The past few years have seen Australian households sink into a protracted recession.

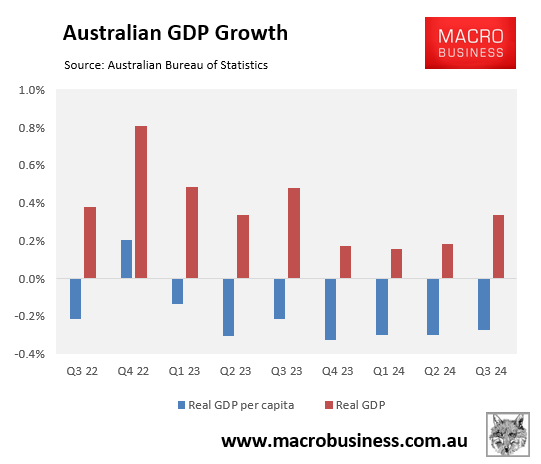

The Q3 national accounts, released last month, showed that real per capita GDP had declined for a record seven consecutive quarters.

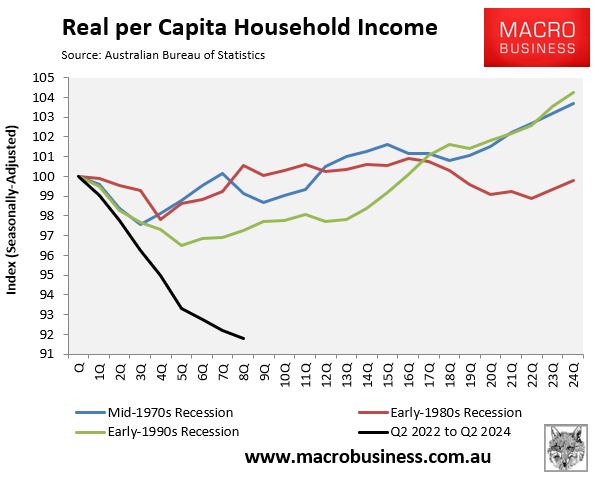

This decline in GDP has been driven by the household sector, which has experienced a record 8.4% fall in real per capita disposable incomes.

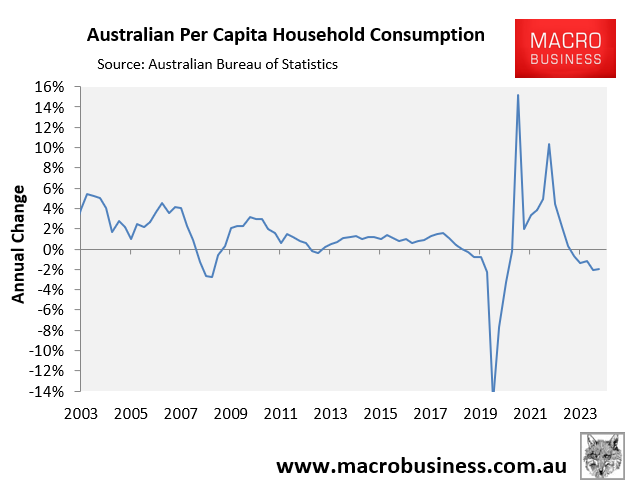

Real per capita household consumption also declined by nearly 2.0% in the year to September 2024.

