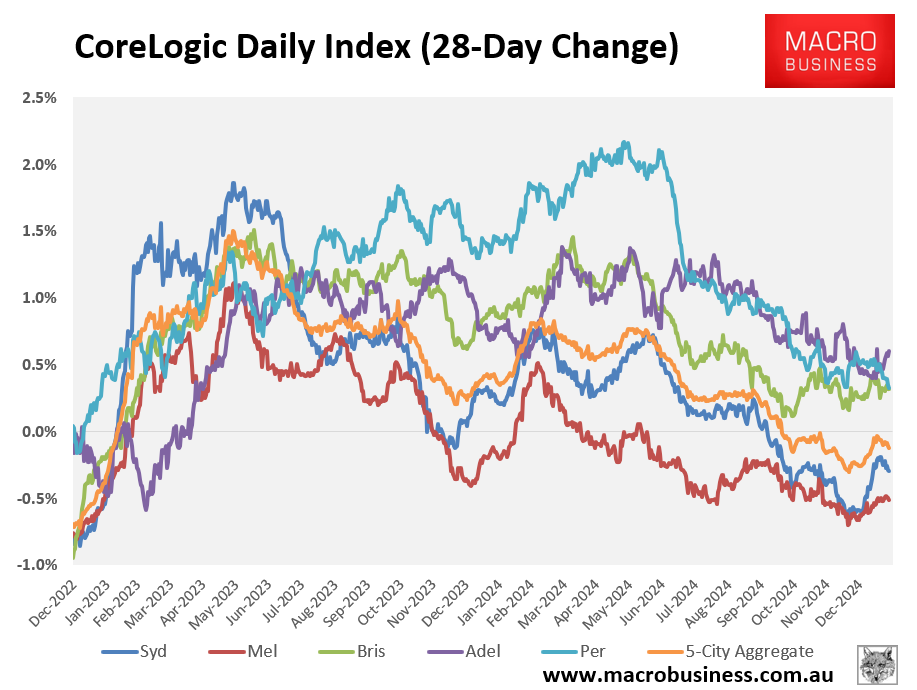

CoreLogic’s daily dwelling values index shows that home values continue to decline across Sydney and Melbourne, down 0.3% and 0.5%, respectively, over the past 28 days.

Data from CoreLogic also shows a sharp rise in the number of homes listed for sale across Sydney and Melbourne in recent weeks.

The number of dwellings on the market in Sydney in the four weeks to 19 January was 6.7% higher year-on-year, while property listings in Melbourne were 1.1% higher.

Eliza Owen from CoreLogic noted that more vendors are seeking to sell, while prospective buyers are less enthusiastic.

“This time of the year is typically slow in terms of demand, but this goes beyond seasonality”, she said.

“There’s less appetite from buyers, but more sellers are coming into the market, which could indicate rising mortgage stress”.

“It foreshadows further drops in home values as sellers might be compelled to reduce their asking prices to get a sale”.

“There could be an element of mortgage pressure among homeowners amid higher-for-longer interest rates and loosening in parts of the labour market that could be affecting mortgage serviceability and prompting more urgent sales”, Owen said.

Cate Bakos, a Melbourne-based buyer’s agency, added that “prices can’t be expected to grow while we have higher stock levels and weaker buyer demand”.

As shown above, dwelling value growth across Brisbane and Perth has also decelerated to 0.3%, respectively, over the past 28 days.

Buyer’s agent Zoran Solano of Hot Property Buyers Agency believes that Brisbane is turning into a buyers’ market amid surging supply and slowing demand.

“In some markets, we’re seeing less buyer activity than sellers would expect”, she said. “For me as a buyer’s agent, it’s a positive sign that the power has shifted back a little bit towards buyers”.

