The past 20 years have seen a proliferation of cafes around Australia.

When I moved to the Melbourne suburb of Ashburton in 2006, there were only a few cafes on the High Street shopping strip.

In the years leading up to the pandemic, the number of cafes on or near the High Street strip increased to more than a dozen.

The quantity of cafes was never sustainable. While a few were regularly busy, most of the cafes remained quiet, with few customers.

Several eateries along my local High Street now have For Lease signs. The number of cafes in operation has declined for the first time since I moved to the area

A similar scenario is unfolding across Australia.

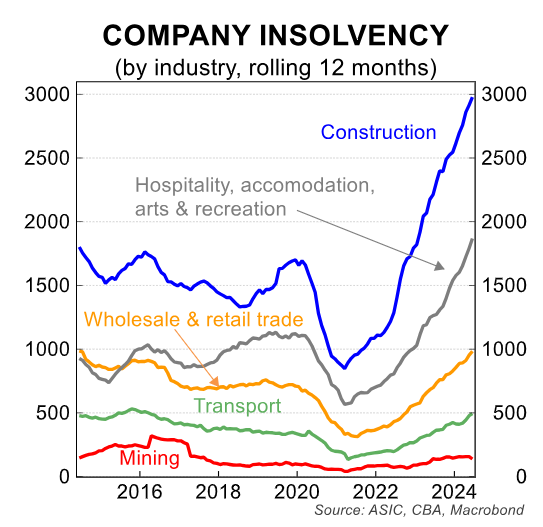

The surge in hospitality industry insolvencies, which are tracking at around double pre-pandemic levels, shows that the great cafe bubble is bursting.

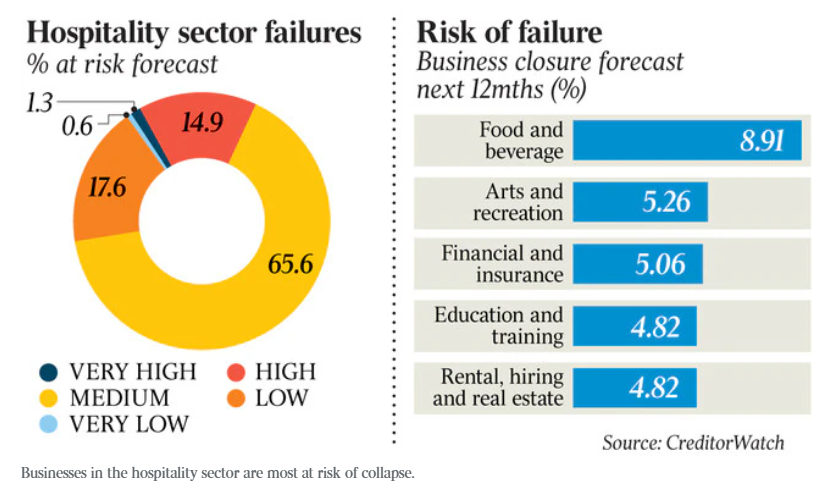

The situation is unlikely to improve. According to a recent CreditorWatch poll, roughly one out of every six (16.2%) hospitality businesses is at high risk of failing because of high interest rates, rising rents, increased living costs, and the pandemic’s long-term effects.

Furthermore, almost 9% of food and beverage businesses are likely to close over 2025.

Six weeks ago, 9New aired a report expalining how the cafe industry was experiencing its hardest year on record, with one-in-ten cafes projected to close in the coming year.

Bringing in a Canberra and a Hobart each year

but 8.5% of cafes went bust last year

and 10% predicted to go bust next year https://t.co/KN52oyFr8L— Matt Barrie (@matt_barrie) November 24, 2024

“In the next 12 months, we are looking at one-in-ten hospitality businesses failing”, CreditorWatch CEO Patrick Coghlan told 9News.

“They have never been doing it so tough as they are at the moment”.

Nine Finance editor Chris Kohler attributed the failures to two primary causes:

- Costs—ingredients, power, labour, rent, insurance—are still rising, crunching margins.

- Cost-of-living pressures have decreased buyer demand.

“Inflation still is running higher than we want it to be”, Coghlan said, adding that “interest rates aren’t going to come down for months and will come down slowly”.

