KPMG Australia is upbeat about the outlook for the housing market in 2025, spurred on by expected interest rate cuts.

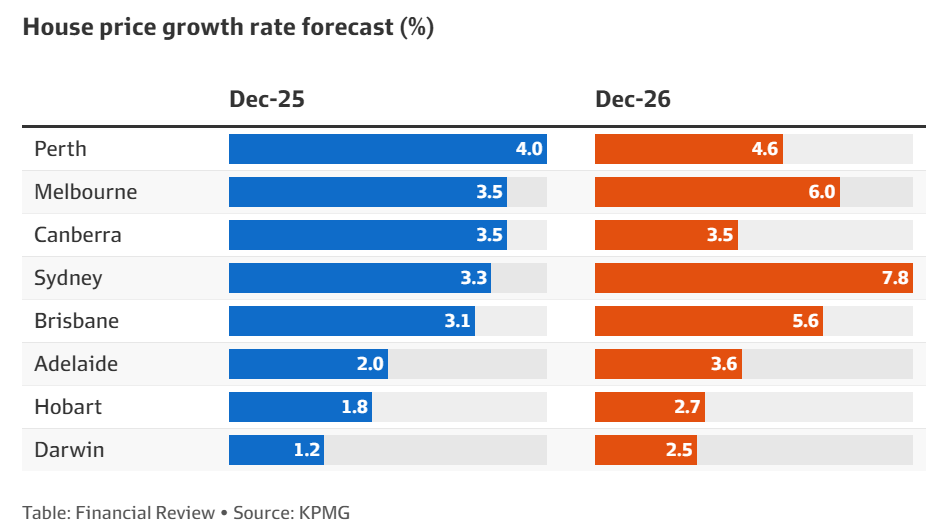

The firm expects house prices in Sydney to rise by 3.3% this year, followed by 7.8% growth in 2026.

Prices in Melbourne are forecast to rise by 3.5% in 2025 and 6% in the following year.

Meanwhile, house prices in Brisbane are expected to rise by 3.1% in 2025, while Perth and Adelaide are tipped to record price growth of 4% and 2%, respectively.

“Sydney will revert to leading the country’s housing market, and while Melbourne is currently experiencing a minor downturn in house prices, we expect prices to recover in 2025”, KPMG chief economist Brendan Rynne said.

“While recent changes to the Victorian land tax and the current downward momentum may hinder growth, these negative factors are expected to be offset by positive demand”.

Nerida Conisbee, chief economist at Ray White, agreed that expected rate cuts would impact the Sydney and Melbourne markets more than the other capital cities.

“At the moment, Sydney and Melbourne are both weak, but if we get three to four rate cuts coming through this year, that will provide a substantial boost to both markets”, she said.

Given that Australian dwelling values and loan sizes are already at a record high, the prospect of further increases is daunting.

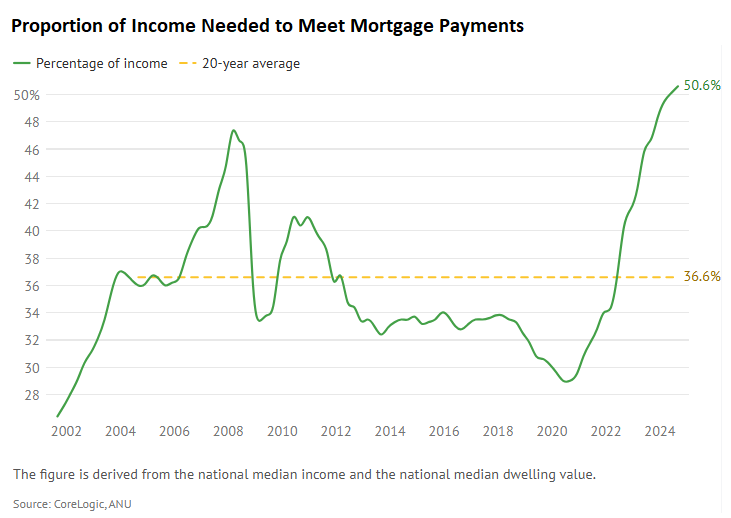

Australian housing affordability is already at an all-time low, with 50.6% of the median income required to meet mortgage payments on the median-priced home.

While interest rate cuts would improve the affordability equation, gains to prospective mortgage holders would be offset by further increases in home values.

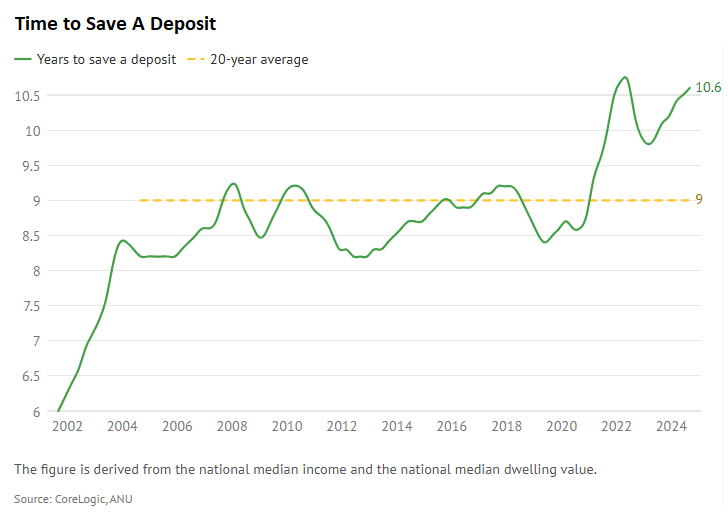

Further price appreciation would also make it more difficult for prospective first-home buyers to save a deposit.

If Australian housing affordability is to improve, prices necessarily need to fall or at least remain flat for a prolonged period.