The Australian Bureau of Statistics (ABS) released housing construction data for Q3 2024, again showing that the Albanese government’s target to build 1.2 million homes over five years is delusional.

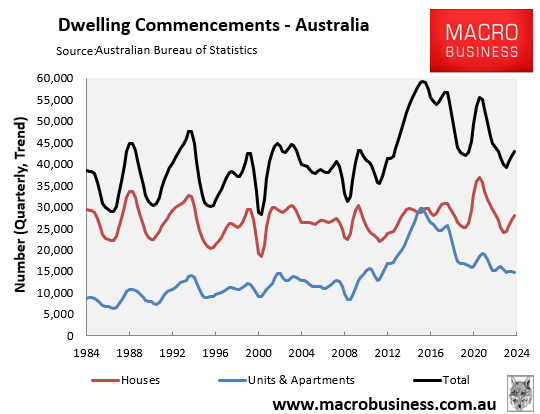

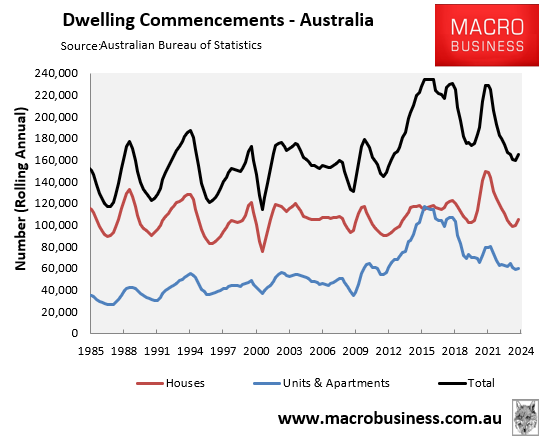

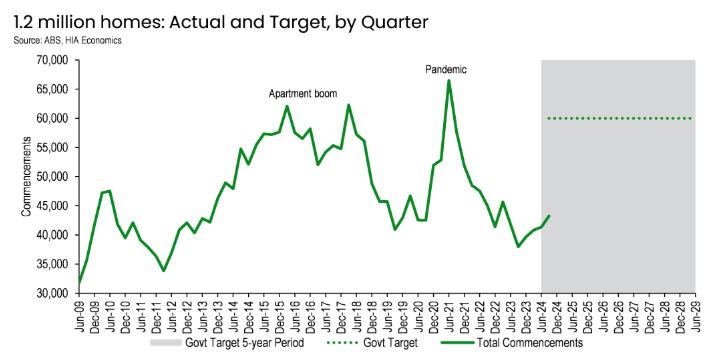

The number of dwellings commencing construction in Q3 2024 rose to 42,874 but remained well below the target’s required quarterly run rate of 60,000.

Only 165,048 dwellings commenced construction in the year to Q3 2024, well below the required run rate of 240,000 to meet the Albanese government’s housing construction target.

