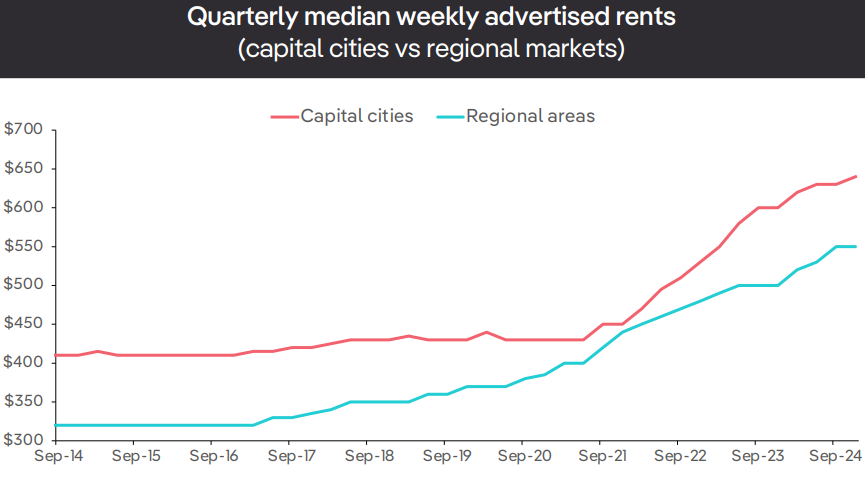

According to PropTrack, national median advertised rents have surged by 47% since December 2019.

Source: PropTrack

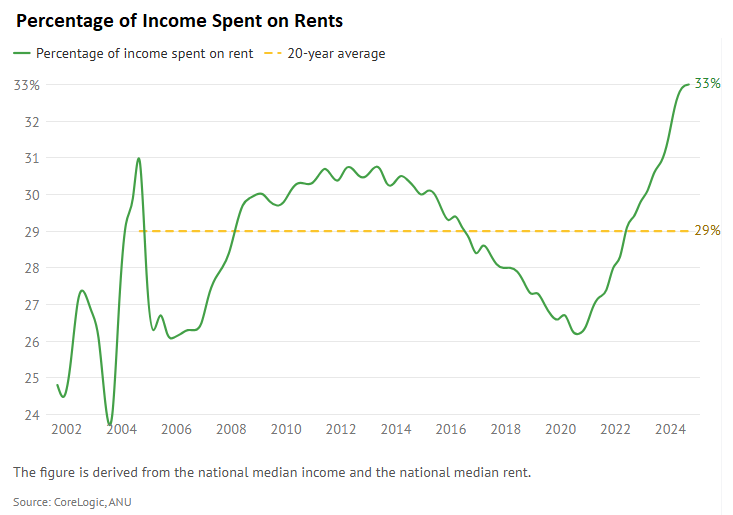

This explosive growth has pushed rental affordability to a record low, with 33% of median household income spent on the national median rent at the end of 2024.

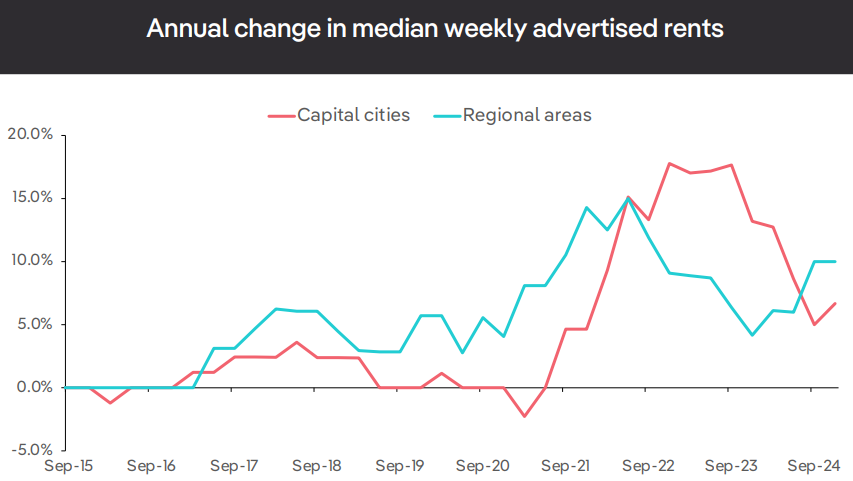

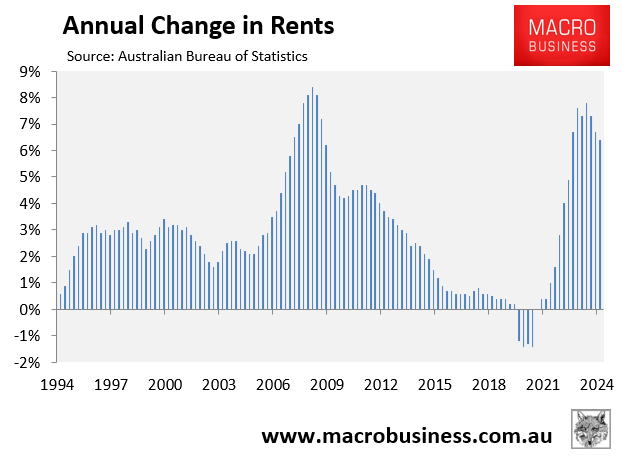

The good news is that Australian rental inflation is finally easing, with PropTrack’s latest quarterly rental report showing that rents grew by 6.9% in the 2024 calendar year.

