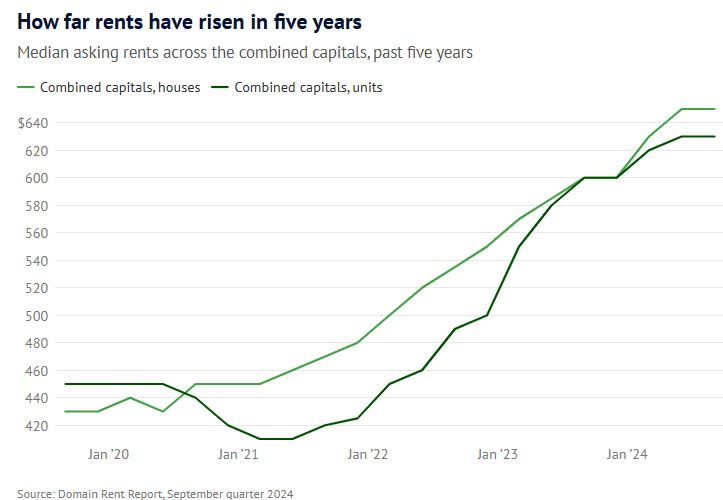

After capital city asking rents soared by more than 40% since the pandemic, rental inflation appears to have hit an affordability ceiling.

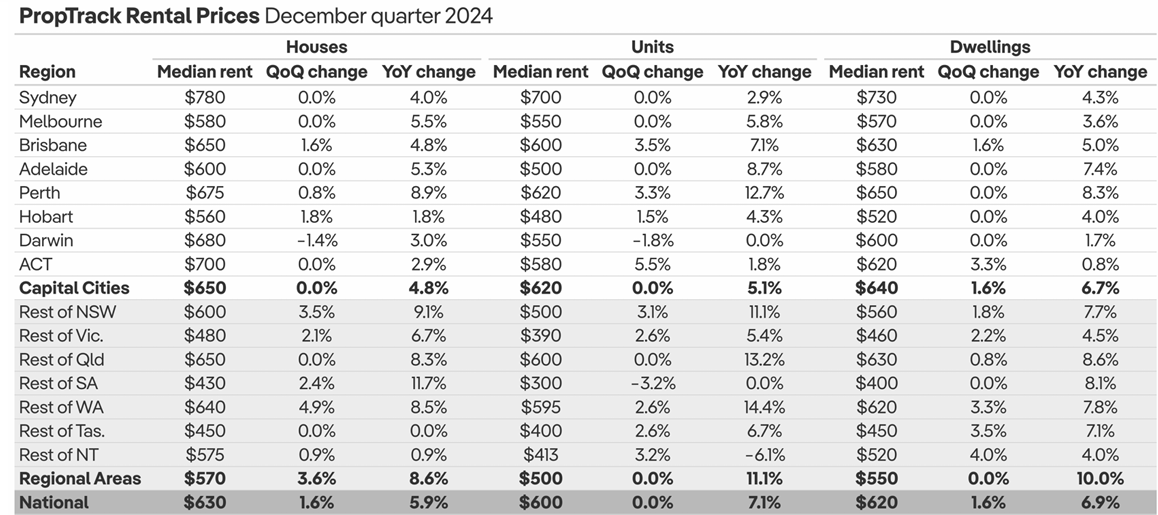

New rental data published by PropTrack shows that national and capital city median weekly advertised rents increased by 1.6% over Q4 2024.

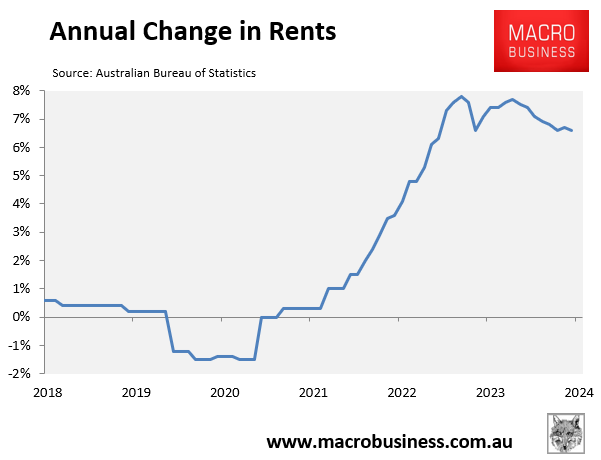

National rental growth also decelerated to 6.9% over 2024, down from 11.5% over 2023. This marked the slowest rate of annual rent growth since Q3 2021.

