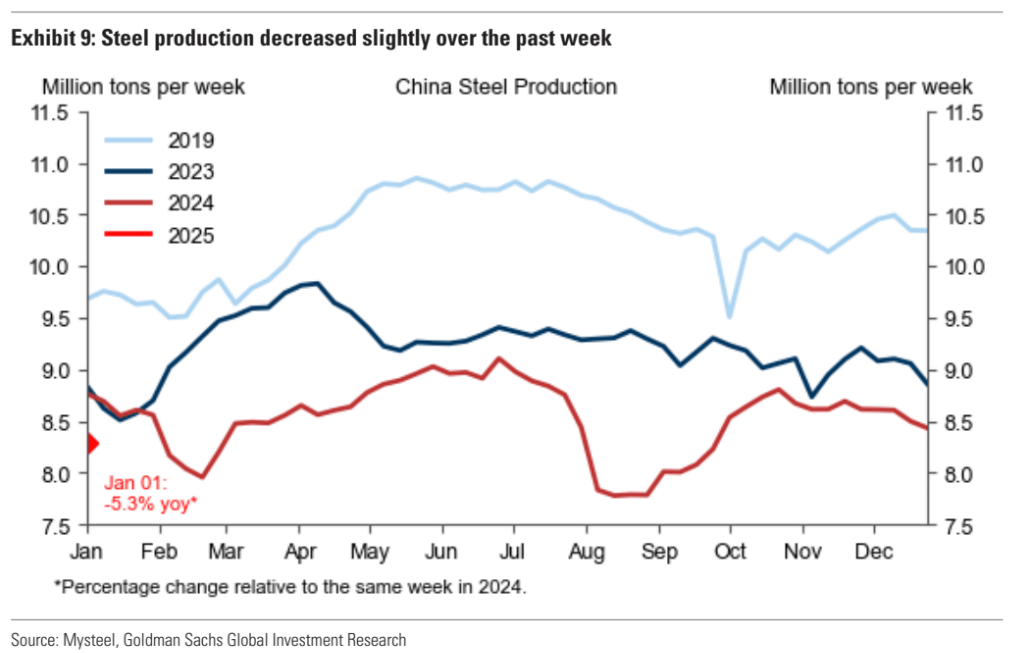

The net result is production has started the year way down.

China is not coming to save demand. On the contrary, long steel demand will keep falling sharply. Once tariffs hit, global demand for Chinese exports will plummet as well.

Ahead this year is more supply from Brazil and Australia before the Simandou Pilbara killer arrives later in the year.

Big miners will not be rationing supply in advance of that event. They will be pumping it to push out higher-cost producers in advance and to sure-up market share.

2025 is the year of iron ore doom.