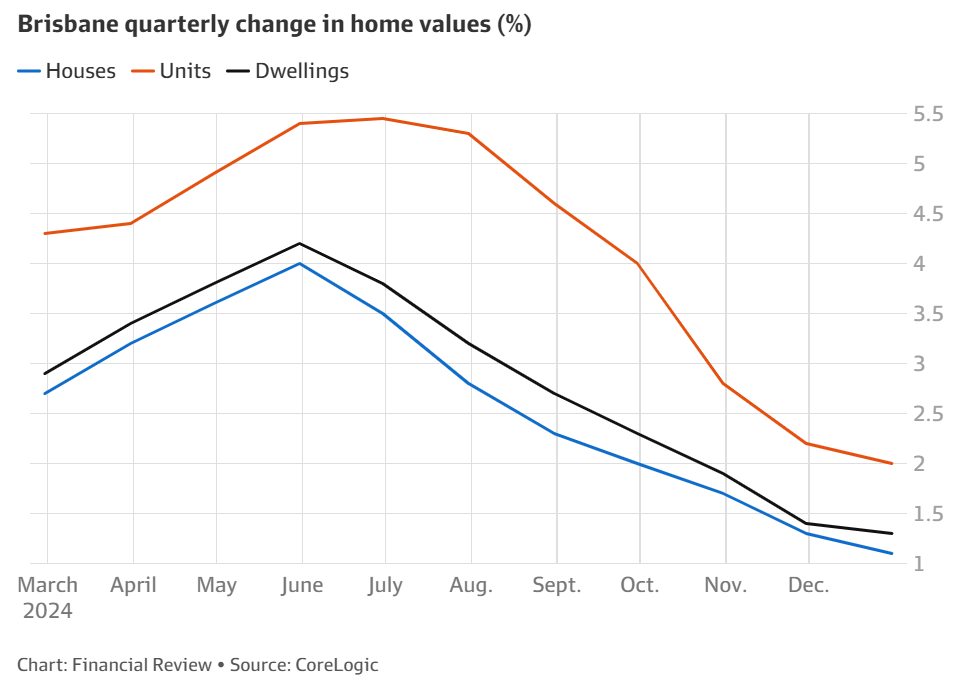

Indeed, The AFR reported over the weekend that home values are falling in one in seven suburbs across Brisbane, the highest level in almost two years—a trend that is likely to worsen.

“The Brisbane housing market is losing momentum across both houses and units, so there’s a potential for values to drift lower based on the growth trend”, CoreLogic’s Tim Lawless.

“Listings have increased compared to a year ago, while lower interstate migration and worsening affordability had also reduced demand”.

“The market is likely to continue to ease, and we could see prices moving into a subtle decline before interest rates come down”, he said.

AMP chief economist Shane Oliver believes Brisbane is the most likely major housing market after Sydney and Melbourne to record falling values.

“Brisbane looks to me like a really soggy market and I wouldn’t be surprised if house prices go negative in the next couple of months”, he said.

“It’s often the case that once the momentum turns negative, you go further negative for a while, so when prices are falling, history tells us that can go on for a little bit.

“I think momentum is starting to work against Brisbane, and it is now weakening at a similar pace as Sydney was six months ago”.

Oliver added that an interest rate cut could boost momentum and prevent home values from falling.

“A rate cut could turn that downward momentum around, so if it occurs in February it has the potential to head off a dip into negative territory for Brisbane prices”, he said.

“However, if interest rates don’t fall until April or May, then we could see prices fall by then”.

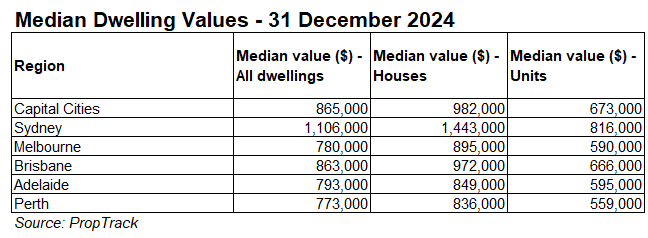

PropTrack has recorded an 80% increase in Brisbane home values since the start of the pandemic in March 2020. This has made Brisbane the second most expensive major capital city housing market in Australia by median value.

Brisbane’s rapid growth, deteriorating affordability, and slowing inward migration position it as the next house price domino to fall.