“The pace of rent growth across the country is slowing, with market conditions easing for renters”, noted PropTrack senior economist Paul Ryan.

“Rents are now growing at their slowest pace since late 2021. The slower pace of growth comes on the back of an increase in the number of available rentals as well as cost of living pressures limiting tenants’ spending capacity”.

The Australian Bureau of Statistics’ (ABS) monthly inflation gauge, released on Wednesday, also showed that rental inflation declined to 6.6% in the year to November 2024, down from a peak of 7.7%.

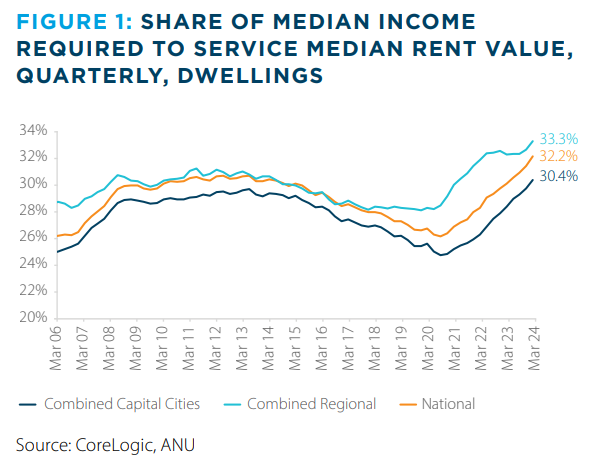

The slowing of rental inflation comes amid record low affordability, which has limited tenants’ capacity to pay.

Tenants have responded to these conditions by moving into group housing, which has tempered demand.

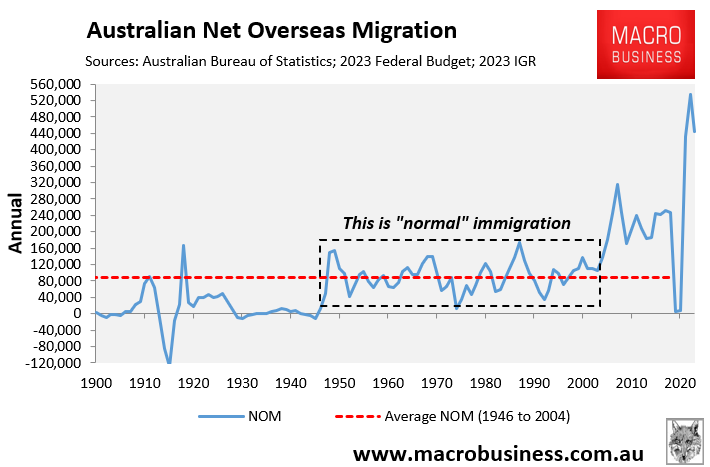

Net overseas migration, while still ridiculously high, has also moderated.

