Late last year, Australian Prudential Regulation Authority (APRA) chairman John Lonsdale warned that the number of Australian households experiencing severe mortgage stress had nearly doubled since 2016 and was trending higher amid the Reserve Bank of Australia’s (RBA) aggressive monetary tightening.

Lonsdale added that Australians are overexposed to mortgage debt.

“Residential mortgages make up two-thirds of all bank loans in Australia, compared to 30% in Europe and only 10% in the United States”, he said.

“Australians also have one of the highest levels of household debt relative to income in the world”.

“Our banking system is, therefore, particularly vulnerable to any scenario that results in large numbers of borrowers being unable to make their mortgage repayments”, Lonsdale said.

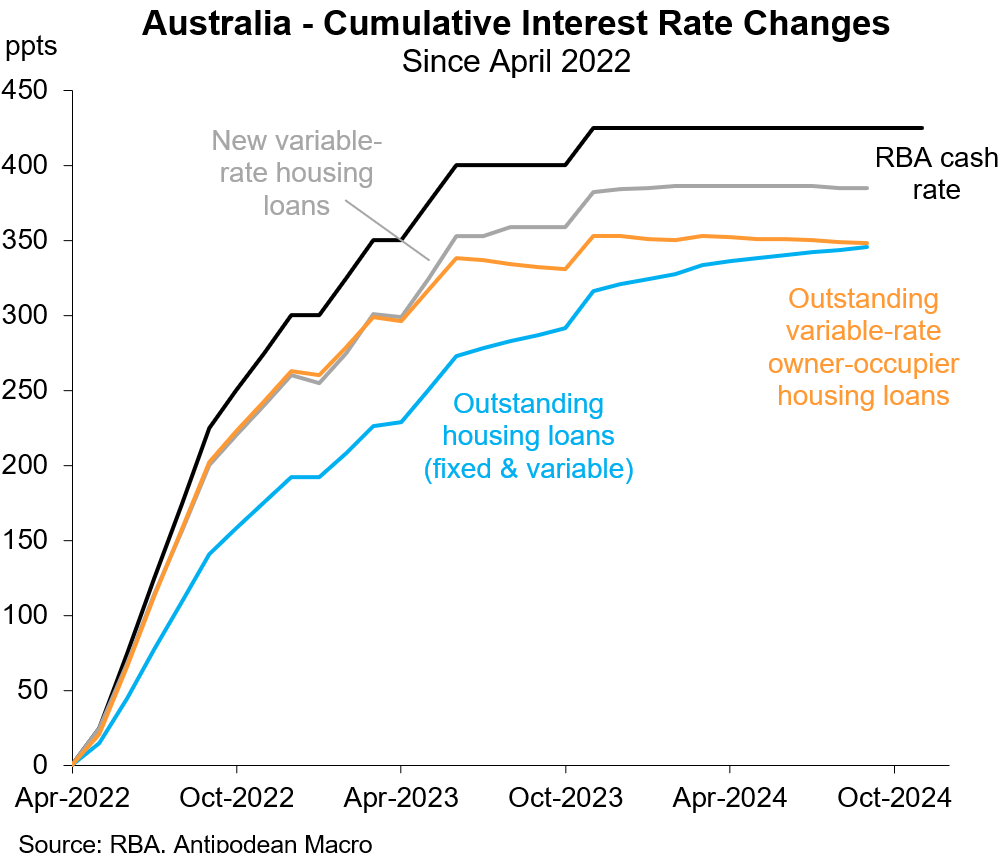

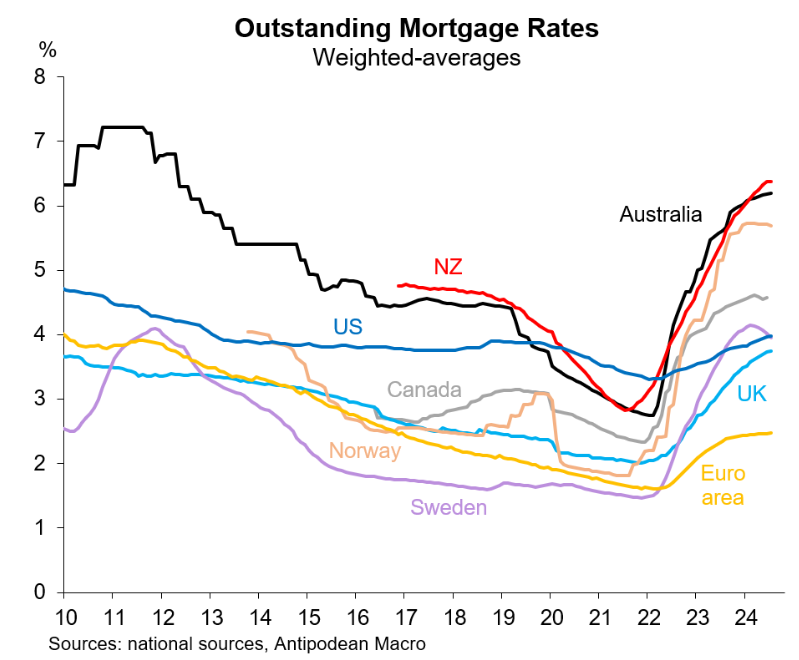

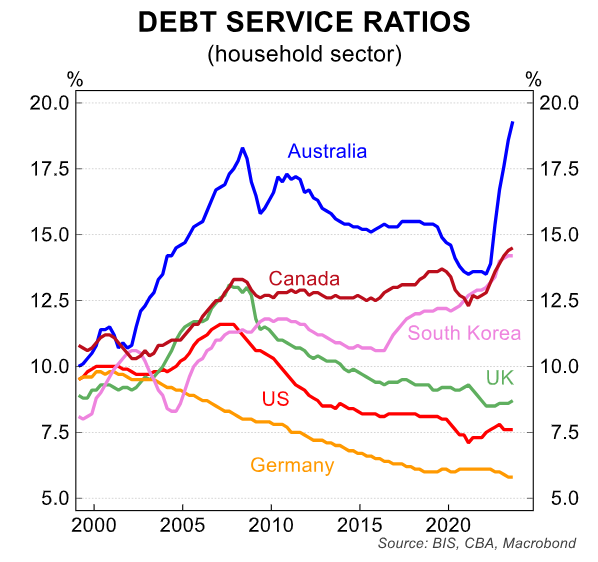

Australians have experienced one of the sharpest rises in mortgage rates in the developed world, owing to the RBA’s monetary tightening and our high share of variable-rate mortgages.

As a result, Australians have experienced one of the most significant increases in debt servicing costs in the developed world.