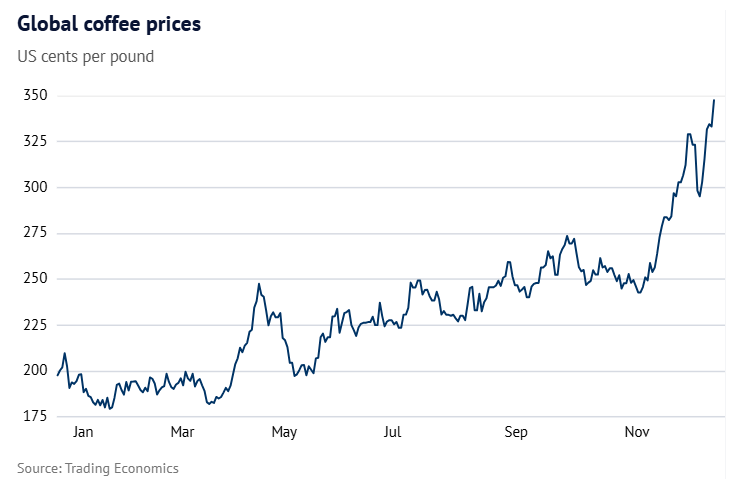

News.com.au reported earlier this week that the skyrocketing costs of beans could drive coffee prices higher, leading to the closure of more cafes.

“This is happening all around Australia. This is affecting every cafe”, Australian Restaurant and Cafe Association chief executive Wes Lambert said.

“Up to 30% of businesses will feel heavy pressure by these increases, and we’ve heard about bean prices going up as much as 50%”, he said.

RMIT logistics and supply chain management Professor Vinh Thai warned that higher coffee prices could smash buyer demand.

“If customers choose to change their coffee habits, this might threaten the Australian coffee industry, which employs almost 70,000 people, as of 2023″, he said.

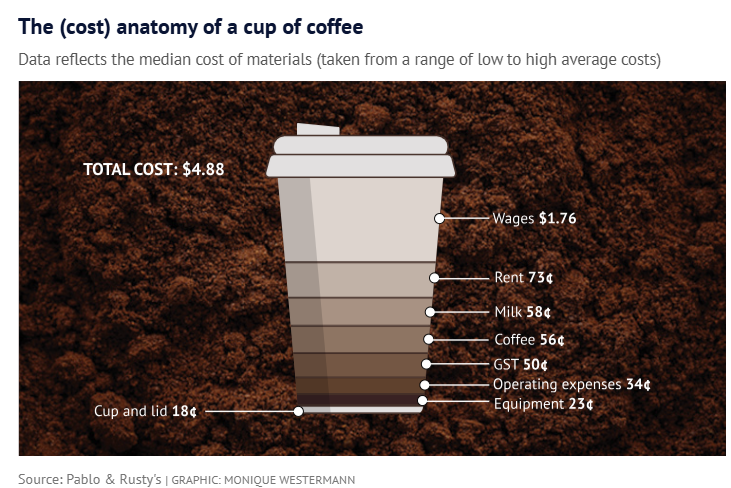

Coffee roaster Pablo and Rusty’s claims that the cost of making coffee in Australia has risen to nearly $5:

Pablo & Rusty’s chief executive, Abdullah Ramay, said that the retail price for a coffee needs to rise to $7.

“The cost of this thing should’ve been $7-plus. If you’ve been buying coffee for $4.50 … the cafe’s been subsidising”, he said.

“You should thank your cafe owner and barista; you’ve been getting the bargain of the century”.

“I want to shout this from the rooftop: cafes are not selling a product, they’re selling a service”.

Ramay asserts that a surge in costs has led to the closure of numerous cafes due to financial difficulties.

“They’re not insolvent,” he said. “They’re like, ‘this is too hard … I can’t make this work, here’s your lease back’”, he said.

“Hospitality in general is being almost attacked from multiple directions”, CreditorWatch chief executive Patrick Coghlan said.

“They feel the reduction in discretionary spend more than any other industry, they are constantly dealing with rising costs they can’t pass on in the same way that business services, or construction, or most other industries can”.

“There’s only so much a consumer will pay for a cup of coffee or a sandwich, right? That just puts a huge amount of pressure on their margins”, he said.

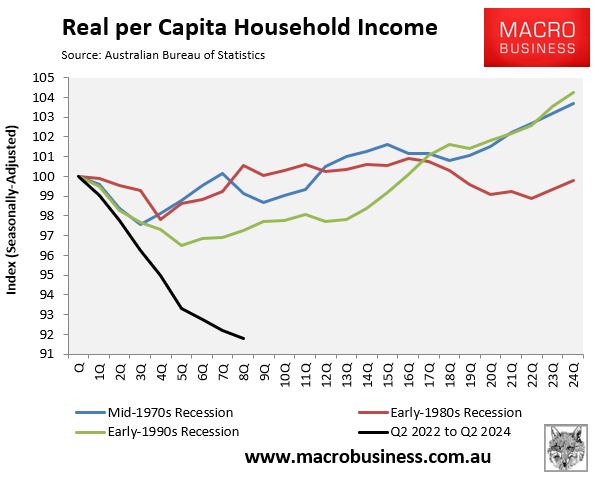

Australians’ disposable incomes have recorded their largest decline on record, prompting people to reduce discretionary spending, including at cafes.