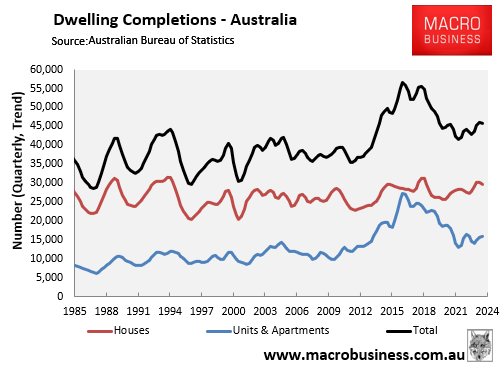

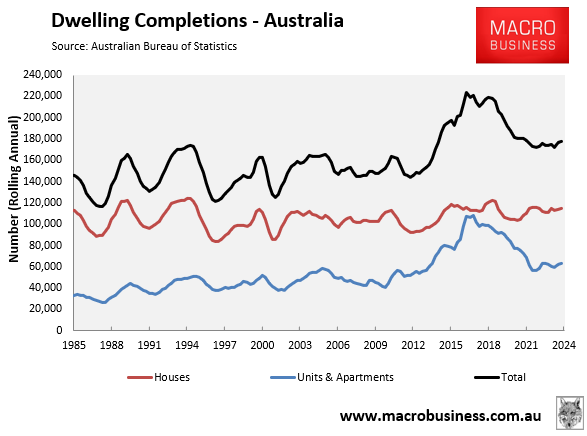

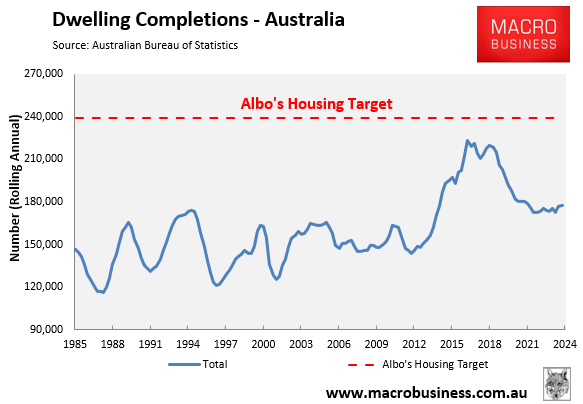

It was similar for dwelling completions, with only 45,782 homes completed in Q3 2024, well below the required quarterly construction run rate of 60,000.

Only 177,702 dwellings completed construction in the year ended Q3 2024, well below the required annual run rate of 240,000.

Commenting on the results, HIA Senior Economist Tom Devitt noted that “based on the current trajectory, only 173,000 homes will be commenced during the first year of the National Housing Accord period, 67,000 short of that necessary to meet the annual targets”.

“There were also just 44,880 new homes completed in the quarter, once again, well short of the desired 60,000 per quarter”.

“The September quarter result is less than three-quarters of the required build rate. This is simply too slow out of the blocks”, Devitt said.

The following chart from HIA shows how quarterly dwelling commencements are lagging way behind target.

The following chart of annual dwelling completions tells a similar story.

The truth is that Australia’s housing supply will remain constrained for the foreseeable future.