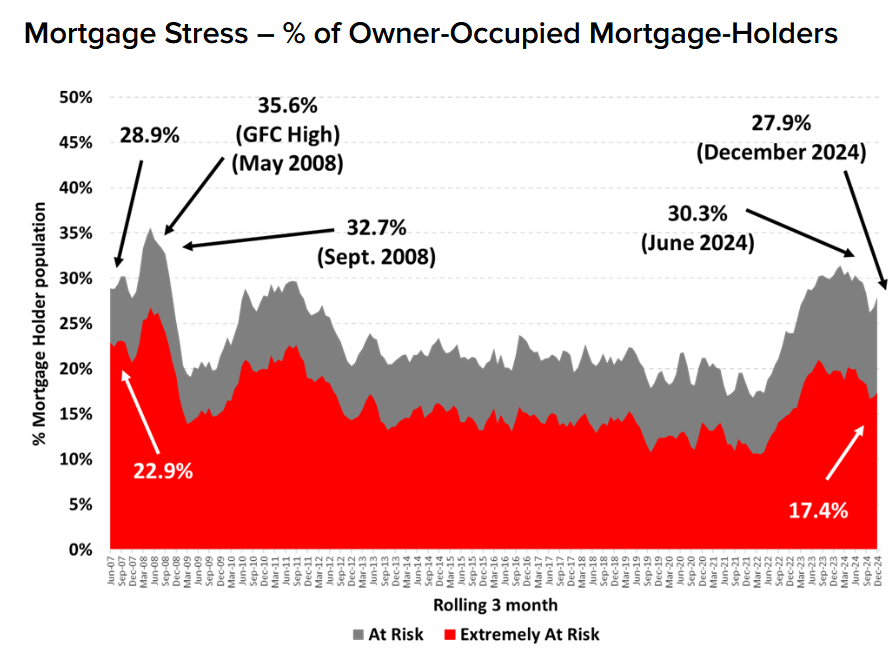

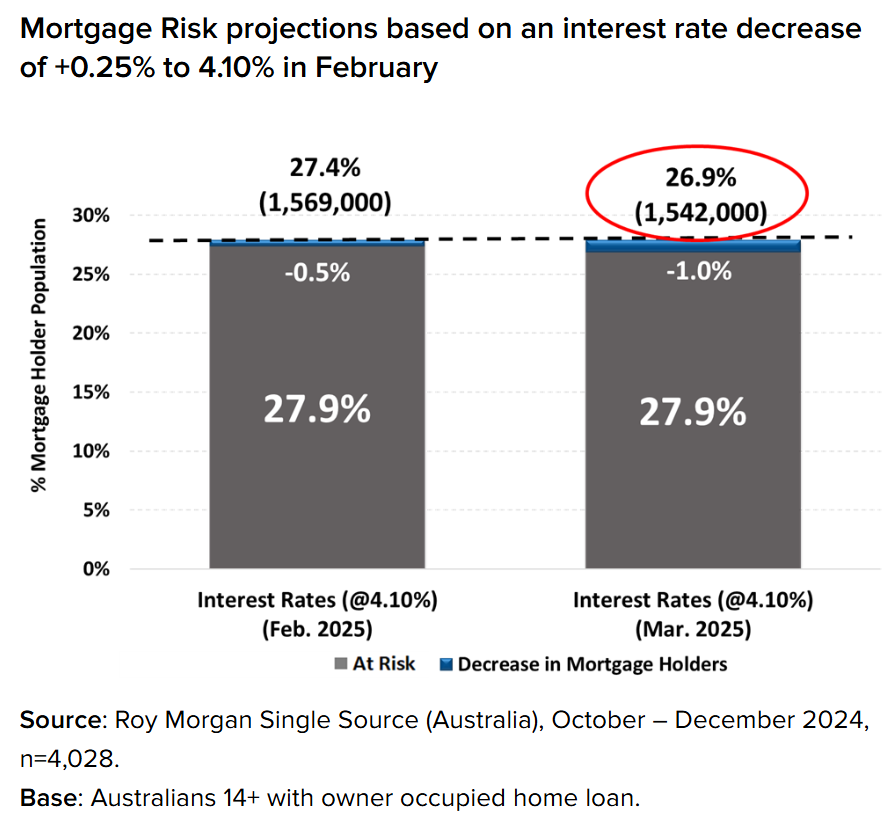

The impact on the budgets of Australian mortgage holders is illustrated in the next chart from Roy Morgan Research.

According to Roy Morgan, “the number of Australians ‘At Risk’ of mortgage stress has increased by 788,000 since May 2022 when the RBA began a cycle of interest rate increases”.

“The number of Australians considered ‘Extremely At Risk’, is now numbered at 973,000 (17.4% of mortgage holders) which is significantly above the long-term average over the last 10 years of 14.6%”.

While mortgage stress moderated for four consecutive months after the introduction of the Stage 3 tax cuts in July 2024, it ticked upwards for two straight months after the RBA left interest rates unchanged in both November and December.

Following Wednesday’s favourable Q4 2024 inflation figures from the Australian Bureau of Statistics (ABS), economists now expect the RBA to cut the official cash rate at its 18 February monetary policy meeting.

Roy Morgan forecasts that the number of mortgage holders ‘At Risk’ of mortgage stress would decrease by 26,000 in February 2025 to 1,569,000 (27.4% of mortgage holders, down 0.5% points) if the RBA cuts the official cash rate by 0.25% to 4.10% at its 18 February meeting.

Looking ahead, the share of mortgage holders considered ‘At Risk’ would drop further in March, down an additional 27,000 to 1,542,000 in March 2025, equivalent to 26.9% of mortgage holders. This would represent a decline of 1% (down 53,000) from the current figures for December 2024.

Looking further ahead, the RBA will likely cut rates several times this year, lowering mortgage stress.

