In 2013, Labor Resources Minister Gary Grey made the unfortunate decision to allow the Gladstone liquified natural gas (LNG) terminals to be developed without the need to reserve gas for domestic users.

“Let me say very clearly, a reservation policy could not lead to lower gas prices or more gas”, Grey told reporters at the time.

“Calls for intervention in the market only serve to dampen any appetite for the very investment that’s needed to bring on new gas supplies”, according to him.

“We must allow our markets to respond as they are intended to do”.

Grey also denied that gas prices were rising as a result of the significant expansion of LNG facilities on the east coast, arguing that a gas price spike would occur “irrespective of the development of the east coast LNG industry”.

Gray’s decision not to reserve gas for domestic use came in reaction to lobbying by big gas producers Santos and Origin, who resisted pleas from the manufacturing industry to reserve gas for domestic consumption.

Manufacturing Australia warned that the projected tripling of gas exports by 2017 could result in price spikes and shortages, potentially costing 200,000 jobs and reducing GDP by $28 billion annually.

As a result, Manufacturing Australia wanted a national interest test on exports, along with the reservation of gas for domestic use.

However, Santos and Origin reject the plan, claiming that domestic reservation would keep it underground and stifle economic growth.

A spokesman for Federal Resources Minister Gary Grey also stated that the government did not believe that a gas reservation scheme would keep prices low.

“In the government’s view, it will create uncertainty and deter investment in new gas supply”, the spokesman said.

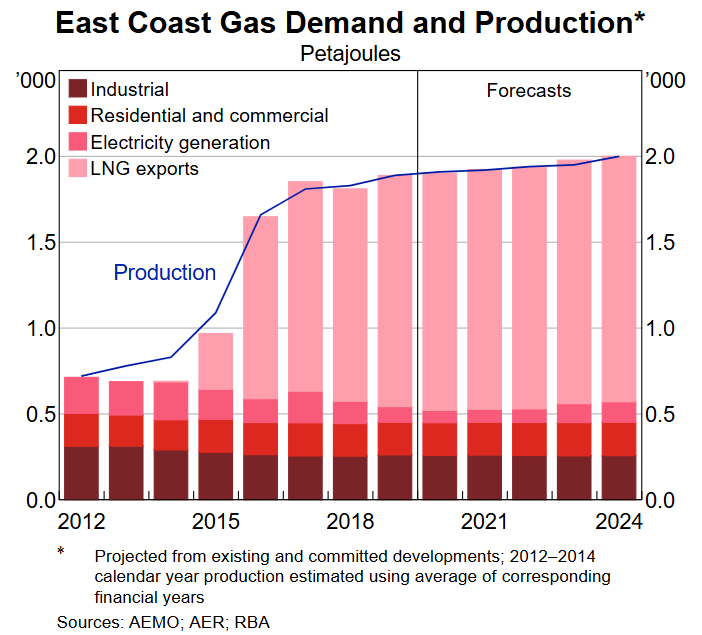

The rest is history. The Gladstone LNG export plants went online, resulting in almost three-quarters of East Coast gas being exported, primarily to China.

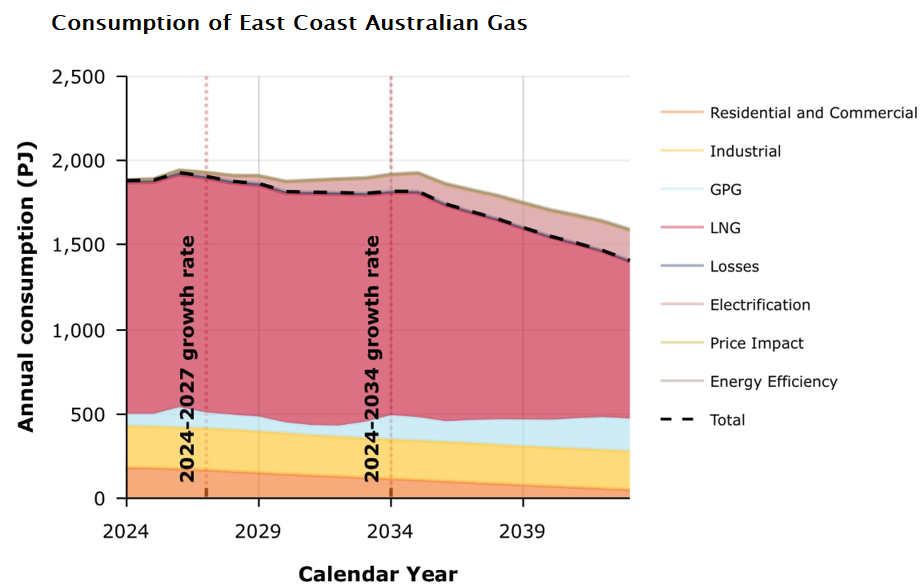

East Coast Australia is now experiencing persistent gas shortages, which have resulted in higher gas and energy prices.

The end result is that LNG import terminals will be developed in New South Wales, Victoria, and possibly South Australia, further raising gas and electricity prices:

Australia’s energy ministers are developing a plan to kickstart the first deliveries of huge liquefied gas shipments into Victoria and NSW, fearing they are out of time and other viable options to avert a domestic gas crisis.

Despite Australia’s position as a top global gas exporter, homes and businesses in the south-east are facing a shortage of the fuel by 2028 unless urgent measures are taken…

If projects proceed, retailers in the south-east would be able to ship in giant cargoes from LNG ventures in Queensland, the Northern Territory, Western Australia or overseas and turn it back into vapour to supply their customers.

Dubai-based company AP&G, which is set to acquire Venice Energy, is also working on developing a LNG import facility at Adelaide’s Outer Harbor.

It is understood that AP&G has approached the South Australian government with a proposal that would see it contract LNG cargo to be transported to Australia.

“The proposal is a possible solution to what industry figures say is a looming gas catastrophe”, reported The Australian.

“An shortfall on Australia’s eastern seaboard could curtail heavy industry, limit supplies to residential customers and drive household energy bills higher”.

Of course, Tony Wood of the Grattan Institute, who lobbied heavily against East Coast domestic gas reservation a decade ago and even lobbied for Western Australia to repeal its reservation policy, is a major supporter of LNG import terminals.

Grattan Institute lobbied against East Coast gas revervation in 2013.

Grattan Institute demanded an end to West Coast gas reservation in 2013.

“I think everybody recognises that we’ve got to find a way to get these terminals working”, Wood said.

“And that means serious commercial arrangements have to be put in place involving the gas producers, terminal operators, the big customers and probably the government”.

The remedies are obvious.

- Reserve enough East Coast gas for domestic use and set the price at an affordable level using classic cost-plus pricing.

- Either create a second north-south pipeline or more southern storage facilities that can be filled in the off-season and used in the high season.

- Explore for additional onshore and offshore gas deposits to feed the domestic market. Any new initiative should be government-owned and operated.

We all know what’s going to happen instead. Australia’s East Coast, which exports around three-quarters of its gas, will instead import gas for the domestic market, locking in permanently high gas and electricity prices.

We are governed by treacherous clowns.