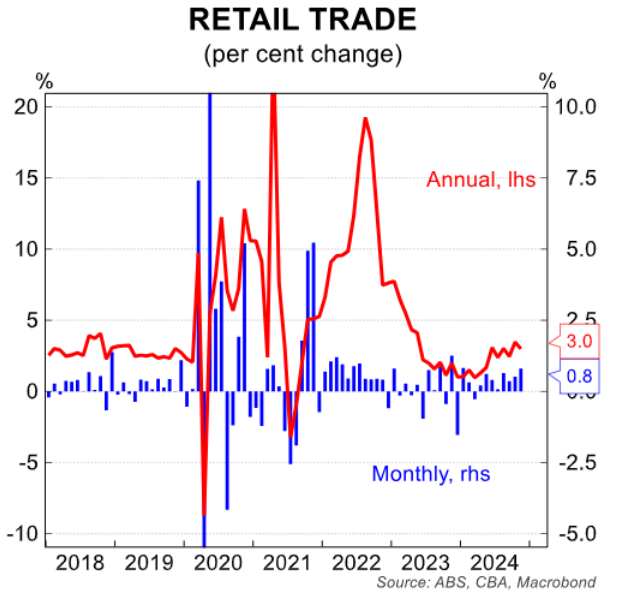

On 1 July 2024, the stage 3 personal income tax cuts took effect, which boosted household disposable incomes.

This extra income appears to have delivered a mild boost to retail sales, which grew by 3.0% in the year to November.

“Overall, growth in retail spending has improved through 2024”, noted CBA economist Harry Ottley. “The annual rate of growth has risen from ~1.0% early in the year to 3.0% in November”.

“At the same time, retail prices have moderated. This has led to stronger outcomes for the volume of retail spending (+0.5%/qtr in Q3 24)”.

“That said, on a per capita basis, real retail spending was only flat in Q3 24”, Ottley added.

“The improving momentum is not unsurprising given real household disposable incomes are finally increasing, consumer sentiment is improving, and interest rate cuts are likely approaching”.

“However, the rise in spending has to this point not been as strong asthe RBA had initially expected”, Ottley said.

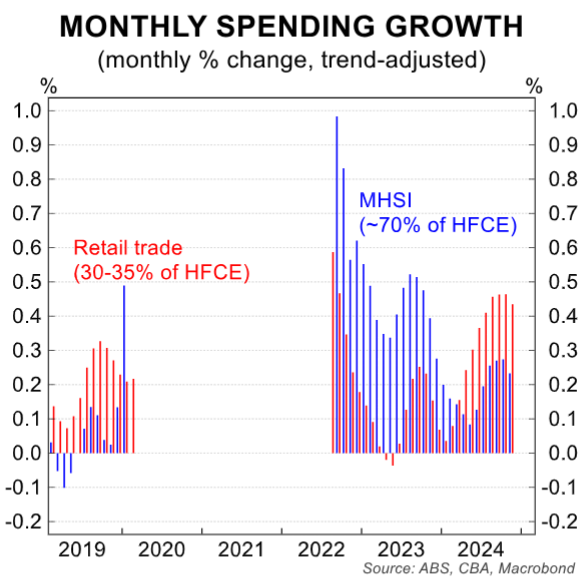

According to the ABS, retail sales account for around 35% of consumer spending. It also focuses on categories most responsive to sales events, such as the Black Friday sales.

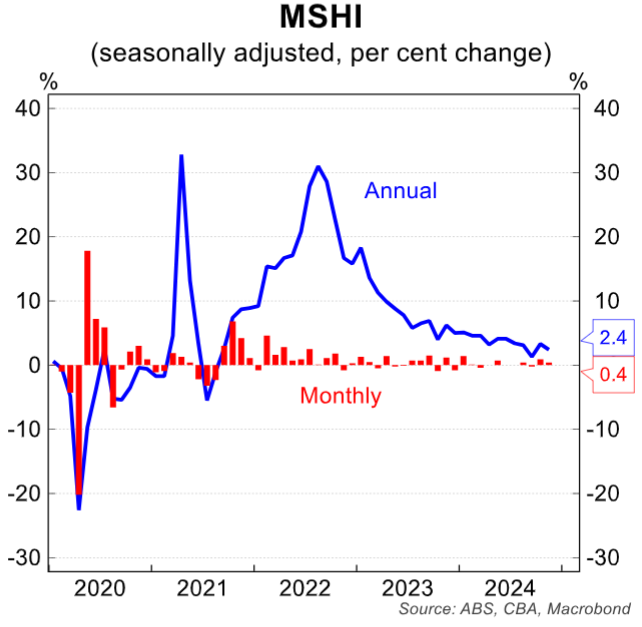

The ABS also released its Monthly Household Spending Indicator (MHSI) for November last week, covering nearly 70% of consumer spending.