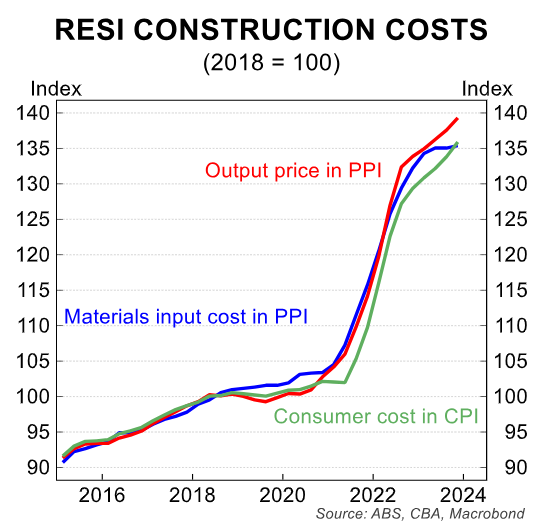

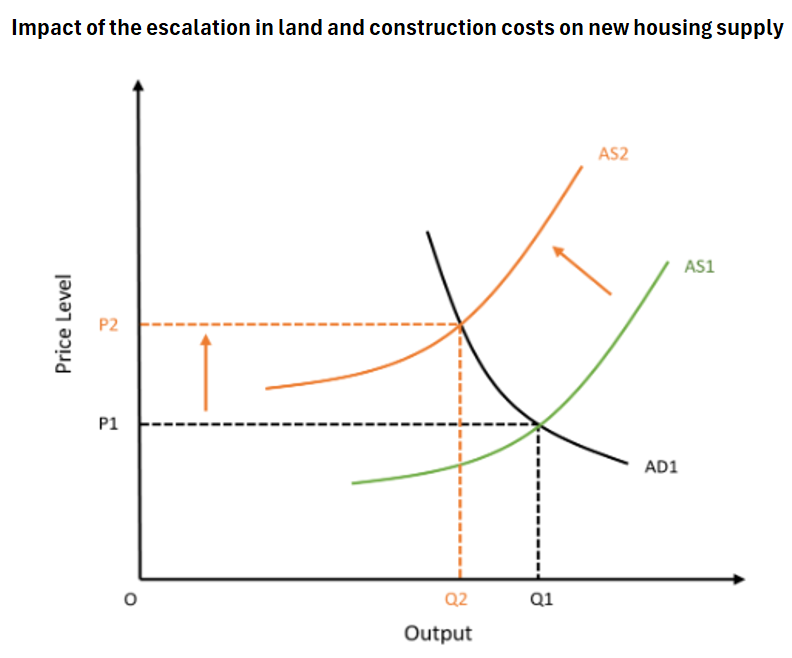

Residential construction costs have increased by around 40% since the start of the pandemic, making it unprofitable to build apartment projects.

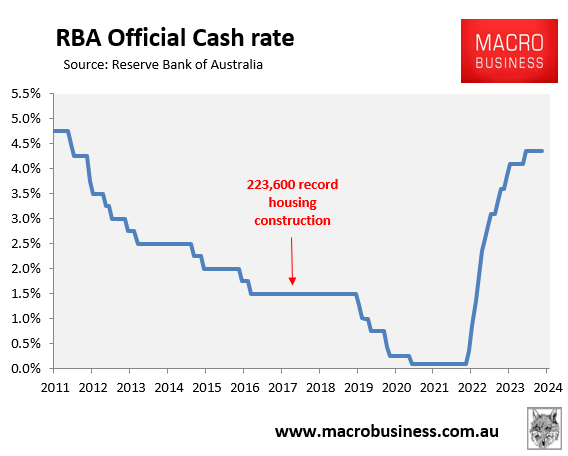

Australia also has high interest rates. During last decade’s record construction boom, the cash rate was 1.5% versus 4.35% currently.

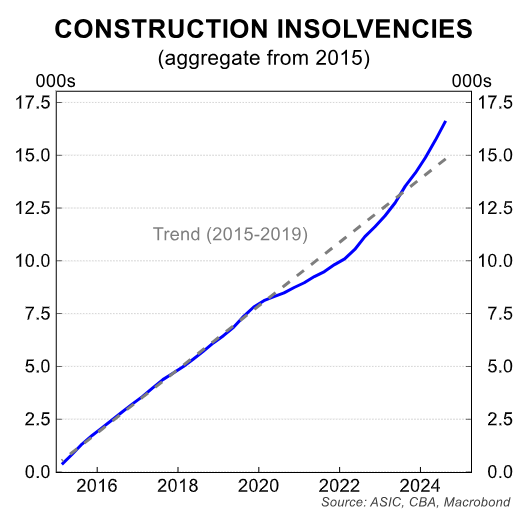

The sector’s capacity has decreased following the collapse of thousands of home builders.

Home builders are also competing for workers with government ‘big build’ infrastructure projects.

These factors have shifted the supply curve for housing to the left, reducing capacity and increasing cost.

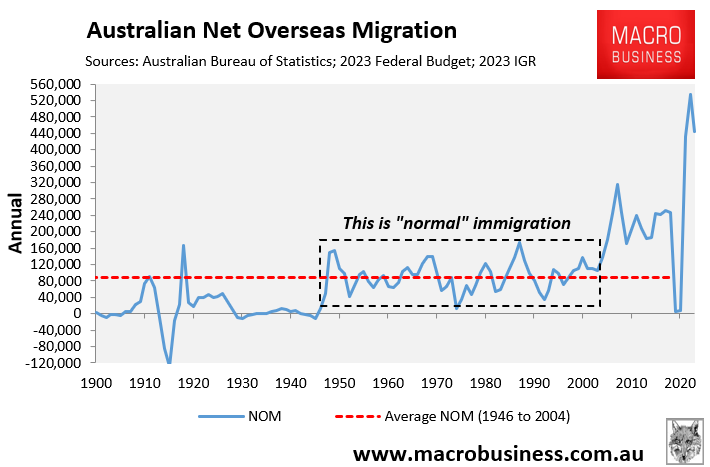

The logical policy response is to lower demand commensurably by slashing net overseas migration to a level compatible with the supply side.

Regrettably, Australian policymakers and purported housing experts refuse to acknowledge this obvious solution and continue to paint the problem as a supply issue.