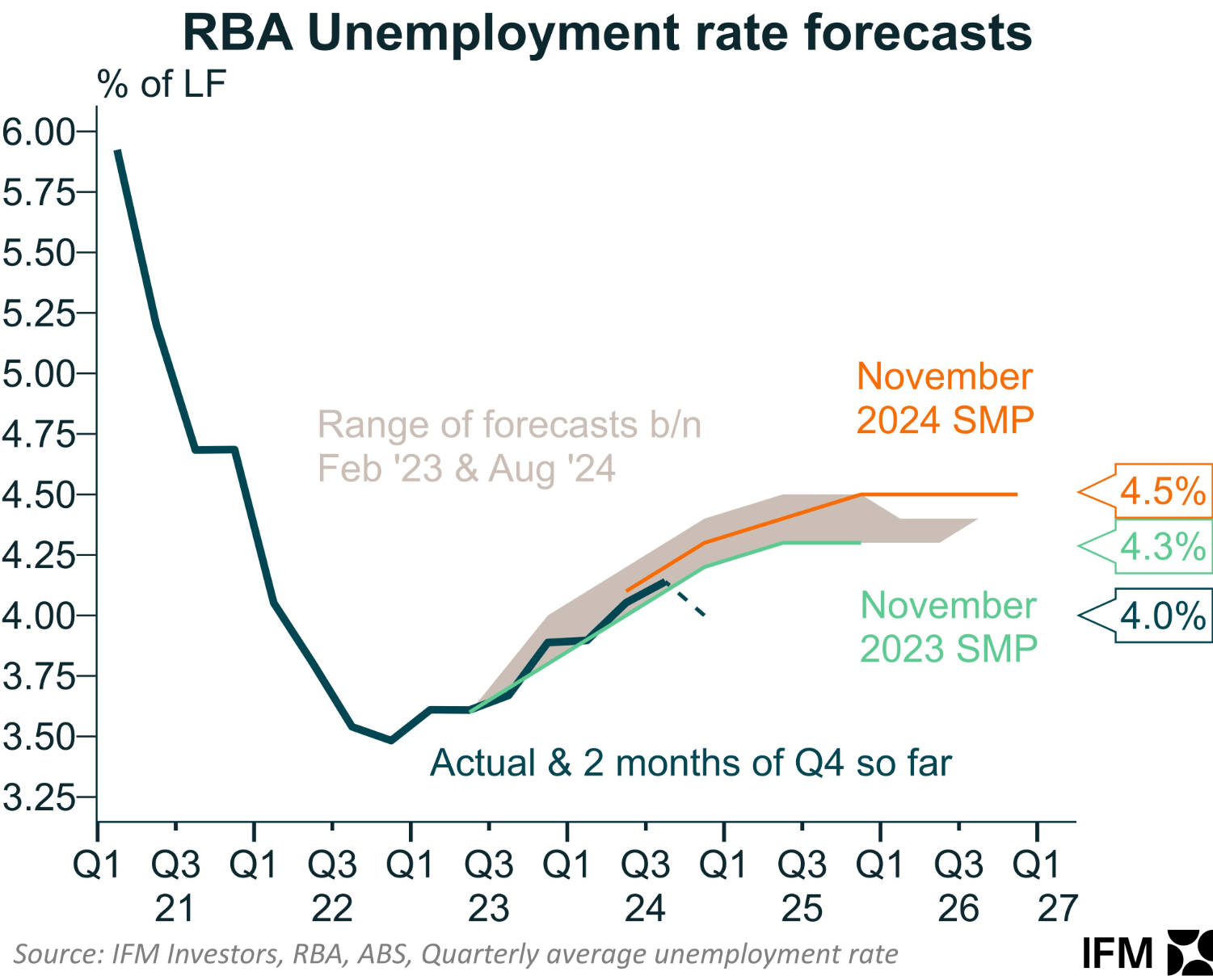

However, the unemployment rate is the bigger risk factor. The RBA projects a modest rise in the official unemployment rate over the forward estimates, which would work to increase mortgage stress (other things equal).

If you wish to save thousands of dollars in mortgage payments, try the MB Compare n Save mortgage comparison tool. It takes less than a minute.

And if you choose to refinance, Compare n Save will handle the process.