The news was less optimistic, with consumer spending rising by only 0.4% in November, slower than the 0.9% growth recorded in October.

The annual growth rate in the MHSI dropped to 2.4% from 3.3% and is now in line with growth in the working-age population.

The trend rate of nominal consumer spending growth also slowed to 0.2% per month and remains below the trend growth in retail trade.

“The lack of a noticeable pick-up suggests that the relatively muted consumer response to the Stage 3 income tax cuts likely continued into the end of 2024”, CBA’s Harry Ottley noted.

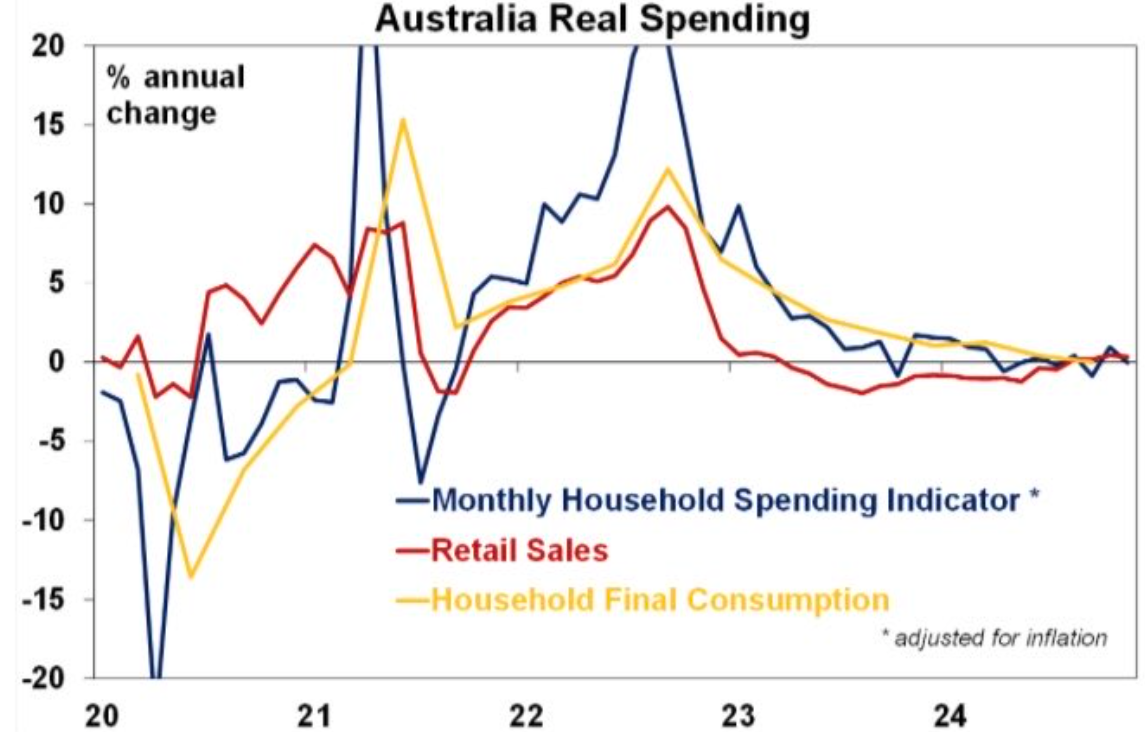

The following chart from AMP chief economist Shane Oliver shows that real consumer spending remains stuck in quicksand.

Chart by Shane Oliver (AMP)

Stripping out population growth would show that per capita household spending continues to fall.

Therefore, while tax cuts provided a modest boost to retail sales, Australian households ended 2024 stuck in recession.