This was the slowest pace of rent growth since mid-2021 and is far weaker than the nearly 20% annual growth seen in 2023.

Source: PropTrack

While rental growth has slowed, PropTrack warns that rents remain unaffordable amid strained availability.

“The market remains much tighter than before the pandemic and availability is strained”, PropTrack noted. “Rents are likely to continue growing this year, though we expect the pace will continue to moderate”.

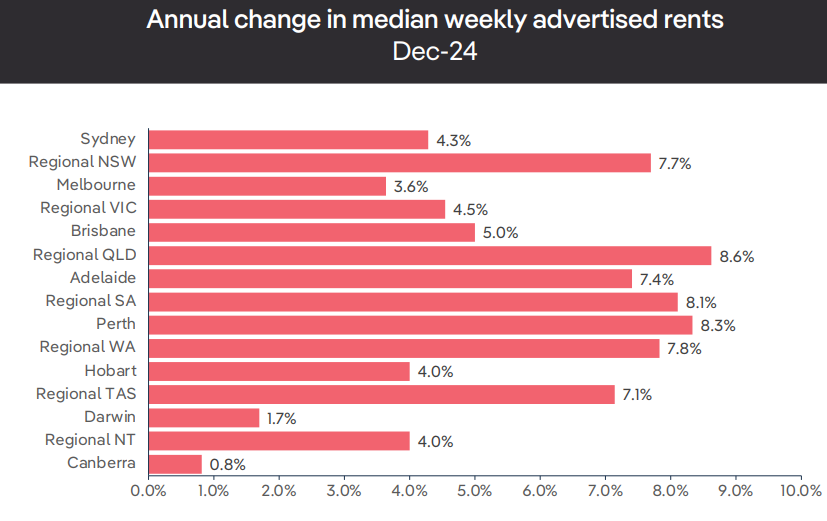

Sydney and Melbourne have led the easing of rental growth, recording annual changes of 4.3% and 3.6%, respectively, in 2024.

Source: PropTrack

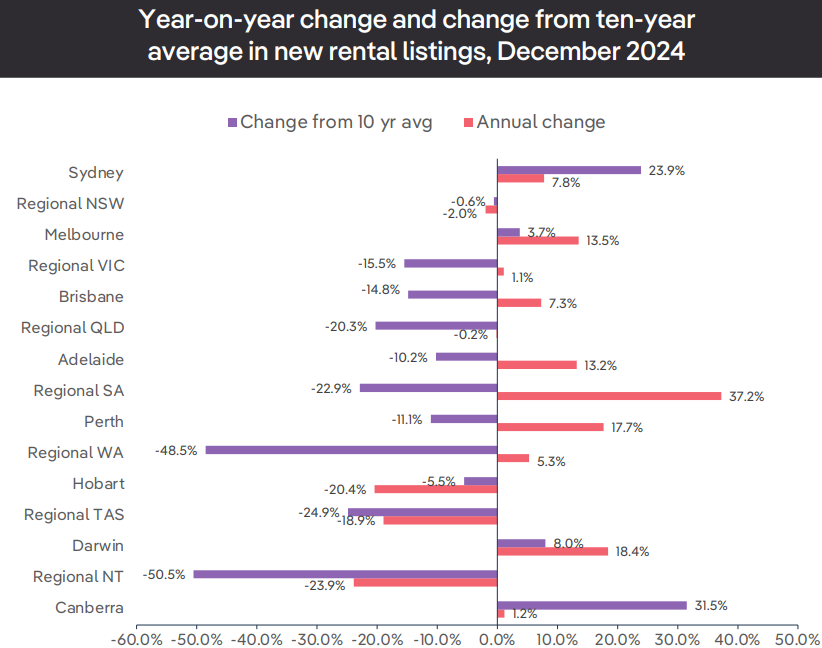

PropTrack also notes that the number of newly advertised rental properties was 4.1% higher than a year ago.

In the second half of 2024, there were 4.6% more new rental listings on realestate.com.au than in the second half of 2023, and 2024 had the busiest second half of the year for rental listings since 2020.

In all capitals, more new rental listings were hitting the market at the end of 2024 than at the end of 2023, although availability remains well below the decade average.

Source: PropTrack

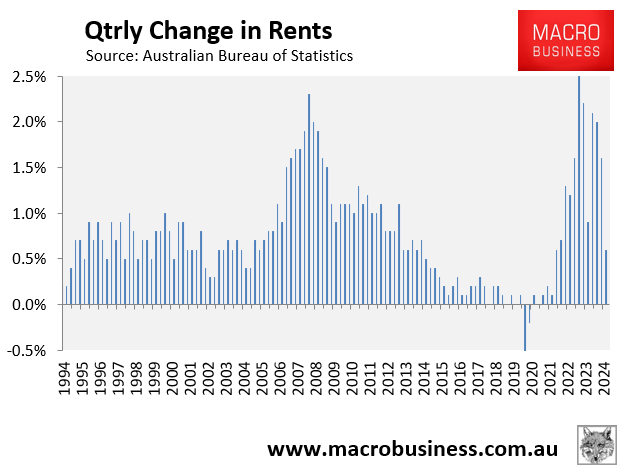

Separate data released Wednesday by the Australian Bureau of Statistics (ABS) showed that rental inflation eased to 0.6% in the quarter, the softest result since Q1 2022.

Annual rental inflation also eased to 6.4%, the softest result since Q1 2023.

So, while overall rents are highly unaffordable and hurting Australian tenants, at least the situation is no longer worsening.

Australian rents have hit an affordability ceiling.