CBA with the bad news.

Despite our expectation for a lift in household expenditure to a more trend-like pace as the cash rate is normalised, there will be a natural handbrake on the pace of consumption growth.

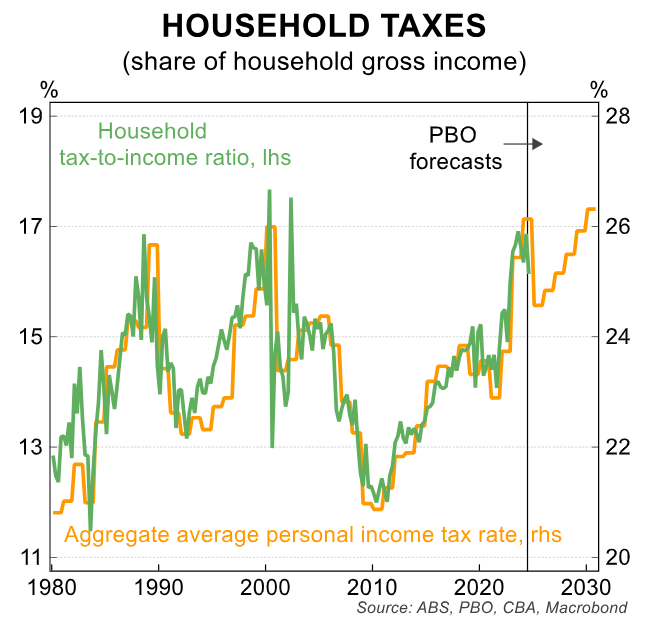

First, the positive impact on household income from the Stage 3 tax cuts will fade as no personal tax cuts are legislated in 2025/26. Indeed we will return to the world of fiscal drag given marginal tax rates are not indexed in Australia. Tax payments by households as a share of household income will start to lift again without another round of personal income tax cuts or genuine tax reform (see facing chart).

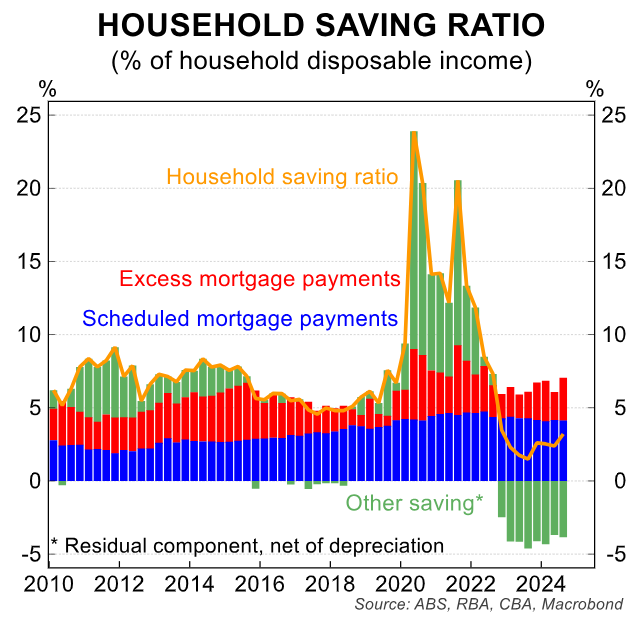

Second, the tailwind of the notional drawdown of pandemic savings has largely run its course. This drawdown partially offset the impact of significantly higher interest rates on household consumption over the past three years.

Third, real wages growth is likely to be only around 0.5% over the next few years (the average spread on our forecasts between the annual change in the wage price index and trimmed mean inflation).

Just wait until the bulk commodities are smashed over the next two years and the mining “rivers of gold” dry up.

Not only will there be no room for tax cuts, there’ll be hikes, just as there were after 2015.

The Australian dark age rolls on.