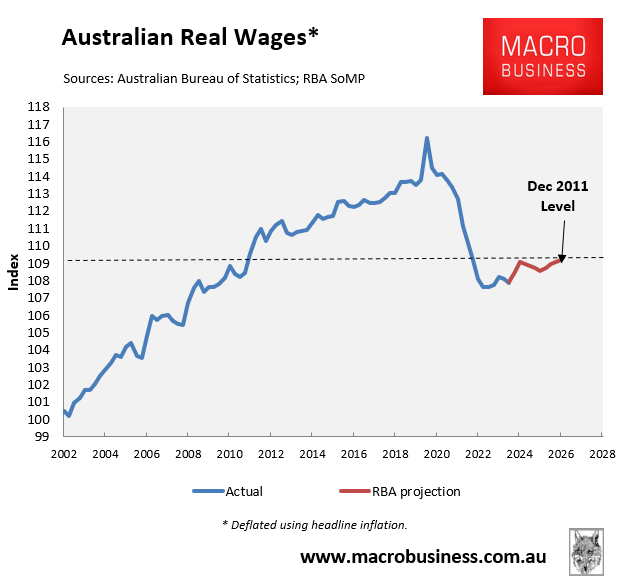

The RBA has also forecast a very slow rebound in Australian real wages, indicating continued pressure on hospitality businesses for the foreseeable future.

The reality is that most Australians cannot afford to spend more than $5 on a coffee or $20 on smashed avocado and eggs on toast. Excessive price inflation has destroyed demand.

Thus, Australia’s twenty-year cafe boom is coming to an end, with the number of cafes reducing to match demand.

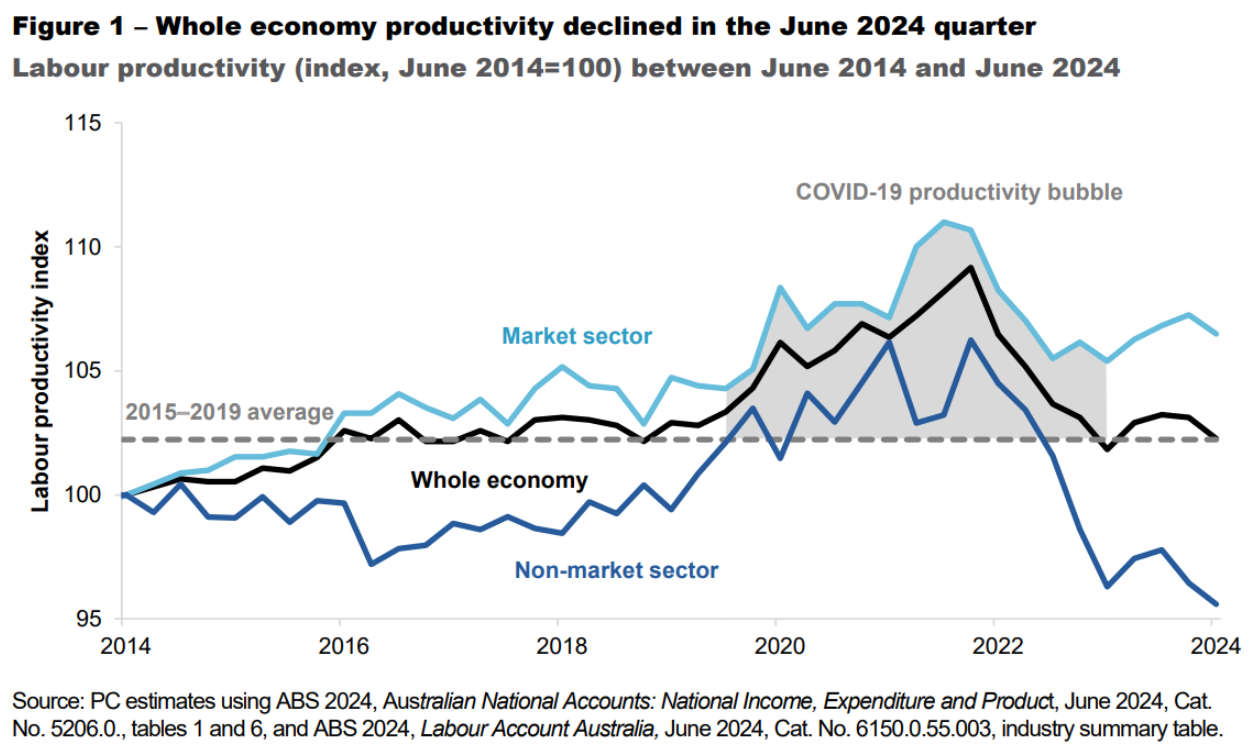

The advantage is that hospitality is a low-productivity, low-wage industry. As a result, any contraction will allow workers and capital to shift to more productive areas of the economy.

That said, most of these workers will probably end up working in non-market areas such as the NDIS, which has even lower productivity.