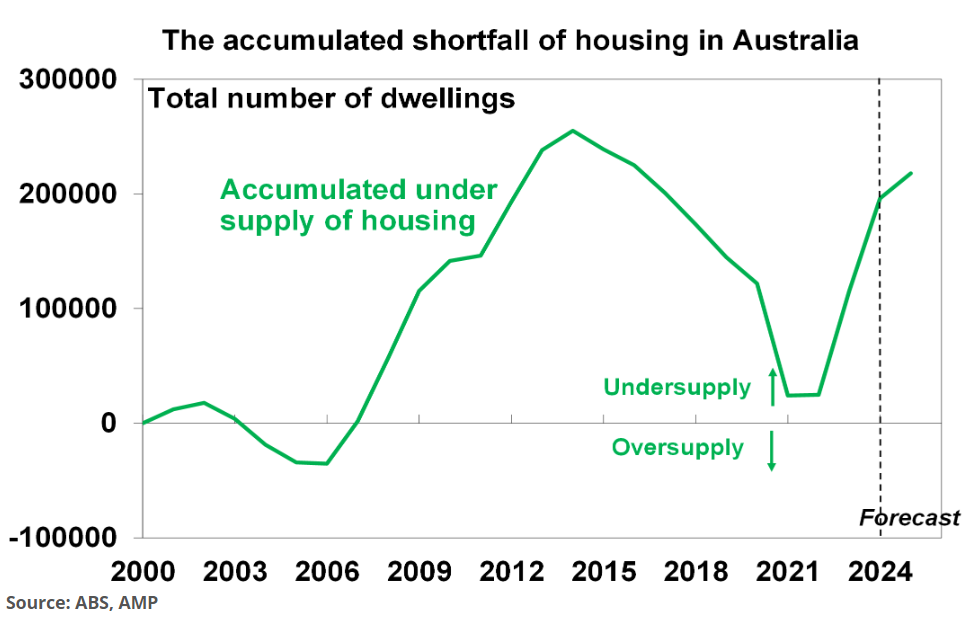

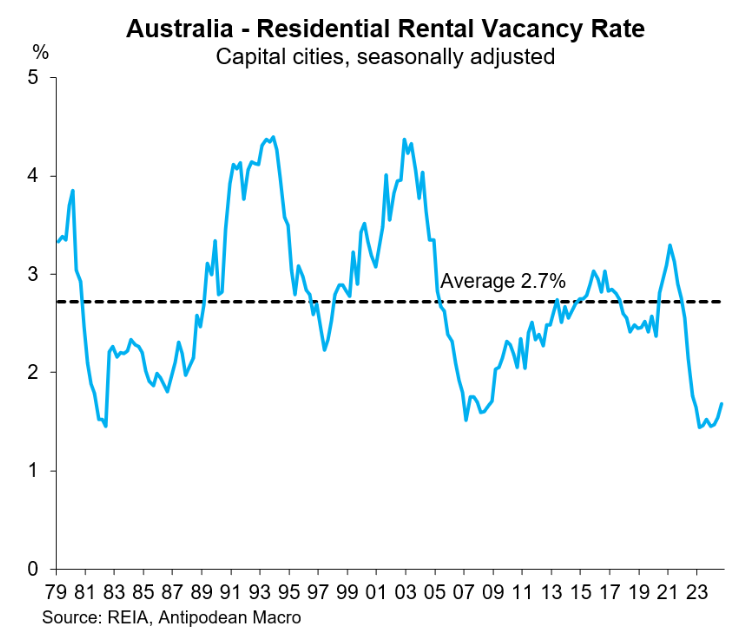

Nevertheless, Australian tenants still face an undersupplied market with historically low rental vacancy rates.

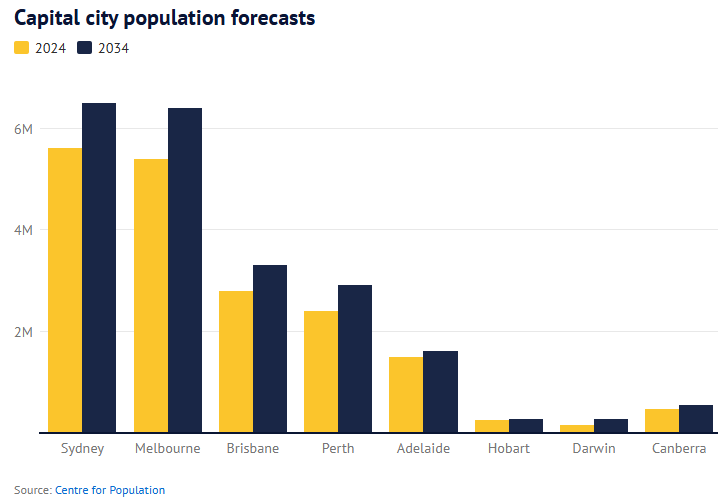

The Centre for Population has also projected 410,000 annual population growth over the next ten years—roughly equalivalent to growing by a Canberra every year—which will ensure that population demand will continue to outstrip supply.

Melbourne’s population is projected to balloon by one million people over the coming decade, Sydney’s by 900,000 people, whereas Brisbane’s and Perth’s populations are projected to swell by 500,000 apiece.

As a result, Australia’s housing shortage will inevitably grow, punishing tenants.