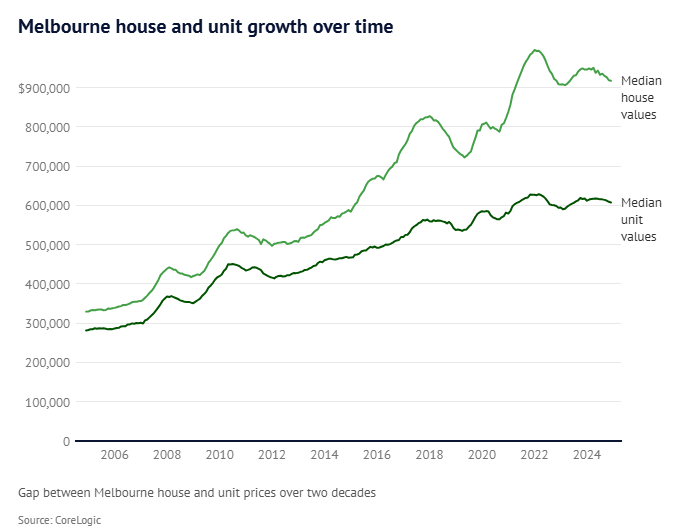

Domain published the following chart showing how Melbourne house values have risen far quicker than unit values.

“A typical house in Melbourne cost buyers 51.1% – or $310,202 – more than a unit in December 2024, according to CoreLogic data”, the article reads.

“That has more than doubled since December 2014, when the gap was $121,322. It has increased more than six-fold since December 2004, when the difference was just $47,976”.

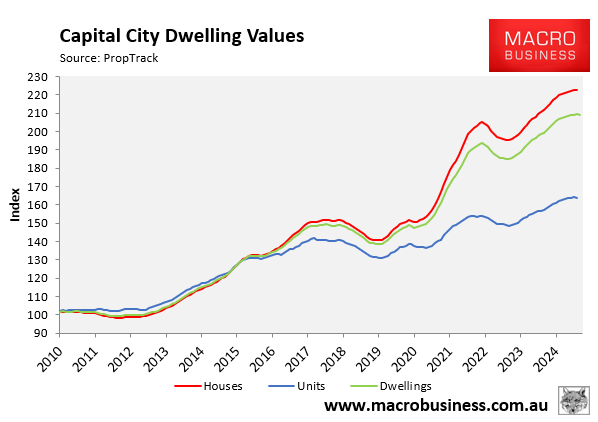

The same phenomenon has taken place across Australia’s capital cities. As illustrated below using PropTrack data, median capital city house prices have risen by around 123% since 2010 versus 64% for units.

CoreLogic head of research Tim Lawless noted that the widening gap meant that owning a unit was no longer a stepping stone to owning a detached house.

“Buying a unit probably used to be a bit of a stepping stone”, Lawless said. “You buy into the apartment sector and then hope to eventually upgrade into a larger, detached home, but with such a big price difference, and the fact that it’s probably been a lot harder for unit owners to accrue equity, that upgrading step is a lot more challenging now”.

Brendan Coates from the Grattan Instute noted that “land is scarce, and therefore it’s valuable, so if you want to have that backyard, you are going to pay a premium for it”.

“Not everyone can have a freestanding house, and that means there’s more competition for the limited number of freestanding homes that exist”, he said.

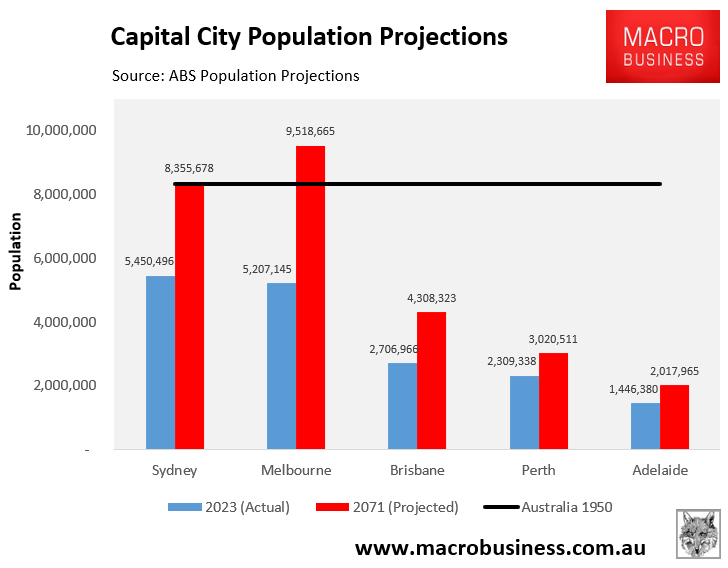

The reality is that the gap between unit and house prices will widen as Australian capital city populations swell and the housing stock densifies.

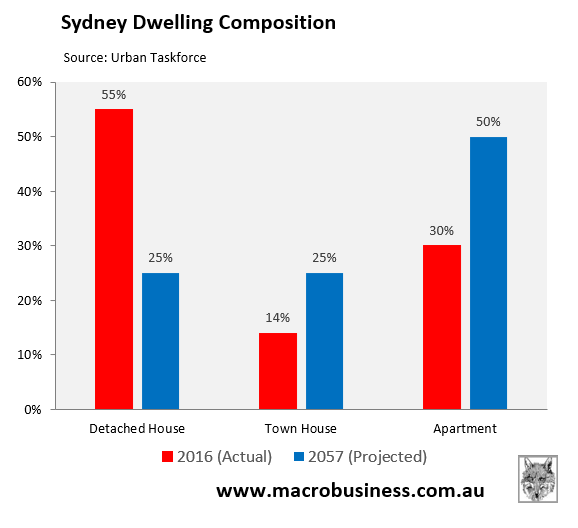

For example, the Urban Taskforce projected that the share of detached houses across Sydney would more than halve to only 25% by 2057.

Similar changes will happen across Australia’s other capital cities as their populations balloon.

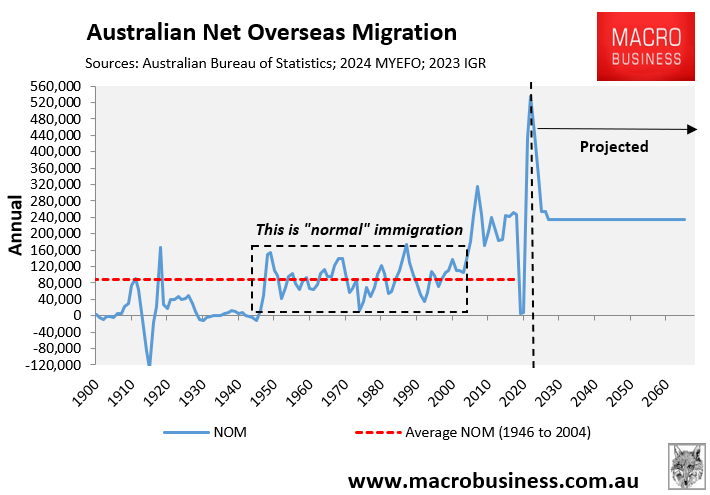

Perpetual high rates of net overseas migration will put upward pressure on house prices and rents, making housing more unaffordable.

Detached houses will become especially scarce and expensive, resulting in fewer households having access to a backyard.